The diversification benefits of managed futures hedge funds have been proven over two decades, but many investors have questioned whether the typical hedge fund fee structure consumes too much alpha. For example, a U.K. hedge fund manager apparently made between $2 and $3 billion dollars in fees over 5 years on one fund alone while investors actually lost money. This raises the question: Is there a lower cost, higher alpha way to access managed futures’ performance?

One approach promulgated over the past few years has been to build simple “trend” models: the notion of capturing excess returns by buying securities that have risen and shorting those that have declined. Banks create indices and offer over-the-counter swaps that track their performance; some asset managers, including those in managed futures, offer static trend-following models. The thesis is that “trend” is a key driver of managed futures’ performance: if you can access this key driver cheaply, you’ll get most of the value of managed futures.

But has this approach worked? The unsatisfying answer is: not really.

- The track record of most “trend” products is short and somewhat unreliable.

- Trend products have relatively low correlation to actual managed futures, which suggests that static trend models fail to explain a significant portion of managed futures’ performance, particularly before fees.

- Trend products on average fail to improve returns over high cost hedge funds, so investors might benefit from daily liquidity but fail to see better performance over time.

Trend Risk Premia Products

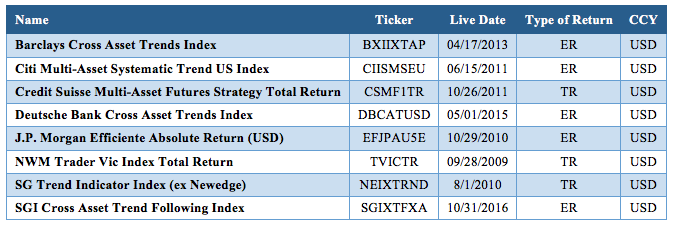

We reached out to sophisticated allocators for recommendations on which products we should include in this study, identifying the eight indices below.

An initial concern is that the track records are relatively short—surprising given that a key element of the marketing pitch is that excess returns from momentum has persisted for decades. One of these products (Citi) was discontinued last year; another issue with analyzing index-based products is that firms often shut down indices when they underperform and replace them with new, back-tested indices that look better.

We exclude those products that don’t have a live track record of 3 years and are left with only five products.

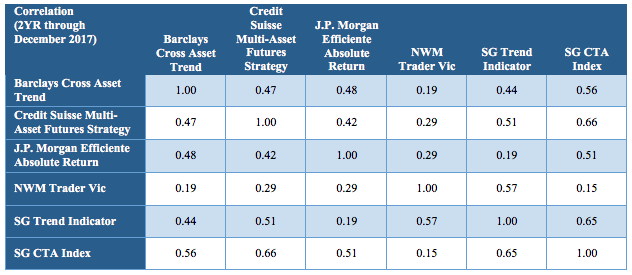

Correlations Among Products

While the correlation among similar equity indices is often well above 0.95, the correlation among the risk premia indices over the past 2 years has been quite low: 0.39 on average. The next question is how the products correlate to the SocGen CTA index, which most allocators consider broadly representative of the overall managed futures space. Such correlation ranges from 0.15 to 0.66, with an average correlation of 0.55, undermining the notion that “trend” is an identifiable and predictable “beta” that can be captured easily.

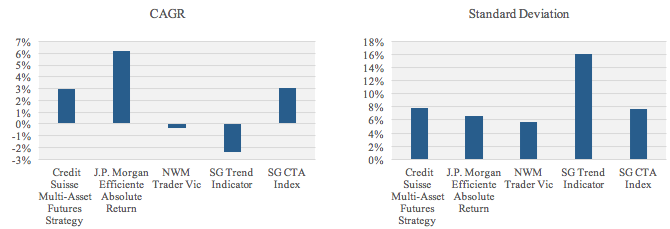

Performance of Live Products vs. Managed Futures Hedge Funds over 5 Years

The four “trend” products with live 5-year track records returned 1.6 percent per annum, about half the net of fee returns of the SocGen CTA index, and the standard deviation of the products varies widely, further complicating the comparison of the reported performance to the SocGen CTA index.

Conclusion: Is This Progress?

The analysis above highlights serious issues with risk premia products: short track records (and unrealistic back-tested numbers prior to launch) and wide variations in products designed to capture the same “risk premia.” Further, despite lower fees, a risk premia portfolio would have failed to improve performance. Arguably, this is two steps forward and, quite possibly, two steps back.

Andrew Beer is managing partner and co-portfolio manager for Dynamic Beta at Beachhead Capital Management, a hedge fund replication strategist with more than $500 million under management.