I love novelties. Newness intrigues me. So when Vanguard announced it was launching a suite of factor exchange traded funds, my curiosity was piqued. After all, Vanguard was making a bit of a splash with the announcement. Though it does have alpha-seeking funds in its mutual fund stable, Vanguard has earned a reputation as an index shop, offering a slew of low-cost passive portfolios. The Pennsylvania-based firm made history with its offer of the first actively managed factor ETFs.

It’s now been a month since the six-fund flotilla left the dock, just enough time—for me, anyway—to gauge its early performance.

There isn’t room here to look into a half dozen funds, so I’ll start with just one and leave the others for future columns. Best to start, I think, with the overarching Vanguard U.S. Multifactor ETF (BATS: VFMF), which invests in a wide swath of domestic stocks exposed to value, momentum, quality, and low volatility factors.

Benchmarked against the Russell 3000 Index, VFMF draws large-, mid-, and small-cap stocks into its rules-based crop and looks for those issues with strong recent price performance, robust financials and low prices relative to fundamentals. The manager’s quantitative methodology aims to produce a diverse mix of stocks representing various capitalization tiers, market sectors and industry groups which, when combined, minimize active risk. In sum, VFMF is managed to provide, as much as possible, a market-like risk profile. To the extent Vanguard is successful in its pursuit of alpha while controlling active risk, VFMF seems suitable as a core U.S. equity position rather than a tactical play.

But let’s not get ahead of ourselves. How’s VFMF actually fared since its launch? And how has it stacked up against other multifactor ETFs that draw their components from the broad market?

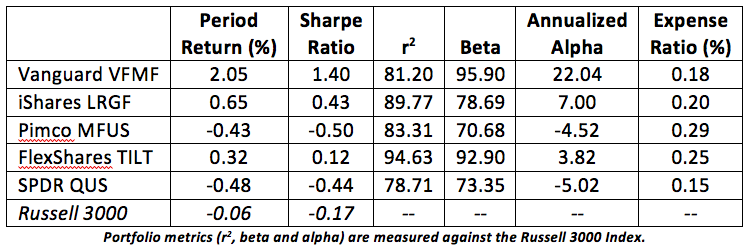

Well, in its first month VFMF clearly outperformed both its benchmark and a slate of other multifactor funds that stretch beyond the large-cap tier to fill their portfolios. The proof’s in the numbers below.

It’s early days, but the Vanguard ETF’s gotten off to a great start fulfilling its mandate. There’s a substantially positive alpha coefficient earned with a near-market beta. I’ll be watching closely to see if this sweet spot continues to be hit in the months to come.

Brad Zigler is WealthManagement’s Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.