United Income is hoping a move toward “radical transparency” in client reporting. The kind that it’s releasing in its new performance reporting tool—will catch on and spread throughout wealth management—and if it doesn’t, the firm is counting on regulators to compel holdouts to change their ways.

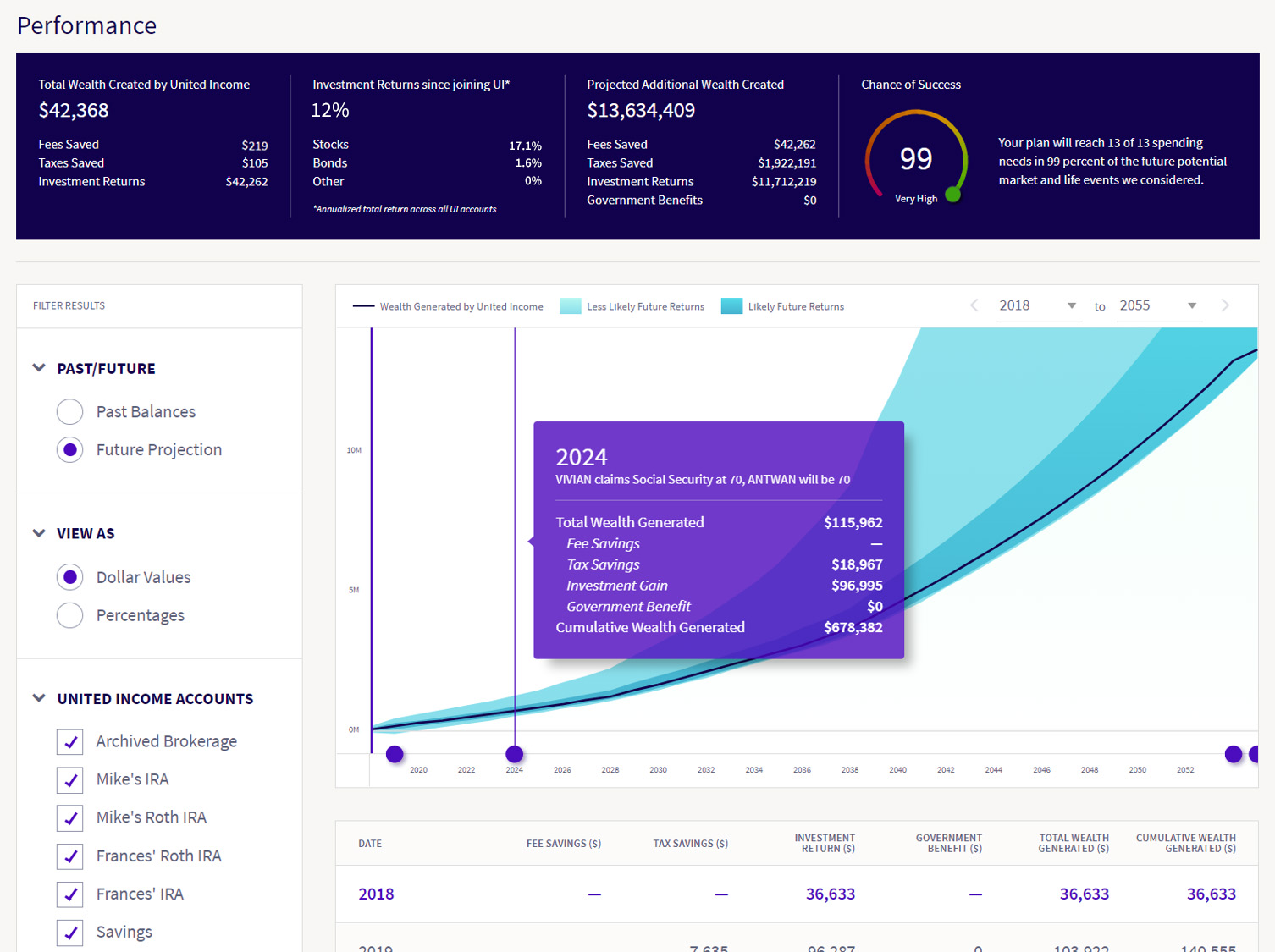

The automated investment platform built for those nearing retirement, founded by Morningstar’s former chief innovation officer Matt Fellowes, is calling on the industry to report a “total wealth return” for each client in lieu of simply reporting investment returns. It’s a step they’re implementing in a new upgrade to the platform which will report clients’ returns net of investment fees, tax considerations and other factors, giving end clients a better picture of their financial health over time.

The new reporting tool runs a number of comparisons to provide its total wealth return. It compares the fees charged by an end client’s advisor immediately before transferring funds to United Income, and displaying the fees saved, if applicable, with the automated platform. It calculates future projected taxes saved by running the firm’s tax optimization drawdown advice against the standard advice of first drawing down taxable accounts followed by tax-deferred accounts. The tool also looks at the optimal Social Security claim age, providing guidance in real dollars and cents against common financial behavior.

In the long run, United Income expects that providing client reporting in terms of total wealth return will also encourage advisors to use more of their expertise to build wealth, said Fellowes. “There’s really no distinction currently between what financial advisors report and what investment fund companies report,” he noted. “It’s surprising because advisors have lots of additional tools at their disposal to build wealth, but as long as they’re just reporting investment returns, they really are not incentivized to make the investments needed to pull those additional levers to build wealth for clients.”

Taking his argument one step further, Fellowes said that he’s calling on the Securities and Exchange Commission “to update their performance reporting to distinguish between the performance reporting advisors provide, and what fund companies provide, and to encourage advisors to begin reporting wealth returns rather than just investment returns.”

In actuality, there are already several tools and software providers, like Black Diamond and Orion, that allow advisors to show their value, or “advisor alpha,” to an end client, if they so choose. “Advisors should take credit for what they’re doing on the planning side, absolutely” said Tim Welsh, founder of consulting firm Nexus Strategy. And a holistic wealth return is a better reflection of reality than just investment returns, he said. But Welsh suggests that financial advice is far too personal and unique to each client for a one-size-fits-all calculation to gain much traction. The variety of advisors and advising strategies are meant to meet those unique needs. “It’s all different styles and approaches. One is not right; and one is not wrong,” he added. “The reason we have such an interesting industry is because there are so many movements of what different people are doing.”

Fellowes argued that United Income does provide the financial personalization that Welsh described, perhaps even beyond what advisors do. The algorithms take in end clients’ risk tolerances and behaviors, including lifestyle factors like smoking and exercise habits. It pulls in personalized actuarial data and spending calculations, and utilizes data feeds funded by the U.S. government. He is quick to point out the policy wonks on the company’s board, including Dr. Erica Groshen, a former commissioner of the U.S. Bureau of Labor Statistics. All of the data goes to provide a maximized plan for clients that will be captured in their performance metrics, against a straightforward investment return calculation.

Given the turmoil over the “best interest standard” and the DOL’s fiduciary rule, it seems a stretch to expect additional reporting regulations anytime soon, he said. But, United Income’s location in Washington D.C. should help, said Fellowes. “Washington is a resource to what’s been largely untapped,” he added. The idea that D.C. bureaucrats won’t get more involved in overseeing financial planning is “going to become an increasingly risky view as technology makes it easier to digitize the public policy that’s been created.”