Last year, I wrote an article for Trust & Estates titled “Can I Do Better?,” which questioned the use of endowment-style portfolios for trusts and ultra high net worth (UHNW) individuals. Approximately one year later, the answer to the question seems to be revealing itself: Resist the temptation to invest like endowments, and keep it simple.

Why?

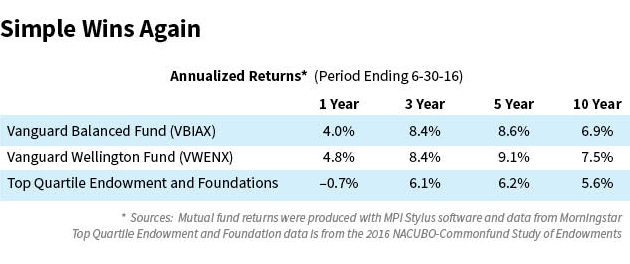

Sometimes a picture tells a thousand words. “Simple Wins Again,” below, uses the same endowment return information that we published last year. It also illustrates how two simple, low-cost Vanguard balanced funds (one index-based and one more active) continue to rank in the top quartile of U.S. endowments and foundations.

A More Complete Story

When I posted this chart on social media, like the article last year, it received some criticism. Beyond private comments from a few hedge fund and endowment-in-a-box fund of funds friends (sorry guys), one that hit home was the following: “Isn’t the story [of the chart] U.S. beats Ex-U.S.?”

This was a great point, and I publicly agreed.

Both the Vanguard Balanced Fund and the Vanguard Wellington Fund invest primarily in U.S. stocks, and the same can’t always be said for endowments and foundations. In follow-up to private comments, I also agreed that, despite their headline-making appeal, the shorter term numbers were statistically noisy.

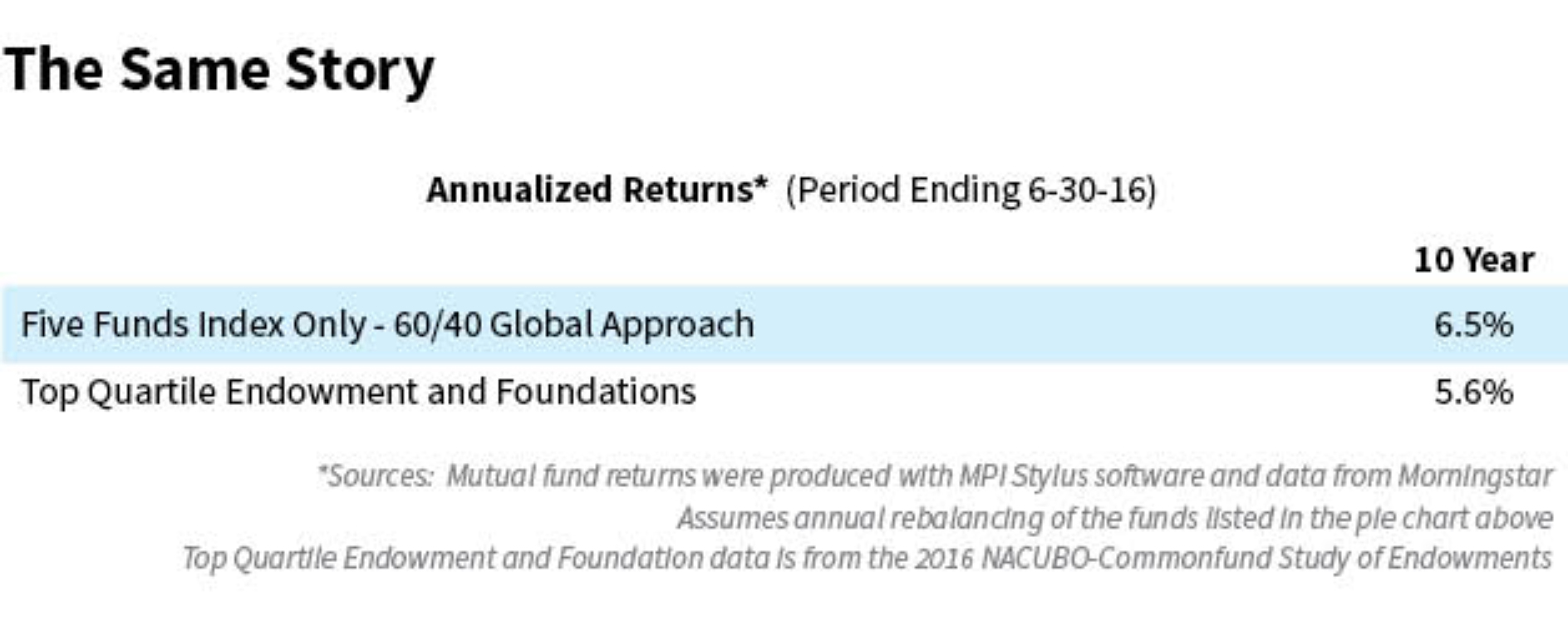

So, in an attempt to tell a more complete story, I ran the same comparison using the simple index fund global portfolio listed in “Global Portfolio,” below, and focused on long-term results.

In full disclosure, this portfolio and the comparison below is more hypothetical, but it’s a portfolio that anyone could easily have implemented by buying these five index funds, then rebalancing back to the original target percentages at the end of each 12-month period.

Revealingly, the story is pretty much the same as the one told by the original chart.

Even when you weight 50 percent of the equity allocation to non-U.S. stocks, a long-term 10-year period that starts at the end of a strong bull market includes one of the worst down-turns in history (2008-2009) and a more recent strong bull market recovery. The data says the following: Simple beats over 75 percent of endowments, who arguably have access to some of the brightest minds and most exclusive and complex strategies in the world. (See “The Same Story,” below.)

Yes, you could use slightly different allocations and get slightly different results, but my point is a larger one.

As I wrote about in “Are Hedge Funds Prudent for Taxable Investors?,” even though trusts and UHNW individuals aren’t endowments, I often hear Chief Investment Officers of many large private wealth management firms say things like, “To be prudent investors and good fiduciaries, it’s import to invest in an endowment-style portfolio."

The FACTS

The point of the charts listed above are to counter claims like this, which I find often break down when you consider what my friend Wesley Gray, from Alpha Architect, calls the FACTS (below is my slightly revised take):

Fees – Incentives that are too high; often improperly aligned and too opaque.

Access – Liquidity, which can be poor and not linear. You need it when you need it and many complex strategies have significant liquidity restrictions when you need the money the most. Just ask some endowment CIOs who ran into this problem during the financial crisis and had to sell illiquid investments at fire sales prices to vulture investors.

Complexity – Many endowment-style products and models are often based on theories, which are contingent upon assumptions based on estimates. Presentations can also be hypotheticals, which may be hard to consistently implement in the real world.

Taxes – Endowments don’t pay taxes, but individuals and trusts do. As an example of the problem, many hedge fund strategies generate the majority of their returns in the form of ordinary income and short-term capital gains, which may cut returns for UHNW investors by 50 percent.

Search – How do you find the hot new manager at the correct time? Is that manager closed when you do find him? How do you properly monitor the strategies when his models, holdings and even performance are relatively opaque?

Along these lines, but moving more specifically to private equity—which is the old, yet new thing again—the president of a UHNW private client consulting firm was recently quoted as saying: “Private investments really are a need-to-do, not a nice-to-do,”

This was said even in the face of more and more research suggesting that any “advantage may have disappeared as the private equity industry [has become] more competitive.” Simple small-cap value index strategies have similar characteristics, but represent a “large improvement in risk and liquidity adjusted returns over direct allocations to private equity funds, which charge average fees of 6 percent per year.”1

Ask Why

What should investors do?

When you hear the next “need-to-do” complex endowment model pitch, consider asking the following simple, but great question that my 9 and 11-year-old children ask me all the time:

Why?

The evidence is consistent; simple strategies often perform just as well, if not better than, many complex active endowment style strategies (in addition to last year’s article and the above charts, click here to read a similar simple beats complex story). I also suggest that simple portfolios of index funds or broad-based index exchange-traded funds have a significant advantage, especially for trusts and UHNW individuals. They are 100 percent liquid, completely transparent, low-cost, very tax-efficient, easy to consistently implement and easy for everyone (spouses, children, trustees, beneficiaries, etc.) to understand.

How do I think trusts and UHNW portfolios can do better?

As David Swensen, the Chief Investment Officer of Yale’s endowment, whose performance consistently ranks in the top quartile, said in his book, Unconventional Success, stay anchored on the following:

“A serious fiduciary with responsibility for taxable assets recognizes that only extraordinary circumstances justify deviation from a simple strategy…”

Endnotes

- www.etf.com/sections/index-investor-corner/swedroe-private-equity-puzzle; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2720479 (see abstract)

Return Data Sources: NACUBO-Commonfund Study of Endowments and Foundations (NCSE) and Morningstar