By Christopher Langner

(Bloomberg Gadfly) --If you're an equity investor and feel like things can't be this good, you're probably right.

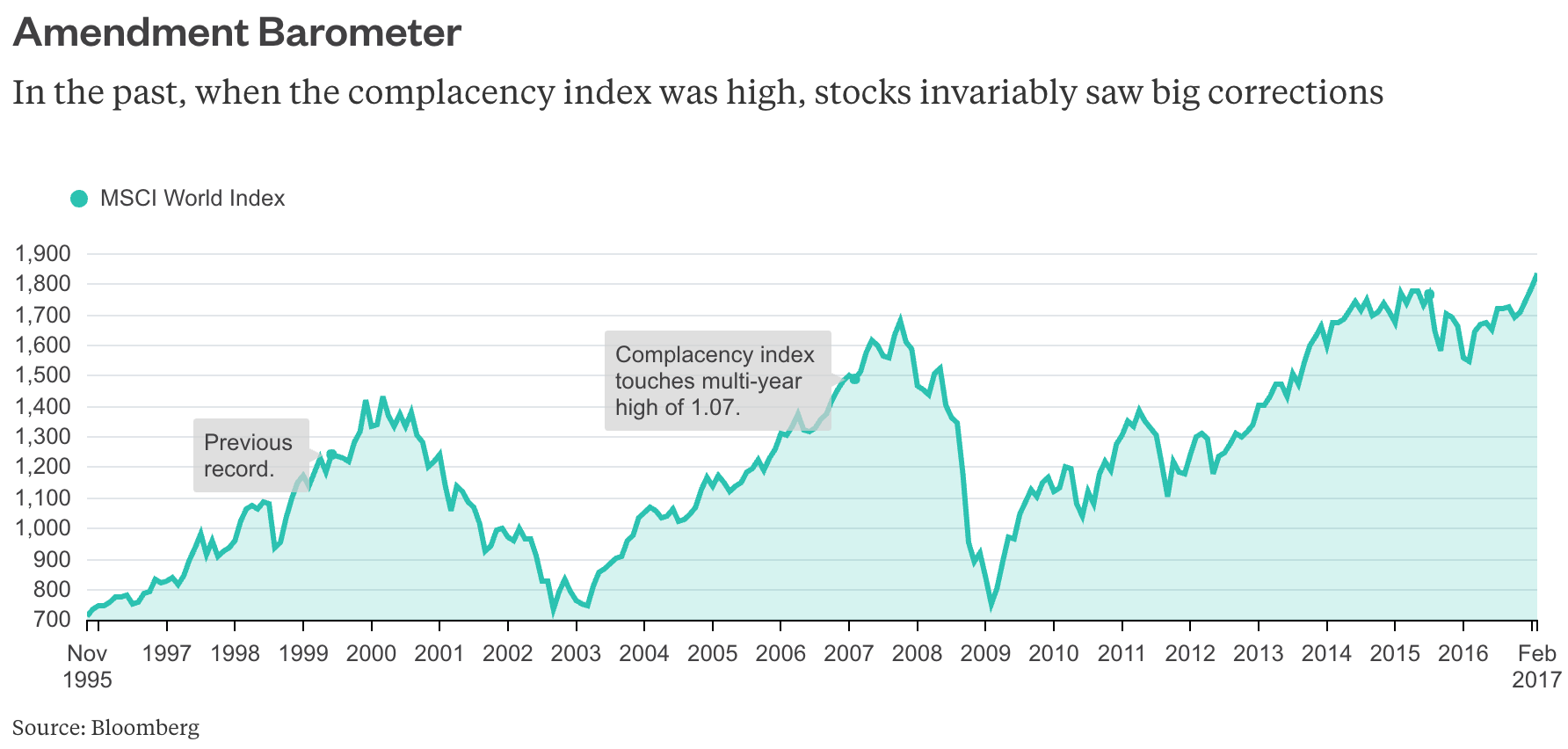

On Thursday, the MSCI World Index touched the highest since 1970, and while it's come back a fraction, it remains elevated. The Chicago Board Options Exchange Volatility Index, or fear index, is at 11.76, close to the 30-month low it reached on Jan. 27.

This divergence has pushed the so-called complacency index, which relates the ratio between enterprise value and Ebitda in the MSCI World Index to the VIX, to its highest level in at least two decades. The gauge peaked on Jan. 27 at 1.145, but the 1.139 it logged on Tuesday is the third highest since at least 1997. The benchmark has been unusually high over the past two years thanks to the endless generosity of central banks, as I have written about before.

The recent levels are reminiscent of other highs, which were almost always followed by a significant correction. The pullback often lagged the complacency peak by a few months, but it came sooner or later.

Perhaps an even bigger reason to be concerned is that sustained high levels in the complacency index were seen in the run-up to both the bursting of the dotcom bubble and the subprime crisis.

Investors do need to bear in mind that the amount of money being printed can skew traditional financial gauges. But anyone who's getting suspicious about the current levels of optimism has history on their side. In the past, this hasn't ended well.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Christopher Langner is a markets columnist for Bloomberg Gadfly. He previously covered corporate finance for Bloomberg News, and has written for Reuters/IFR, Forbes, the Wall Street Journal and Mergermarket.

To contact the author of this story: Christopher Langner in Singapore at [email protected] To contact the editor responsible for this story: Katrina Nicholas at [email protected]