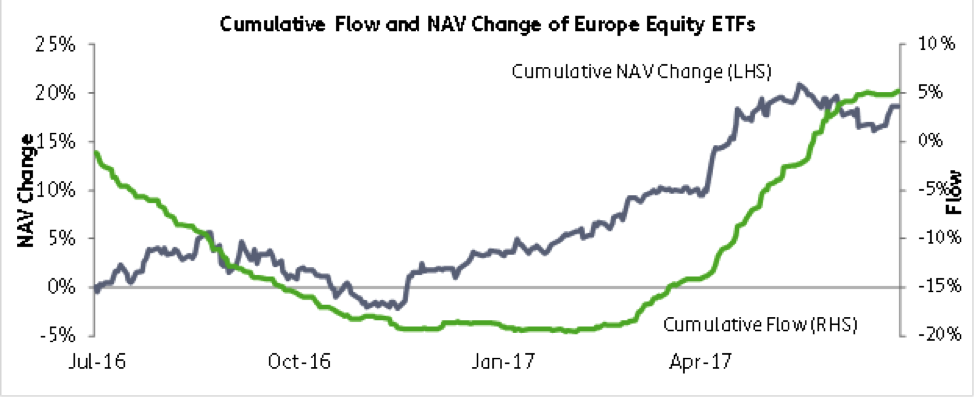

Buying of European equities has fizzled since European Central Bank President Mario Draghi hinted at reducing monetary stimulus, just the latest sign of how dependent financial markets have become on continuous central bank stimulus.

European equity ETFs had heavy, steady inflows from April through June, totaling $11.3 billion (20.1% of assets). This buying was the heaviest since the spring of 2015. After Super Mario delivered his speech on June 27, however, these funds have had outflows on six of 13 trading days and issued a relatively modest $500 million (0.9% of assets) in that 13-day span.

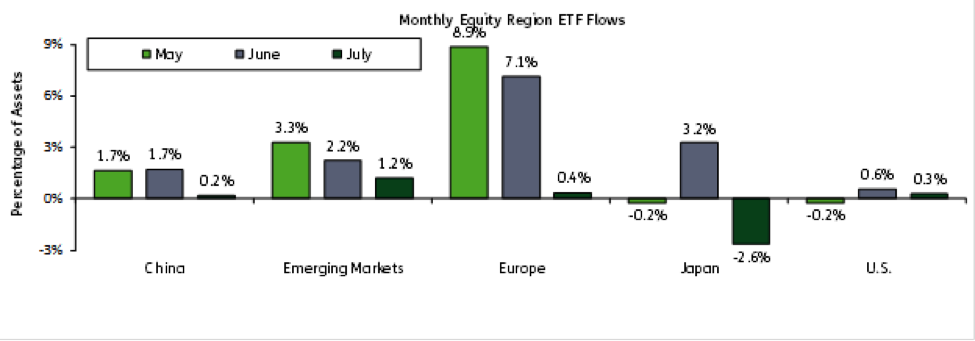

Buying interest has shifted to emerging-market equities. Emerging-market equity ETFs issued $1 billion (0.7% of assets) in the past week, bringing the month-to-date inflow to $1.8 billion (1.2% of assets).

David Santschi is CEO of TrimTabs Investment Research, an Informa Financial Intelligence company.