One of the more frequently asked questions I am asked is what to do when an investor has come into a large amount of cash (perhaps from an inheritance or sale of a business). Should they invest it all at once or by dollar cost averaging (DCA)? Fortunately, the empirical research findings provide the optimal answer from a purely financial perspective.

Academic research, including the 1979 study A Note On The Suboptimality Of Dollar-Cost Averaging as an Investment Policy, the 1992 study Nobody Gains From Dollar Cost Averaging: Analytical, Numerical and Empirical Results, and the 2011 study Does Dollar Cost Averaging Make Sense For Investors?, has found that investors put the odds significantly in their favor by investing all the assets immediately—and when DCA outperforms (in the minority of cases), it tends to do so by much less than when it underperforms (in the majority of cases).

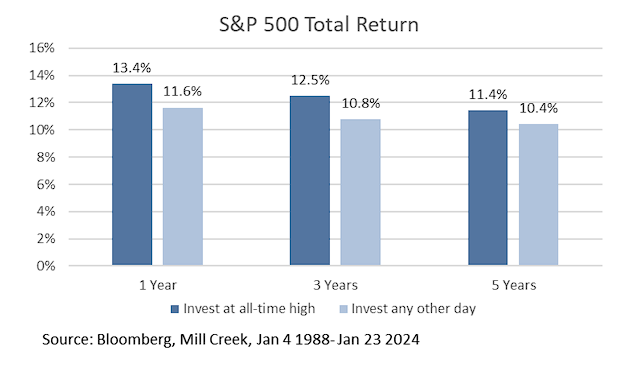

When I presented this evidence to an investor, I was asked: “While that has been the case on average, the market has just set an all-time high, so maybe I should just wait for a market pullback?” Thanks to Michael Crook, chief investment officer at Mill Creek Capital Advisors, we can examine the empirical evidence. Crook reviewed the returns of the S&P 500 Index over the one-, three- and five-year periods following an all-time high and compared them with the returns if they had been bought on any other day. His data sample covered Jan. 4, 1988, through Jan. 23, 2024. As shown in the table below, buying when the S&P 500 Index was at an all-time high outperformed buying on any other day over each holding period examined, with the outperformance ranging from 1 percentage point to as much as 1.8 percentage points.

Despite the empirical evidence, DCA remains a popular strategy among individual investors. The strategy's popularity is likely explained, at least in part, by the lack of knowledge of the evidence we have reviewed. The popularity is also demonstrated by DCA being a risk-averse strategy because those employing it are holding cash until the plan is fully implemented. In addition, behavioralists would explain that the popularity results from DCA investors seeking to minimize the potential regret (loss aversion) of investing a lump sum.

Investor Takeaway

The historical evidence makes clear that DCA is an inferior investment strategy. That said, it may still serve a purpose: If you are so risk averse that you would not invest if you were forced to choose between investing a lump sum or not at all, DCA becomes ‘the lesser of evils.’

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. Third-party information is deemed reliable, but its accuracy and completeness cannot be guaranteed. The opinions expressed here are their own and may not accurately reflect those of Buckingham Strategic Wealth, LLC or Buckingham Strategic Partners, LLC, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-617