Arch, a technology platform that automates the operations and reporting for private investments, has raised $20 million in Series A funding, led by Menlo Ventures. Existing investors Craft Ventures and Quiet Capital also participated in the funding round, as well as new investors, including Carta, Citi Ventures, GPS Investment Partners and Focus Financial Partners.

A coterie of individual fintech founders, investors and entrepreneurs also participated in the round, including the founders of Altruist and Vanilla, as well as that of Aduro Advisors (a fund administration company), Equi (an alternatives platform), and Sydecar (a deal execution platform for venture investors). Scott Prince, executive chairman at Merchant; Gary Cohn, vice chairman at IBM; and Marc Spilker, co-founder at GPS Investment Partners and executive chairman at Merchant, also invested.

In 2021, Arch raised an initial $5.5 million, bringing its total funding to date at over $25 million.

Arch was launched in 2018 by co-founders Ryan Eisenman, Joel Stein and Jason Trigg, and aims to solve many of the pain points financial advisors have with investing in alternatives, including collecting K-1s, the tax forms used for private investments; managing capital calls; and tracking performance, cash flows and metrics across investments.

“Arch solves those workflow and data problems,” Eisenman said. “We’ll connect to every portal, platform, fund, admin, pull all the documents into a single platform, digitize those documents and pull the key data points out of them, and then update downstream reporting systems like Addepar, Black Diamond, Orion and Tamarac, so that clients know what they’re invested in and how those investments are performing, so that advisors can report on those assets, and also to save a lot of the administrative and operational time of getting K-1s to accountants and knowing what capital calls need to be completed.”

On average, a private fund will issue four capital calls a year, Eisenman said.

“If you have 500 active funds across your clients, that could be 2,000 capital calls a year,” he said.

“In my own personal account, I know those pains. I’ve lived them,” said Luis Valdich, managing director of the VC group at Citi Ventures. “What really excites us about Arch is how they’ve honed in on this enormous problem for the industry and for investors, and developed a pretty compelling solution that will effectively extract all the relevant data from your K-1s in a central place that will make all these aspects of managing your alternatives, starting with the tax piece, far more efficient.”

To be sure, there are alternative platforms already out there doing some of this administrative work on behalf of advisors, such as CAIS and iCapital. In fact, Citi Ventures is also invested in iCapital. But those platforms automate those tasks only for the asset managers on their platforms. Arch captures anything with a GP or LP structure, as well as private companies, directly held real estate and directly held startup investments.

“If all of your investments are with a CAIS or an iCapital, then you likely don’t need Arch, because everything is centralized in a single platform,” Eisenman said. “The reality on the ground is, even if an advisor has an exclusive relationship with CAIS or iCapital, they might have alts that pre-date CAIS or iCapital, and their clients might invest in alts outside of the platform—what people might call ‘off-platform’ or ‘held-away alts.’

“What Arch will do is collect all that information—from CAIS, iCapital and any outside managers direct from managers or direct from the platform—and put it all into a single platform.”

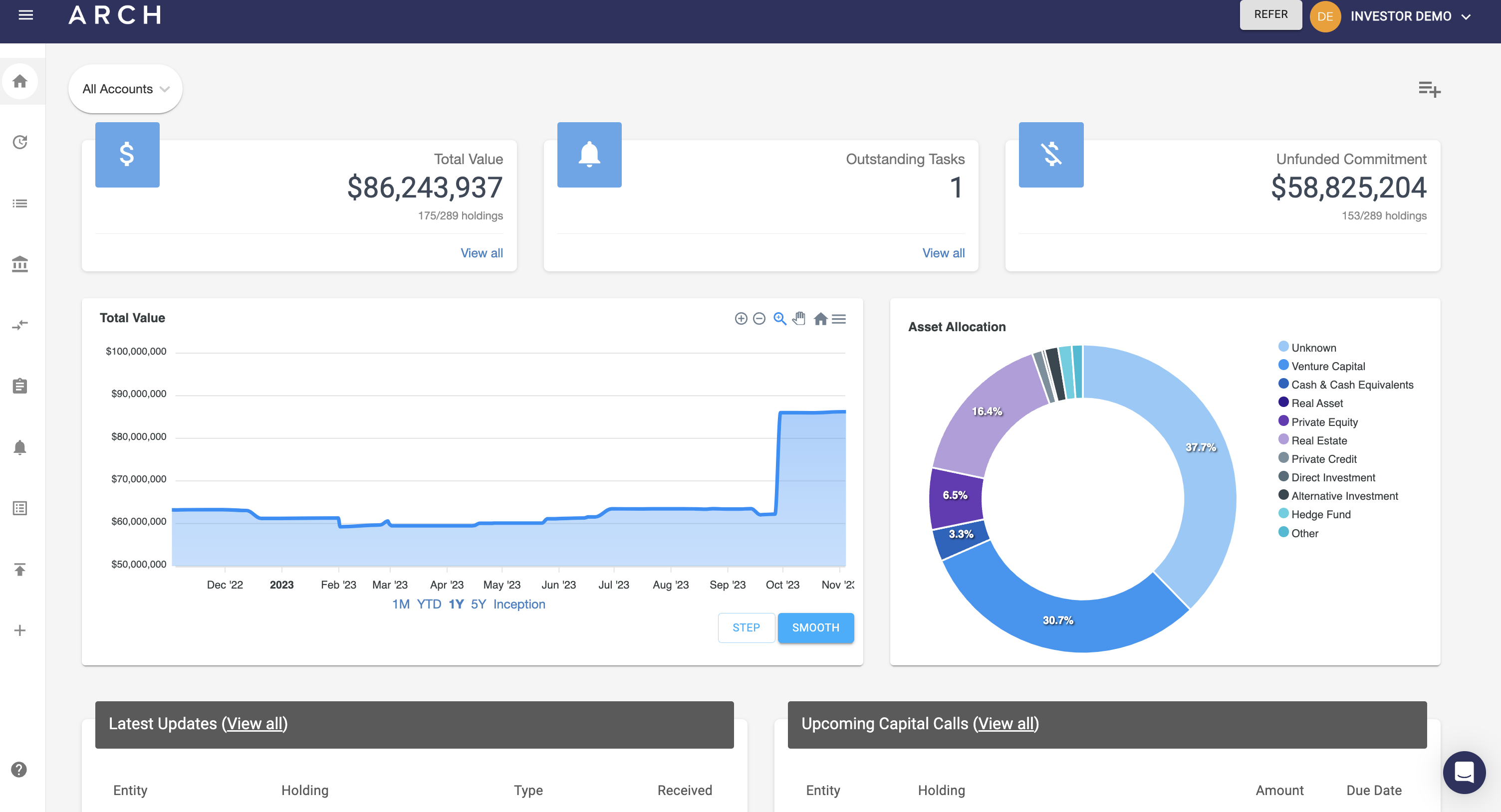

The Arch home screen.

Some of the people and the firms that invested in this funding round have experienced the pain points with alternatives firsthand, Eisenman said.

“Alts is a key part of a lot of these businesses, and it’s a growing part of a lot of these businesses. And a lot of the people that have invested have seen this pain point personally, in addition to seeing some of the applications within their businesses. They see the potential of, ‘Well, if Arch does their job and executes, then we don’t have to build some of these painful parts of the tech stack. We can just integrate this data into what they’re doing.’”

Croom Beatty, partner at Menlo Ventures, said the data infrastructure aspect of Arch was really interesting to him; the company is building that infrastructure by integrating into all the GP portals and fund administrators. He compared it to what Plaid is doing with its data connectivity tools.

“It’s very interesting, this Plaid-esque data aggregation problem that they’re solving, which is giving them this almost like foundational plank from which they can kind of spin off all these other data products and workflows,” Beatty said.

Arch currently serves over 50 RIAs and multi-family offices, over 50 single-family offices and a couple dozen institutional clients, representing about $62 billion in assets. They also recently signed on one of the five biggest U.S. banks by assets, but he declined to name them.

Advisors are charged by the number of investments on the platform, not on an AUM basis, as this anchors the price to the cost savings it brings firms.

“It allows us to really be intentional and ambitious around our roadmap and what we’re able to build and how we’re able to improve clients’ alts experience. It allows us to scale our internal operations and our client service team ahead of larger clients that are coming onto the platform later this year and into next year,” Eisenman said.

While iterating on the initial build-out of Arch Eisenman's team remained lean with just five employees, but in the last two years it has grown to 60. Arch plans to put the funding toward research and development and building out its features and functionality. One area of development is reducing the risk of fraud within capital calls, while another is integrating the data with different systems, such as general ledgers, reporting platforms and CRMs. The company will be releasing an API to allow anyone to integrate with Arch. The funding will also go towards ramping up its marketing efforts, until now, most of its business has come through client referrals.