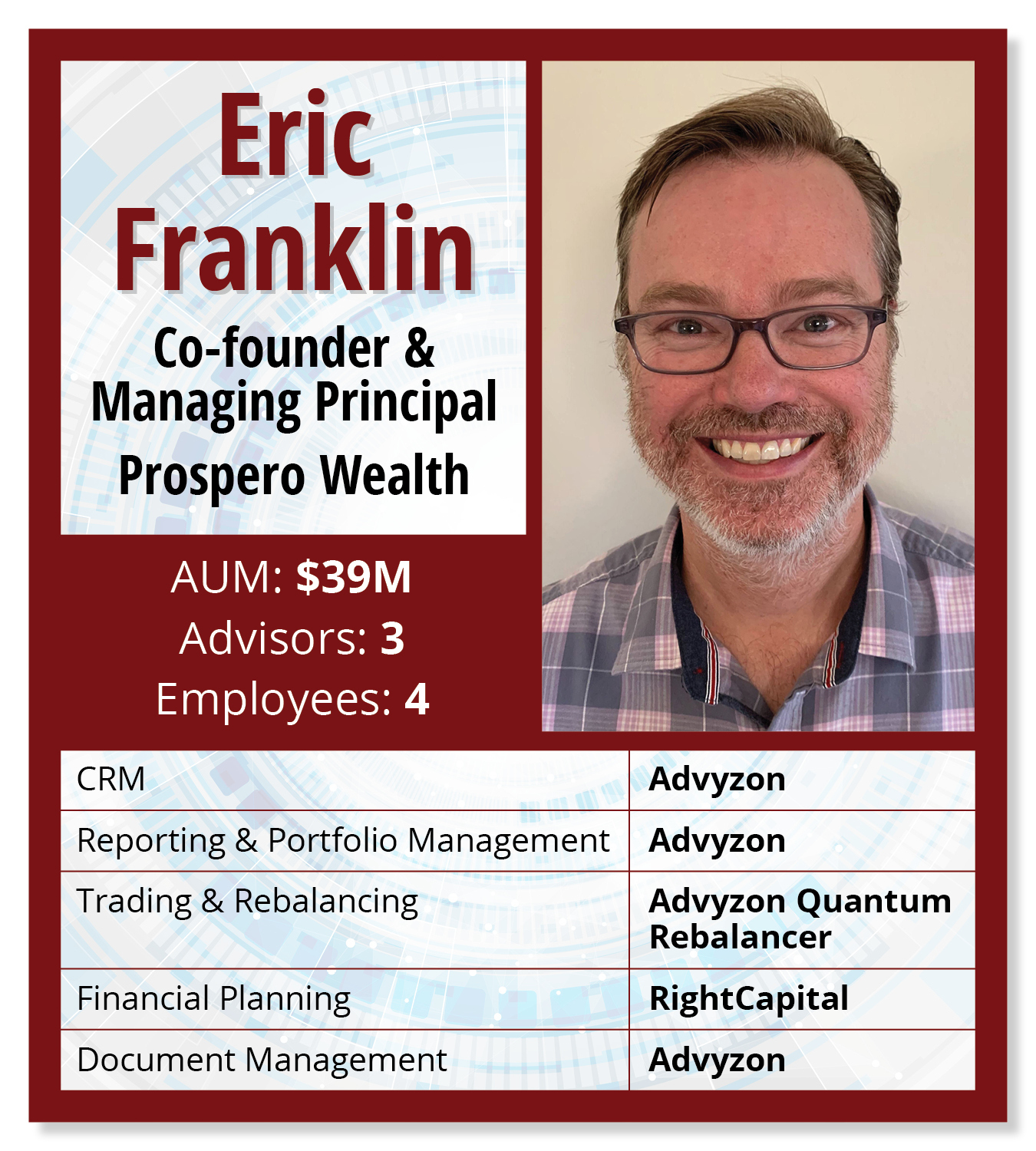

We’re unique in that I come to this from a 23-year background in technology. I’ve only been a full-time advisor for fewer than three years. That allows me to work closer with tech professionals who are skeptical of financial salespeople. That’s how we’re building the business. We’re bringing in people with multiple decades of tech experience to become advisors. We’re training them here and bringing them up to speed. We teach them all the tools and turn them loose.

CRM: Advyzon

We centralized with Advyzon in early 2023. We were previously using Wealthbox. We liked it. However, we wanted to see if we could live within a single tool. Advyzon works well for 80% to 90% of what we need. We live in Advyzon all day. As clients call or text us, those pop up and we deal with it there. We’ll explore using Wealthbox again in the coming months because we like it as a CRM. It offers us some potential automation opportunities that are underdeveloped in Advyzon.

The integrations in Advyzon are deep. When I’m looking at client portfolios, it’s easy to see the current versus target risks. It pulls through details for my planning clients on whether they’re on or off track toward the retirement goals we’ve set for them. It’s great.

The integrations in Advyzon are deep. When I’m looking at client portfolios, it’s easy to see the current versus target risks. It pulls through details for my planning clients on whether they’re on or off track toward the retirement goals we’ve set for them. It’s great.

Reporting & Portfolio Management: Advyzon

We tried to centralize everything on the reporting side. We used to use Capitect. However, we received some fee, invoicing and statement requirements from the state of Washington that Capitect still needed to have in place. They did add it later. They were very responsive to what we needed. But, by then, we had decided to try an all-in-one tool with Advyzon. That works well. Both our fee statements and performance statements are automated every quarter. Those get delivered in the client document file-sharing system.

Trading & Rebalancing: Advyzon Quantum

I have a single interface that I can use to look at exactly when those last activities and rebalances occurred. I can give them details when I’m with a client. I don’t have to navigate different interfaces. Advyzon is still developing Quantum. There are still a few core use cases that make it more manual than I would like it to be. It’s iterating every four to six weeks, and we see improvements in the new releases.

Document Management: Advyzon

I will sound like a broken record here, but Advyzon is where we store all our documents for clients. We have this fundamental tenant of showing our work. As we generate activity for the client, we post it there. It helps drive the usage of our client portal. Many advisors need help getting their clients to visit the client portal. In our case, we log everything we do as a document. It sends the client an email telling them what document we posted. It pulls them in. We see a ton of logins to our client portal.

I will sound like a broken record here, but Advyzon is where we store all our documents for clients. We have this fundamental tenant of showing our work. As we generate activity for the client, we post it there. It helps drive the usage of our client portal. Many advisors need help getting their clients to visit the client portal. In our case, we log everything we do as a document. It sends the client an email telling them what document we posted. It pulls them in. We see a ton of logins to our client portal.

Financial Planning: RightCapital

Coming from tech, I looked at all the different financial planning tools. RightCapital was the only one that clarified what our clients would expect. Since we serve tech professionals, it was a more modern planning application. It allows us to cover the essential bases quickly. We can dive into different modules to help the client. Most of our clients are busy. We must plan perpetually but always want to know the most significant opportunities. We then focus on the following two to three items.

Marketing: Levitate

Levitate has been great for us. We looked at other players and didn’t feel the ready-made content in a lot of those cases would be appealing to our audience. We found Levitate advisor content to be detailed. It’s a great starting point for generating ideas for what we should communicate to clients. Levitate has not integrated with Advyzon. That is a pain point for us and a key reason we’re looking at Wealthbox again.

As told to reporter Rob Burgess and edited for length and clarity. The views and opinions are not representative of the views of WealthManagement.com.

Want to tell us what’s in your wealthstack? Contact Rob Burgess at [email protected].