Your clients shouldn’t be jumping for joy or buying you a bottle of Pappy Van Winkle if their portfolios outperformed in 2014. They should, instead, give you the boot, says wealth advisor Ed Butowsky, writing on TheBlaze.com. Advisors whose client portfolios returned 17 percent last year are ignoring a key tenet in money management: downside protection, Butowsky argues. Advisors should be allocating more to non-correlated asset classes, such as senior rate floating notes, real estate, gold and silver, managed futures, hedge funds and collectibles. “If you had them in your portfolio, they reduced your return —but they also substantially reduced your risk,” Butowsky said.

It's getting to be a pricy proposition for families with kids who want to play sports. According to this New York Times article, families are spending up to 10.5 percent of their gross income on youth athletics, much more than any time in the past. And, and a result, lower-income families are being priced out of the top levels of competition. “Some people are not in the financial situation to pay for their kid to do it,” said Mike Trombley, a former pitcher with the Minnesota Twins who is now a financial advisor.

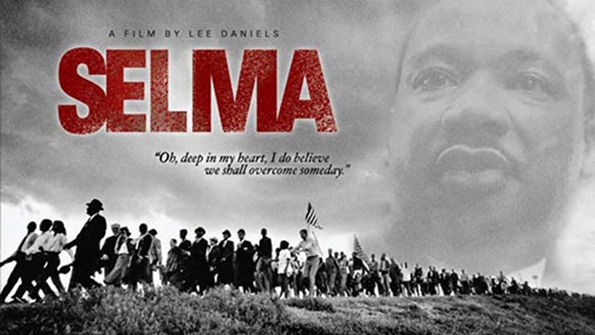

About 1,500 7th, 8th and 9th grade students in San Francisco were able to see the movie Selma for free on Monday in celebration of Martin Luther King Day, thanks in part to $15,000 from Wells Fargo. According to a tweet from Bay Area spokesman Ruben Pulido, the bank underwrote free admission to the Academy Award-nominated film as part of the #SelmaForStudents campaign. The national initiative began in New York after team of African-American business leaders created a fund to allow 27,000 area student to see the film for free. "This is a grassroots effort," Pulido said. "Jim Foley, EVP and president of Bay Area region for Wells Fargo learned about it and decided to support it.”

Cardale Jones may not become the future face of a National Football League franchise, but he might become the future face of financial advisors. The third-string quarterback who took over the Ohio State University football team at the end of the season and led it to a national championship, declared that he would rather stay in school to study financial planning instead of enter the NFL Draft. The Financial Planning Association commended Jones on his decision, and recommended that he seek his CFP certification, study at the Ohio State’s Fisher College of Business, get an internship and connect with other millennial wealth managers.