While some sectors of the world market and economy have seen drastic slowdowns in spending and deal-making, this has not been the case in the fintech arena.

Research firm CB Insights released this week a “State of Fintech Preview” as a teaser for its upcoming exhaustive annual January report on the same topic.

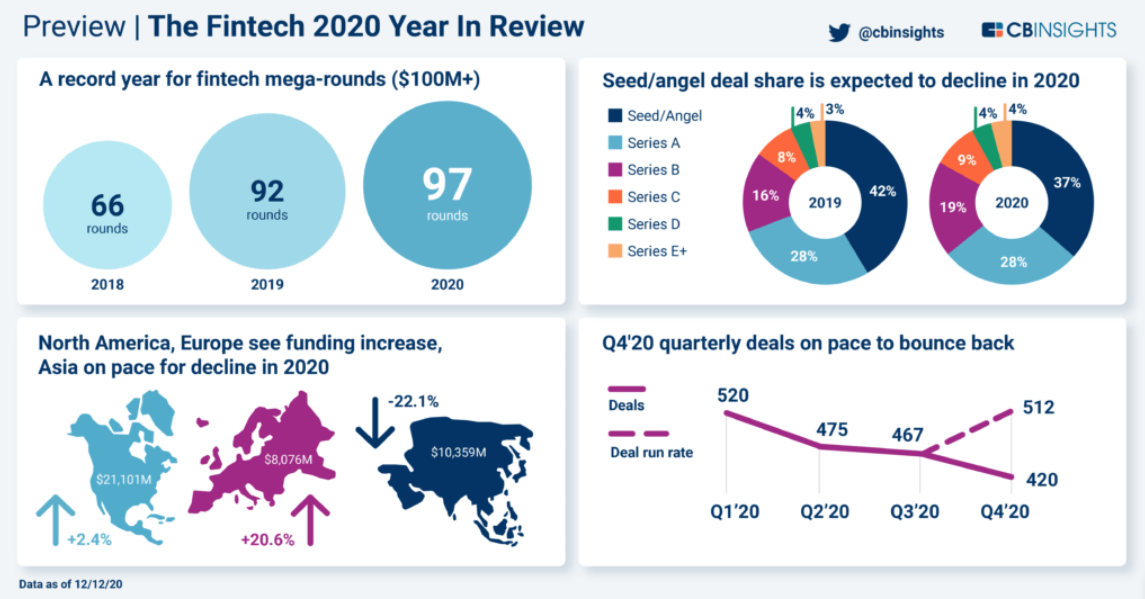

The single, most notable and surprising trend is that mega rounds—venture capital funding rounds in excess of $100 million—year to date set a record for the past five years. This year there were 97 such deals globally, five more than the 92 that occurred in 2019. The majority of these, 54, were in the United States. In comparison, 47 such deals occurred in the U.S. in 2019, while there were 31 in 2018. China had the next highest total of any nation with seven mega rounds each in both 2020 and 2019.

Two fintech startups familiar to financial advisors that have each raised mega rounds in 2020 include Addepar (which closed a $117 million Series E round of funding in November) and Robinhood (which raised $660 million in a Series G round in September). Seismic also just missed out on reaching the "mega-round" level, raising $92 million in a Series F round in September.

CB Insights projects only slight increases in overall fintech funding in both North America and Europe year over year for 2020, an approximately $1.4 billion increase in Europe and $500 million for North America.

Asia is predicted to have a decline of approximately $3 billion despite much of the region having weathered or recovered from the pandemic more quickly.

Want The Daily Brief delivered directly to your inbox? Sign up for WealthManagement.com's Morning Memo newsletter.