Popular financial planning technology provider RightCapital has launched RightRisk, its new risk tolerance measurement tool. Out now, the tool is automatically available as part of the company’s premium and platinum subscriptions.

RightCapital has been on a growth tear for the last few years and remained firmly in the No. 3 spot among financial planning platforms with just under 15% market share in the 2024 T3/Inside Information Advisor Software Survey. Now, the provider has rolled out its own risk tolerance questionnaire and tool, a move addressing an often-requested feature among its advisors.

WealthManagement.com spoke to two advisors, both provided by RightCapital.

Peter Newman, founder of Peak Wealth Planning, said he has been using RightCapital for three years. Prior to that, he used MoneyGuidePro for planning and Riskalyze for his risk analysis (and before that, Morningstar’s risk questionnaire).

“I liked Riskalyze overall, but seven out of 10 of my clients would easily understand the results [the risk score generated], and the last three went ‘huh’—and then Riskalyze raised their prices,” Newman said.

He added he liked how RightRisk integrates with the rest of RightCapital’s planning capabilities.

“What I also loved about it is that I can just load their [the client’s] result in and document that I did it—I thought it was a simple and straightforward solution,” said Newman.

Another advisor who has tested the new tool is Matt Cook, founder and CEO of Stoic Private Wealth, based in Conover, N.C.

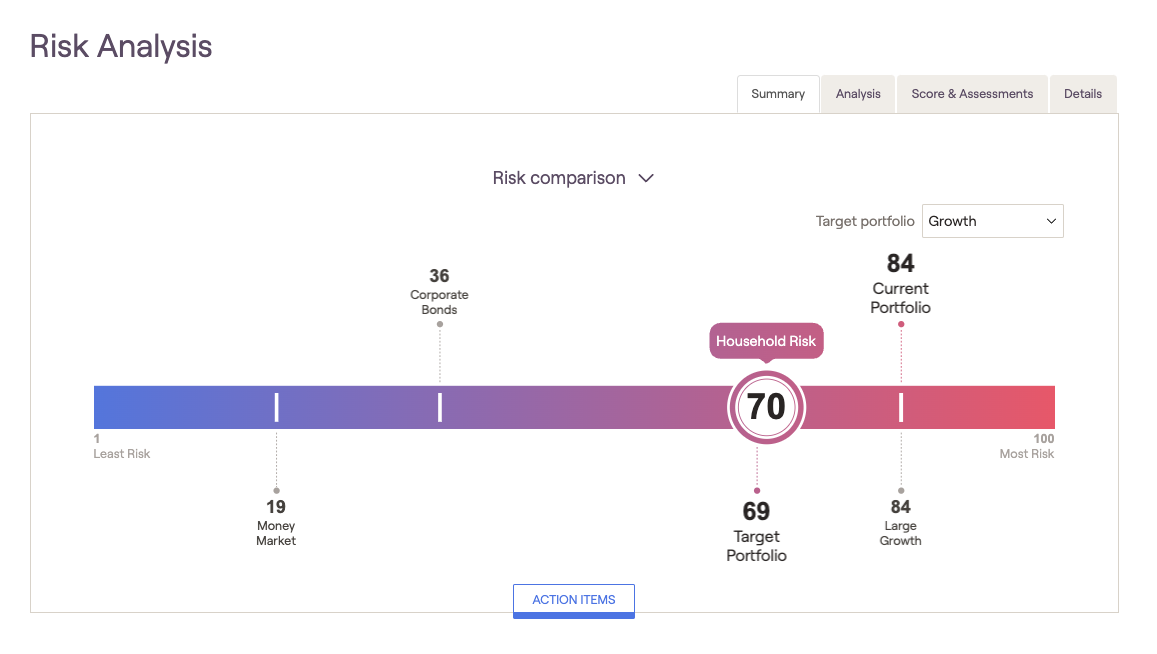

The RightRisk tool's risk comparison shows how an overall household risk score compares to the current portfolio, target portfolio as well as major asset classes.

Advisors can use RightRisk’s default 13-item questionnaire, which is based on the Grable and Lytton scale, or create their own. The ability to customize the questionnaire is a feature Cook found appealing.

“We have a very specific way we like to ask the risk tolerance questions, and it provides us the ability to tailor it to our business,” he said. His practice works primarily with airline pilots for whom he provides comprehensive planning (American Airlines has a hub in nearby Charlotte).

“The biggest thing, the reason we told RightCapital that we wanted to include this was to simplify our platform,” he added. Cook said he did not want to have to add a tool from another company to his tech stack.

Among the other features of the RightRisk tool is a household risk summary, which illustrates household risk score and how it compares to the current portfolio, target portfolio, as well as major asset classes. There is also a visual risk-return analysis that can help end clients understand the potential upside and downside returns of their investment portfolios and major asset classes.

“We warehouse all the feedback we get from customers and having a risk tool was among the top requests we’ve gotten over time,” said Shuang Chen, co-founder and CEO of RightCapital.