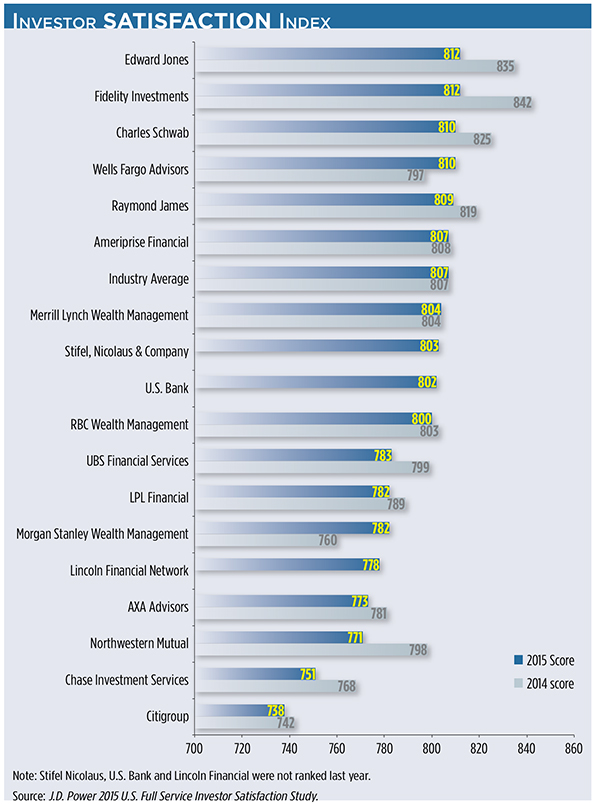

While 12 of the 18 firms in J.D. Power’s annual investor satisfaction ranking had lower scores from last year, investors’ overall satisfaction stayed flat, at 807 (on a 1,000-point scale). And while most of the ranked firms fall below the industry average, it is the unranked firms, such as Cambridge Investment Research and Focus Financial Partners, that are keeping overall satisfaction high in 2015.

“It aligns with what we know about the industry that the big wires and others are losing some market share to independents and others,” said Mike Foy, director of the wealth management practice at J.D. Power.

J.D. Power’s 2015 U.S. Full Service Investor Satisfaction Study includes unranked firms in the industry average calculation. About a quarter of the market J.D. Power covers includes these smaller firms that don’t have enough of a sample size to be ranked, Foy said.

“A higher number of people are reporting affiliation with an unranked firm—either an independent or a regional,” Foy said. “And the satisfaction that those folks have is pretty high. It’s higher than the average of these ranked firms.

“That does sort of show up in our data that firms are stealing a little bit of share and also seem to be delivering a client experience that’s better than at least most of the ranked firms.”

Edward Jones and Fidelity Investments tied for the top spot in the ranking, with investor satisfaction scores of 812, followed by Charles Schwab and Wells Fargo, with scores of 810 each.

“Edward Jones is very much about face time, personal attention of the advisor, and those are the areas where they did well,” Foy said.

Fidelity scored well in account information and account offerings.

“Given the legacy of where [Fidelity] comes from as a firm, they’re really good at marketing; they’re good at technology. They do very well in areas like delivering account information, product and service offerings, their website, commissions and fees.”

Morgan Stanley’s satisfaction score increased from 760 in 2014 to 782 this year, bringing it up from the bottom to the middle of the pack. The increase was based on an improvement in advisor-related factors, with more advisors doing things like financial planning, goal setting and assessing risk tolerance, Foy said.

The study polled about 5,300 investors in January and February 2015. The survey measured satisfaction according to seven factors (in descending order of importance): investment advisor; investment performance; account information; account offerings; commissions and fees; website; and problem resolution.