Why would you bother to read my musings on a weekly basis? For one, HighTower’s approach to research is genuine, as we do not have to sell products, but rather provide advice to our clients. Our business was created with an objective to reduce or avoid conflicts of interest and act solely in the best interest of our clients. True to this promise, we built a firm with “an unobstructed view”, and avoided the limiting concept of a single house opinion when it comes to investing. With this in mind, we continuously strive to share our collective wisdom and feel an inherent obligation to exchange our best practices and ideas: It is the “power of we,” rather than outsourcing important investment decisions to a group of mandated analysts.

Not so fast, you may think—there may actually be benefit in “rule and order.” As I had previously written in A Foolproof Financial Outlook, it is quite a challenge to highlight a single source of reliable market “wisdom,” especially when it comes to notable market events impacting clients and their investments, such as the market crash of the credit crisis. Even the assumed “best-of-the-best” face their challenges. In fact, the Federal Reserve of New York even “came clean” in a 2011 blog entry, admitting “unusually large forecast errors,” related to unemployment and real GDP predictions for 2008/2009. Even better is an extensive list of research on why so many economists failed to predict the Financial Crisis, with explanations ranging from systemic failure of the financial profession to conspiracy theories.

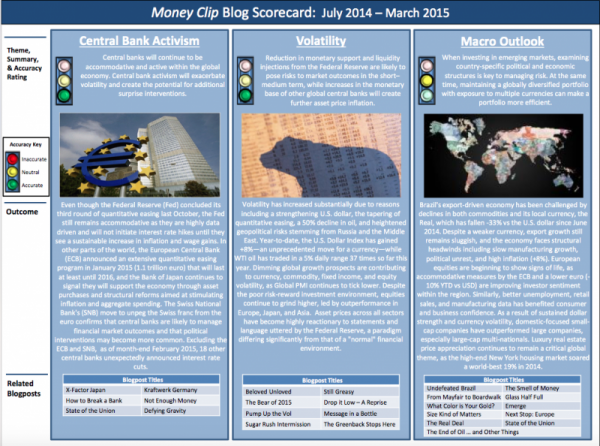

The second reason why you may want to engage with our content is that I truly believe in the concept of open self-assessment. It is for this reason that we are presenting a scorecard of blog entries from July 2014 through March 2015, including comparisons of our major forward-looking themes vs. real-world outcomes, and interpretation related to the accuracy of the presented perspectives:

Matthias Paul Kuhlmey is a Partner and Head of Global Investment Solutions (GIS) at HighTower Advisors. He serves as wealth manager to High Net Worth and Ultra-High Net Worth Individuals, Family Offices, and Institutions.