Under normal circumstances, I provide insight and analysis on the monthly jobs report at the beginning of each month. This month Washington politics has interrupted my routine with the partial government shutdown postponing several important data releases this week and pessimistically next week as well. Not only that but several agencies have completely shut down their websites denying access to already released data and historical databases, which is completely unnecessary. Both parties are employing various forms of hostage-taking in the battle and positions appear entrenched. However, the current stalemate has the potential to collide with the always nasty debt ceiling negotiations in the period ahead. Politicians are dancing on the edge of a cliff and this is never good for markets—default should never be an option. But here we are, again. Further, the Fed’s decision not to taper amid these growing risks together with tighter financial conditions has clearly been vindicated. Indeed, this likely means any quantitative easing (QE) tapering decision may be kicked into next year at the earliest. So instead, I’ll provide some thoughts on the potential impact to growth, if any, from these disruptions.

First question: will this change growth trajectory and, if so, by how much? Yes, modestly, but much depends on how long the nail-biting continues. If agreement is found to fund the government operations by late next week, the shave to growth will be small. Remember tighter financial conditions have also modestly weighed on economic activity since summer. This has been offset by the positive influence of a reduced fiscal drag from the waning effects of the sequester. The current government shutdown, however, represents a renewed fiscal drag if it remains in place long enough. Most expect a shave to growth between 0.1% to 0. 2% (annualized) for every week federal spending is on hold (which amounts to about $300 million a day) based on reduced expenditures for compensation and procurement. I would begin to take notice if these closures last two weeks or more which could potentially cut 0.25% from my already modest 1.5% to 2.5% growth expectations for the second half of 2013. As a result, one week of closures matter little, but extended closures will impart a heavier (but temporary) drag on growth. Keep in mind this is an estimate of the direct and measurable impact of reduced federal spending associated with the government shutdown on non-essential services, and as such appears fairly limited. But it does not measure any related hit to business or consumer confidence that might impact private sector spending in the event of an extended shutdown, or any indirect effects of reduced government activity such as processing mortgages, visas and applications for government programs. Many indirect shocks may be more substantial but are difficult to estimate. Further, once government operations re-started, most of this would be made up through back pay and increased spending that was postponed. So what is taken away in one quarter resulting in slower growth would likely be made up in the next in terms of increased growth.

A complicating factor here is that current discussions over the government shutdown are blending into discussions on raising the debt ceiling where the critical deadline for some action, per the Treasury Secretary, is mid-October (October 17 to be exact), although there is likely some leeway on that out toward the end of the month. The White House is now tying these two issues together in an effort to avoid fighting two battles. The hit to confidence and to growth from a default, even if technical in nature, would be more substantial and very hard to measure.

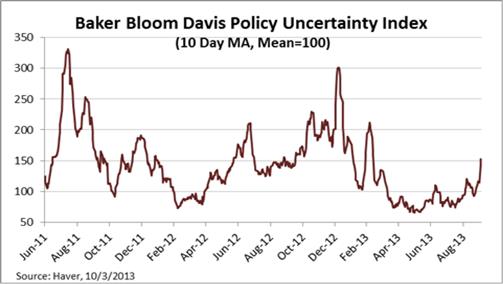

One measure of concern that can be monitored is the Baker Bloom Davis Policy Uncertainty Index (see chart) which has shown a sharp rise recently but is still at half of the peak level seen around the fiscal cliff showdown at the end of last year. Recall growth slowed dramatically in the last year’s fourth quarter to a barely measureable 0.1% on the hit to confidence, as the country appeared paralyzed over those worries. While worst case outcomes were avoided, higher taxes and reduced government expenditures did shave growth again in Q1 to about 1%. Market reaction was mildly negative in Q4 with the S&P500 falling about 7% but for only a brief period. The Policy Uncertainty Index jumped in mid-to-late 2011 as well during the last debt ceiling crisis, when default worries escalated and U.S. debt ratings were downgraded. There was no government shutdown, but confidence plummeted and so did growth to about half the level of the prior period. Markets reacted more negatively during this time falling about 20% for a short time before heading higher again as growth bounced back smartly in the next quarter. So some caution now is entirely warranted, at least temporarily. But also recall in both episodes the Fed pushed the accelerator on QE, likely dampening market impact.

What about other prior historical precedents? The only one of significance was the government shutdown in late 1995 to early 1996 during the Clinton years. There were two separate shutdowns lasting a total of 26 days. During this period there was no discernible hit to growth at all and market reaction was also only modestly negative for a short period and followed by firm bounce back to trend. Prior government shutdowns were much briefer and many did not see material lapses in appropriations or federal spending, and debt ceilings were always raised after much hand-wringing and outcry.

On the surface, the shave to growth will be small if this lasts two weeks or less. Longer shutdowns represent a heavier burden, but the game of chicken with the debt ceiling is the largest worry. The situation is fluid and hard to predict as confidence plays heavily into the dynamic on growth. It is still too early to assess outcomes, but based on history, it appears growth will be a little lighter and markets temporarily more volatile while the Fed throws in a life preserver. Based on history, the disruptions were temporary for the most part and in most cases represented a buying opportunity for those with a long horizon. To view the current stalemate as an opportunity, however, depends in part on market volatility and identifying where we are in this process toward a positive outcome. To date, there has been only modest market reaction, the path to resolution is not evident, and there is high potential for more disruptions. Patience is recommended.

Disclosure

The views expressed are as of 10/7/13, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon, and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that the forecasts are accurate.

This material may contain certain statements that may be deemed forward-looking. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable.

There are risks associated with fixed income investments, including credit risk, interest rate risk and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is more pronounced for longer-term securities.

Investment products are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities products offered through Columbia Management Investment Distributors, Inc., member FINRA. Advisory services provided by Columbia Management Investment Advisers, LLC.

© 2013 Columbia Management Investment Advisers, LLC. All rights reserved. 741920