(Bloomberg) -- Robinhood Markets Inc. is outrunning its online-brokerage rivals, at least by one widely followed industry metric for customer activity.

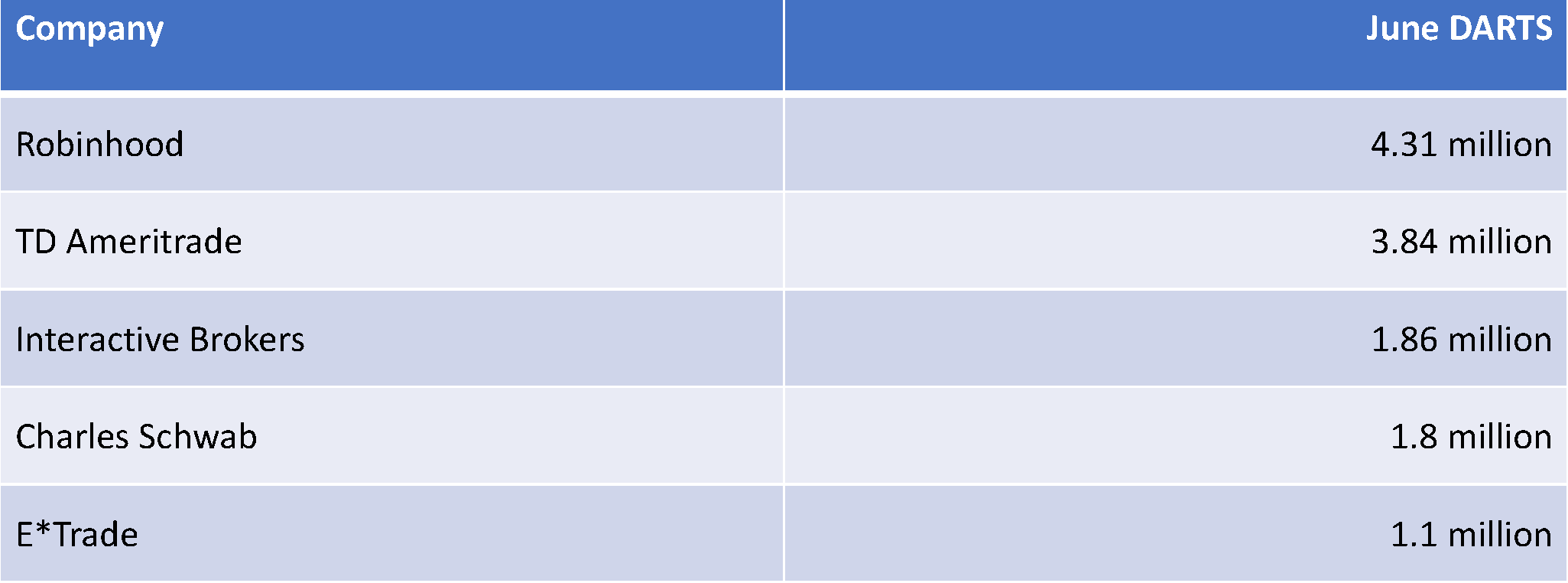

The company, which runs a no-fee trading app in the U.S. that’s drawing millions of new users as well as a few critics, said that daily average revenue trades -- known as DARTs -- were 4.31 million in June. That’s about four times the number of fee-generating trades at E*Trade Financial Corp. for the same period, and higher than all of its publicly traded rivals.

The firm is revealing the data for the first time, in the wake of a surge in online dealing among people stuck at home during the coronavirus pandemic. Newbie investors this year have flocked in record numbers to zero-fee trading apps such as Robinhood and British platform AJ Bell Plc, but the rush has prompted concerns over whether they properly understand the financial risks they’re taking.

And just as Robinhood is disclosing DARTs, it’s blocking access to other trading data. Robintrack.net, the website with hourly updates on retail stock demand that became a minor obsession of Wall Street, will end its service after Robinhood curtailed access to the data on which it ran.

Robintrack used data from the app showing broad trends among Robinhood users’ trading to display which stocks were popular with its clients. The information became a proxy for the preferences of individual investors everywhere. Robinhood will stop providing the feed on which the site’s information is based out of concern that it misrepresents client activity.

The online brokerage has repeatedly argued that most of their users “buy and hold” stocks, rather than engaging in frenzied trading. “As customers spend more time on the platform, most of them buy more stocks than they sell,” a spokeswoman said in an email. “The vast majority of Robinhood customers are not day traders.”

The data shows that daily trades at Robinhood more than doubled in the second quarter from the prior period. The top three days in terms of trading volumes occurred in June.

Robinhood had said in May that 3 million new funded accounts were added in 2020, with half of the new customers being first-time investors. It announced new funding in July, pushing the company’s valuation to $8.6 billion. Last month, the firm put its global expansion on hold and postponed its launch in the U.K., following several technical issues and outages to its platform this year.

Growth at a breakneck speed has been accompanied by some hiccups. A system-wide outage in March lasted an entire trading day, preventing customers from making trades as stocks surged after an intense rout. In June, Robinhood changed aspects of its options offering after a young customer’s suicide.

--With assistance from Annie Massa and Sarah Ponczek.

To contact the reporter on this story:

Sonali Basak in New York at [email protected]

To contact the editors responsible for this story:

Pratish Narayanan at [email protected]

Lisa Fleisher