Despite this year’s political discourse, many investors remain committed to aligning their portfolios with their values, supporting companies that exhibit ESG leadership and operate for long-term profitability. ESG and sustainability indices and indexed products have proliferated to meet this desire.

As an advisor, you have a goal and responsibility to select investments that address your clients’ ideals and objectives. Index funds may frequently be part of your strategy, given the cost and diversification benefits they provide. But while these products serve their purpose across many allocations and themes, they fall short when it comes to sustainable investing.

Albeit well intentioned, rules-based approaches to sustainable investing merit skepticism for a few key reasons: many ESG considerations are intangible and need to be assessed with qualitative judgment, existing quantitative data can be incomplete and inconsistent and, importantly, ESG scores for the same company can vary widely from provider to provider.

Above all, investors and those stewarding their wealth deserve to know what they’re investing in. For a discipline as complex as sustainable investing, the due diligence and deep engagement of an active manager are required.

What Matters to Investors

Not only are investors interested in making a positive impact with their capital, but many also recognize the way a business interacts with its environment, society and shareholders makes a financially material difference to the bottom line.

While there are a range of approaches to sustainable investing, one shares commonalities with quality investing. In this school of thought, strong sustainability characteristics are seen as indicative of quality, alongside traditional markers such as a competitive advantage in the market, high return on invested capital, high free cash flow and a conservative capital structure.

The hallmarks of a quality business, then, are competitive and financial durability, governance that embodies a strong corporate culture and environmental and social sustainability.

Measuring the Tangible and Intangible

Though certain financial metrics are routinely quantified, getting a full picture of the quality markers requires more than just data. For example, to understand a company’s culture and employee satisfaction levels, one can review filings like EEO-1 reports, and even some “big data” such as Glassdoor ratings. Those metrics can be tremendously helpful, but without judgment, fundamental research and detailed knowledge of a company and its management, industry and customers, they can also be tremendously misleading.

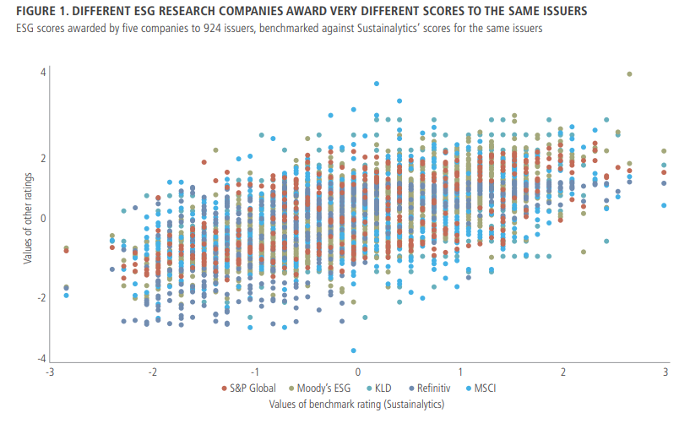

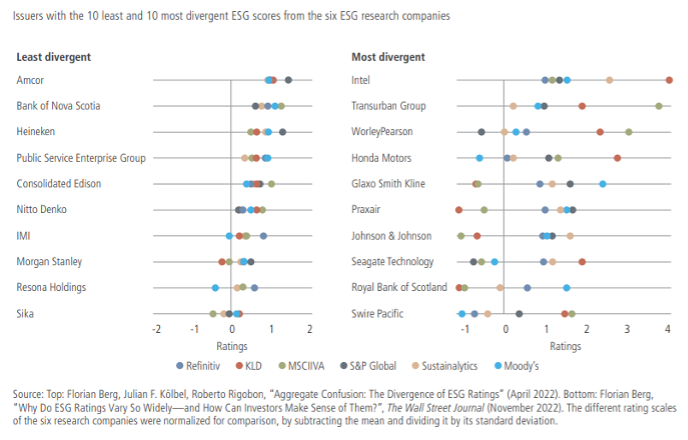

Moreover, there are discrepancies in a lot of ESG-related data that simply aren’t present in traditional financial metrics. Two value factor indices that weight the same equity universe by P/E ratio are likely to look very similar. The same cannot be said for two ESG indices that weight by an ostensibly similar ESG score—even though they ultimately draw on the same reported data.

Several studies have found that research companies’ ESG scores for the same company can vary widely, with almost zero correlation. That’s partly because ESG datasets are often incomplete, requiring those who generate ESG scores to fill in the gaps with modelled inputs.

The processing of reported data also varies, adding another layer of subjectivity to any rules-based investment approach. Couple that with the variability in the frequency with which data inputs are updated, in the weighting of particular metrics, and in the choice of peer sets used to derive relative scores—not to mention the human biases involved when translating underlying metrics into ESG scores—and the challenges of relying on a rules-based approach become clear.

Engagement by Fundamental Active Owners

Index providers and fund manufacturers have been successful with market-capitalization, style and factor index products, with many now aiming to replicate that success in the sustainable investing space. Some regulators have encouraged this activity, seeing the availability of such benchmarks and products as enabling broader investor participation in sustainability.

Index investment products cannot offer an essential pillar of sustainable investing: genuinely engaged ownership of and influence with portfolio companies.

Index fund providers may have a team of stewardship professionals, but it is very difficult to engage deeply and meaningfully if one is not a seasoned analyst of the fundamentals of a company and its industry. Even if the stewardship team identifies an issue and works with a company’s board and management to reach a conclusion, that result could take months or years to be reflected in reported data, ESG scores and index weighting—and, in some cases, it might never be reflected at all.

By contrast, active managers can point to specific examples of constructive engagement yielding positive results. Much of the work is in encouraging communication and disclosure, rarely telling company leaders how they should operate, but instead work toward standardized reporting of the right metrics so that active managers can properly assess their strategy and progress, and hold them accountable if necessary.

These efforts are sometimes met with resistance, particularly when advocating for reporting practices that may not be standard today but will likely be in the future. This was the case, for example in 2018 when the Neuberger Berman Sustainable Equity team started advocating for Science-Based Targets aligned emissions reporting and may arise again as the focus shifts to emerging issue of the regulation and ethical deployment of technology. It’s questionable whether discussions of how management is thinking about these issues and communicating to shareholders can be achieved outside the environment of active management.

The Transparency Investors Deserve

At minimum, investors and advisors who are considering adding an ESG index product to their strategy should understand exactly what that entails. In practice, it means selecting an ESG index investment product provider, an ESG index provider, an ESG index and an ESG score provider—with an understanding of all of the variability described above. And these decisions should be informed by the same level of due diligence they would apply to selecting an active manager.

The virtues sought after by sustainable investors are challenging to identify in a rules-based, passive strategy. Sustainable investing requires fundamental judgment and is an inherently active discipline.

Daniel Hanson, CFA, is Managing Director, Group Head and Senior Portfolio Manager—U.S. Sustainable Equity at Neuberger Berman