In the aftermath of the credit crisis, diversification has come under the microscope. Portfolios that were traditionally considered diversified could not withstand the global reach of the crisis and protections failed when they were needed most. The past decade has proven that simply adding foreign investments to a portfolio does not equal diversification.

Below we take a deeper look at diversification and the different alternative investments available to retail investors to determine the effect they have on a portfolio and whether they are doing their intended job or not.

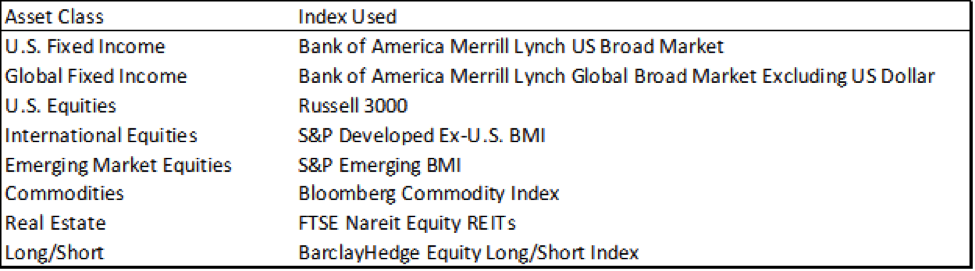

Before we get started, it’s important to disclose the asset classes and corresponding indexes used to run the mean variance optimization analysis. Table 1 displays the basic asset classes, in addition to the three alternative assets used: real estate investment trusts (REITs), commodities and long/short funds.

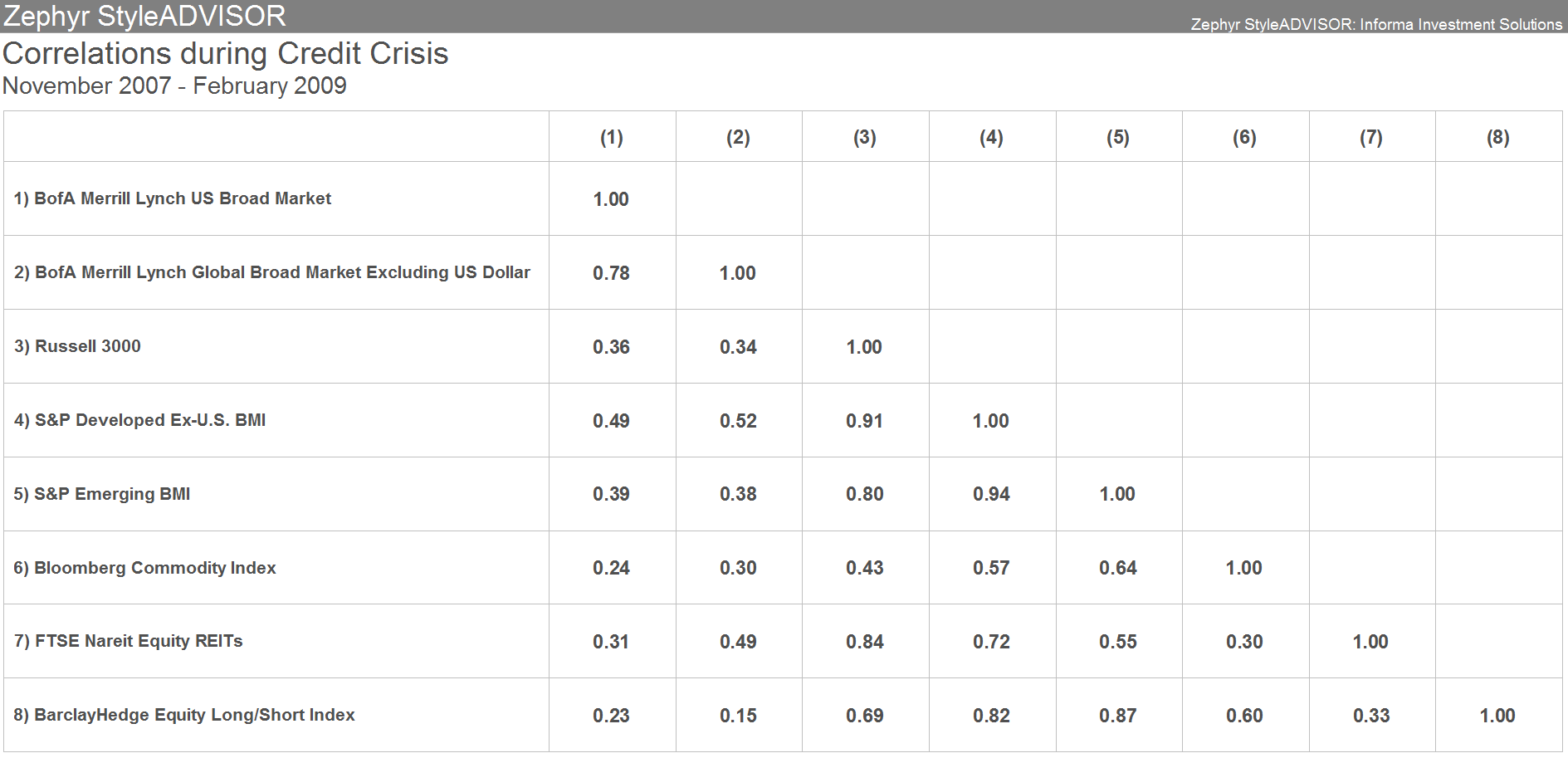

The process for constructing a risk/return optimized portfolio begins with creating a mix of investments with low correlations. Since investors are risk-averse, it’s important to realize that correlations often fluctuate during a market cycle, and particularly increase during a crisis compared to long-term averages. Figure 1 shows the correlations between different asset classes from January 1997 to September 2016, which are noticeably lower than the correlations for the same asset classes during the credit crisis (Figure 2).

The above correlation matrices provide insight into why a diversified portfolio based on historical standards fell prey to the credit crisis and why it’s imperative to broaden your use of alternatives when looking for enhanced diversification.

In addition to knowing how the different asset classes correlate to one another, it’s equally important to understand where the risk in the portfolio is coming from so you know the type of hedging strategy needed. As shown in Figure 3, a typical 60/40 portfolio is nearly perfectly correlated to an all equity portfolio, while this same 60/40 portfolio has very low correlation to interest rate movements (10-year Treasury) and is negatively correlated to changes in inflation (CPI).

With the above knowledge in hand, we can move forward with constructing an efficient frontier to determine the effect alternatives have on a traditional asset allocation consisting of basic asset classes. To determine the forecasted returns for the core asset classes, we use the Black-Litterman forecasting model, whereas for the alternative asset classes we use the historical returns (January 1997 – September 2016).

As you can see in Figure 4, by adding the three alternatives listed above to an allocation case which includes the basic assets, the efficient frontier shifts to the northwest, which represents higher returns and lower risk. This is the intended result of adding alternatives to an allocation.

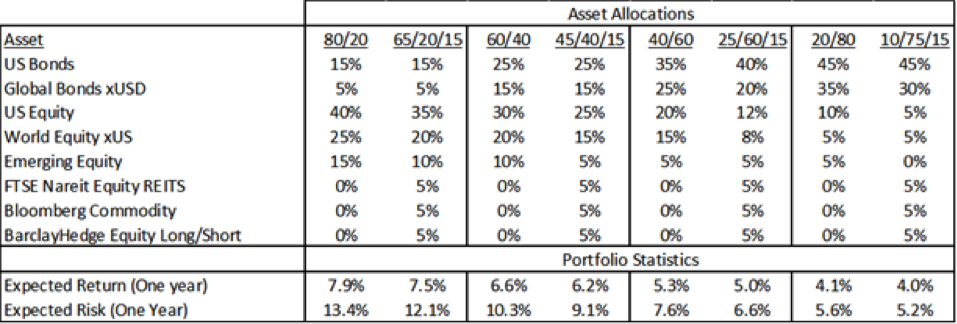

Figure 4 also displays hypothetical portfolios, composed of the basic assets (blue font) as well as portfolios including alternatives (olive font). Table 2 below provides the details of each portfolio. Focusing on hedging against equity risk, we added a 15 percent allocation to alternatives, split evenly across the three alternative investments, while reducing the equity allocations of each portfolio. As expected, adding alternatives increases diversification by reducing the expected risk; however, adding alternatives results in lower expected returns for each portfolio.

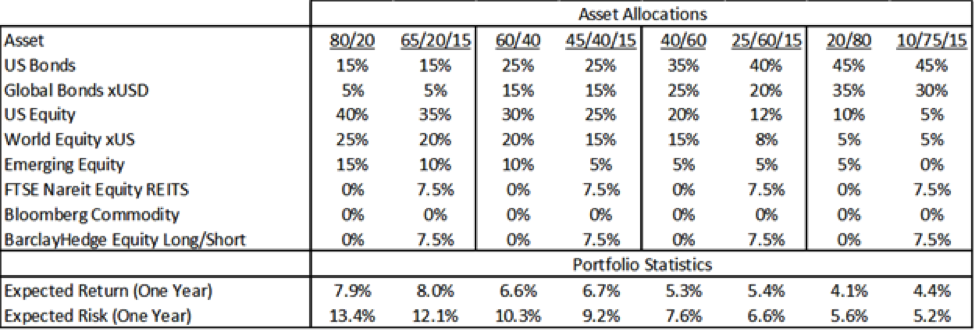

Taking this a step further, we can look at the individual alternative investments to determine if they are adding value to the portfolios. As you can see in Figure 5, the commodity asset has a very low forecasted return while its risk is in line with U.S. equities. By removing the 5 percent commodity allocation from the portfolios, the return/risk characteristics for the portfolios become more attractive (see Table 3).

When creating a portfolio for your client which aims to reduce unsystematic risk via diversification, alternative investments need to be considered. Keep in mind that not all alternative investments are created equally, and that each alternative provides unique benefits to a portfolio. It’s important to look at all factors including what risk(s) you are trying to protect against, as well as how correlations fluctuate during different market cycles.

Ryan Nauman is a VP, Product and Markets Strategist at Informa Investment Solutions. His market analysis and commentaries are available at www.informais.com/blog.