By Julie Verhage

(Bloomberg) --From Brexit to Donald Trump to the S&P 500 Index's worst-ever first month, the past year was anything but quiet for investors.

The tumult provided pain and opportunity alike, so as 2016 draws to a close, it's time to tally up the best- and worst -performing assets across the globe this year.

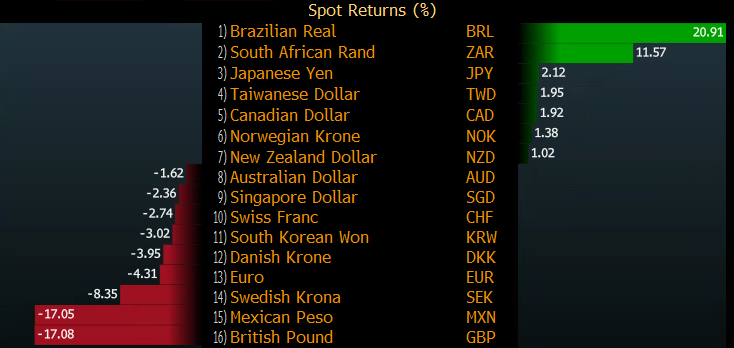

Currencies

It was a particularly bad year for any currency called the "pound." The Egyptian version was the worst performer in 2016 as the nation took the dramatic step of allowing it to trade freely in an attempt to stabilize an economy struggling with a dollar shortage and concerns over social unrest. Britain's pound tumbled after Brexit and never recovered.

On the other side of the spectrum, digital currency bitcoin was the best performer this year, rising more than 100 percent as capital controls in places like China and isolationist rumblings in the U.K. and U.S. have fueled interest in alternate currencies.

When it comes to currencies issued by governments and central banks, the Russian ruble has been the best performer of the year as the oil market rebounded.

Here's the full look at the best and worst of all currencies.

While the U.K. currency's slide didn't match those in some emerging markets, it did tally the worst performance among major currencies.

World Equity Indices

Despite recent unrest, Brazil's Ibovespa stock index remains the best performer for 2016. This is largely due to hopes that President Michel Temer, who took office after Dilma Rousseff was impeached, will end the worst recession in a century and bring about political stability.

Nigeria's equity market fared worst in the year. The nation's economy is set to contract in 2016 for the first time in more than 20 years as capital controls deter foreigners from investing and militants are blowing up pipelines.

Commodities

While 2015 was rather rough for commodity bulls, this year it's hard to find red on the screen. Natural gas was the standout, up more than 60 percent over the past 12 months, and forecasts for a cold start to January are sending it out with a bang.

Oil bounced back, though the ride was rough. West Texas Intermediate slid below $30 before rising above $50 -- good for a gain of more than 50 percent this year. Crop farmers had it hardest, as wheat and corn took tumbles of 13 percent and 1.6 percent, respectively.

Here's a full look:

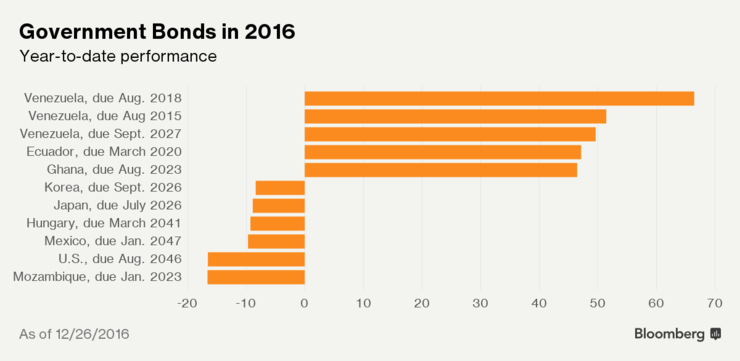

Bonds

Venezuelan bonds have been among the top investments, somewhat surprisingly given the social unrest in the financially struggling nation. Its bonds rallied on rumors the government may be looking to strike a deal to push back looming debt maturities, which would give the cash-strapped nation fiscal breathing room. More debt comes due in 2017, and some payments have already been missed.

The worst performing bond came from Mozambique as the nation struggles with a debt crisis and surging inflation.

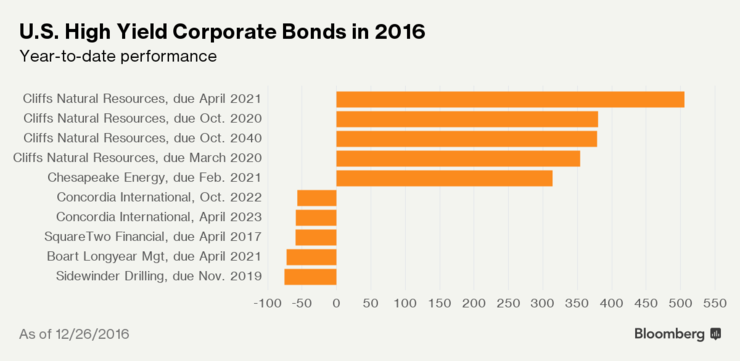

When it comes to U.S. high yield corporate bonds, a number of energy names were top performers as bets that oil would stabilize paid off. Bonds issued by Sidewinder Drilling Inc. were the worst performing, as rating agency Moody's Investors Service downgraded the firm and warned of a possible default.

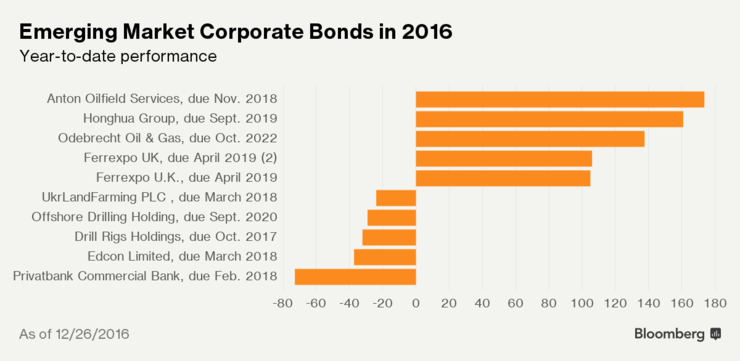

Lastly, Anton Oilfield Services was the top performer when it comes to emerging market corporate bonds. The company has come back from a downgrade last year, as it signed an agreement with a Shanghai bank to obtain more financing. Privatbank Commercial Bank was the worst performing, with Fitch Ratings placing the firm on rating watch following renewed concerns over the company's solvency.

To contact the author of this story: Julie Verhage in New York at [email protected] To contact the editor responsible for this story: Joe Weisenthal at [email protected] Isobel Finkel