By Nir Kaissar

(Bloomberg Gadfly) --The U.S. stock market rally that has raged since March 2009 -- the S&P 500 is up 249 percent since its post-financial crisis low that month -- has often been called a hated bull market.

Well, it’s hated no longer.

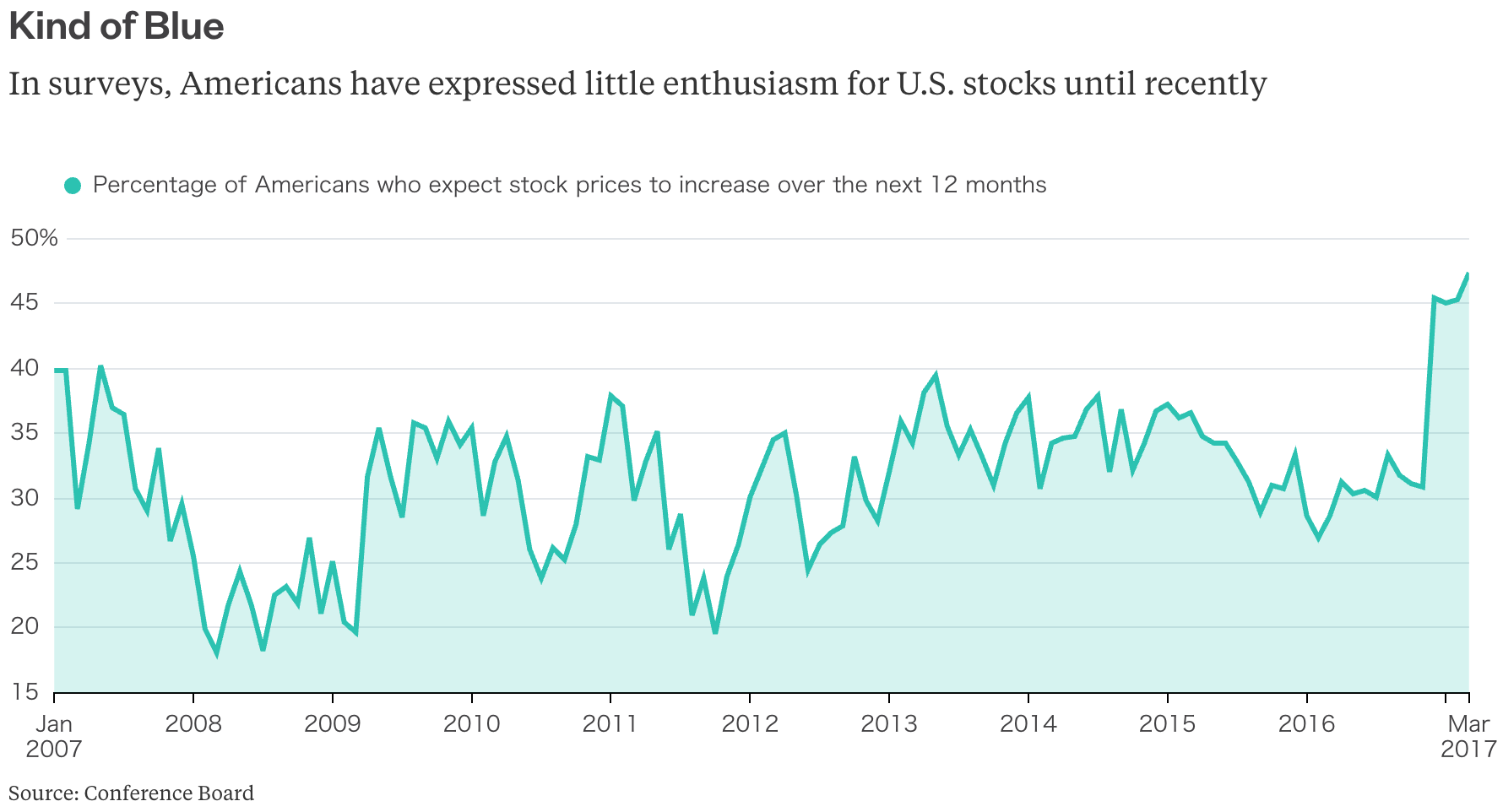

According to the Conference Board’s latest consumer confidence survey, 47.4 percent of respondents expect U.S. stock prices to increase over the next year. That’s a bigger number than it looks. Since the survey’s inception in June 1987, respondents have only been more bullish once: In January 2000, 47.7 percent of respondents expected higher stock prices ahead, just weeks before the dot-com crash.

It took Americans a long time to get behind this bull market. From March 2009 to November 2016, only 31.8 percent of those surveyed on average thought that stocks were headed higher. In the meantime, the S&P 500 has posted a positive total return for eight consecutive years since 2009.

In December, sentiment suddenly spiked: 45.5 percent of those surveyed were bullish, up from 30.9 percent the month before. It happens that stock valuations reached a notable high in December, too. For the first time since the financial crisis, the cyclically adjusted price-to-earnings ratio climbed to 28. Both valuations and sentiment have climbed further since then.

All of this reinforces the stereotype of ordinary investors as rubes who perpetually mistime the market. But the historical survey data suggests that reputation may be undeserved.

Granted, there have been times when sentiment was stunningly misguided. For example, Americans were high on stocks from June to August 1987, just two months before the savage October stock market crash that sent the S&P 500 tumbling 31.5 percent in two weeks. Americans were also feverish from 1997 to February 2000 at the peak of the dot-com bubble, and then downright depressed during its aftermath in 2001 and 2002.

At other times, however, sentiment has been amazingly prescient. Americans were unusually confident in 2003, just as U.S. stocks began a multiyear winning streak. And they turned a deep blue in September 2007, well before it was evident that a financial crisis was underway. In fact, sentiment hit an all-time low of 18.1 percent in March 2008, a month before Bear Stearns collapsed.

On the whole, the numbers don’t support the conventional wisdom that betting against sentiment is a profitable endeavor. The correlation between sentiment and subsequent one-year total returns for the S&P 500 is just 0.04, and the correlation with subsequent three-year annual returns is a negative 0.06. In other words, there’s no correlation between how Americans feel about stocks and how stocks subsequently perform.

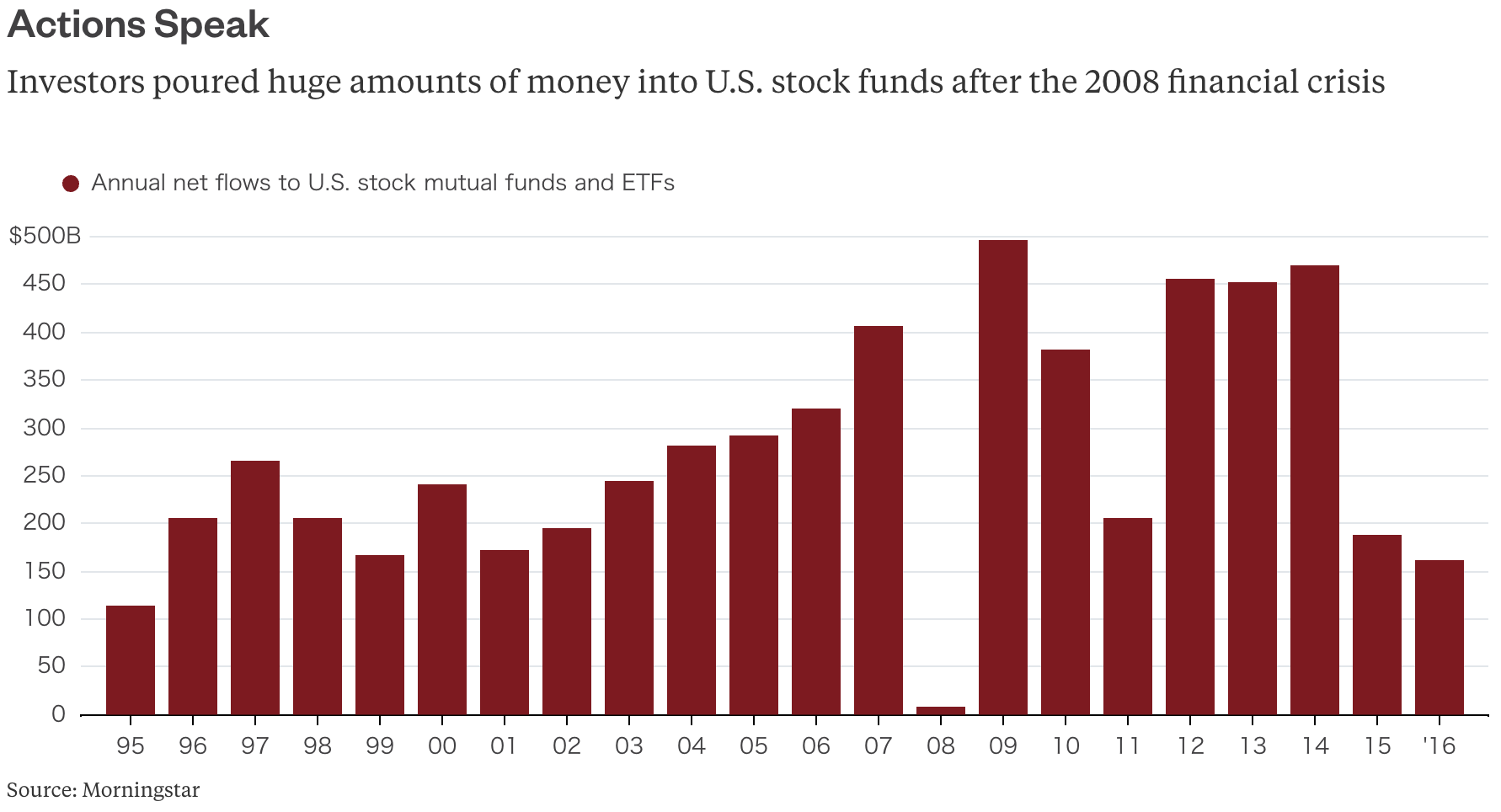

Obviously, how Americans say they feel about stocks and how they invest their money may be entirely different. When I looked at asset flows to U.S. stock mutual funds and ETFs since 1993 -- the earliest year that numbers are available -- I found that investors have made better decisions than they get credit for.

According to Morningstar, for example, the annual net asset flow to U.S. stock funds averaged $192 billion during the dot-com craze from 1995 to 1999. But in the bear market that followed from 2000 to 2002, the average net flow actually increased to $203 billion a year.

Investors also appear to have navigated the financial crisis and its aftermath better than advertised. A record low $9 billion flowed to U.S. stock funds at the height of the crisis in 2008. When stock valuations tumbled to multidecade lows in 2009, fund flows swelled to $496 billion, the highest one-year flow on record. Fund flows remained strong in subsequent years -- an average of $399 billion a year from 2009 to 2014. But as valuations climbed, fund flows slowed to $188 billion in 2015 and $163 billion last year.

Americans may say that they’re finally behind this bull market, but they’re betting less and less money on it. Perhaps ordinary investors are savvier than everyone thinks.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Nir Kaissar is a Bloomberg Gadfly columnist covering the markets. He is the founder of Unison Advisors, an asset management firm. He has worked as a lawyer at Sullivan & Cromwell and a consultant at Ernst & Young.

To contact the author of this story: Nir Kaissar in Washington at [email protected] To contact the editor responsible for this story: Daniel Niemi at [email protected]