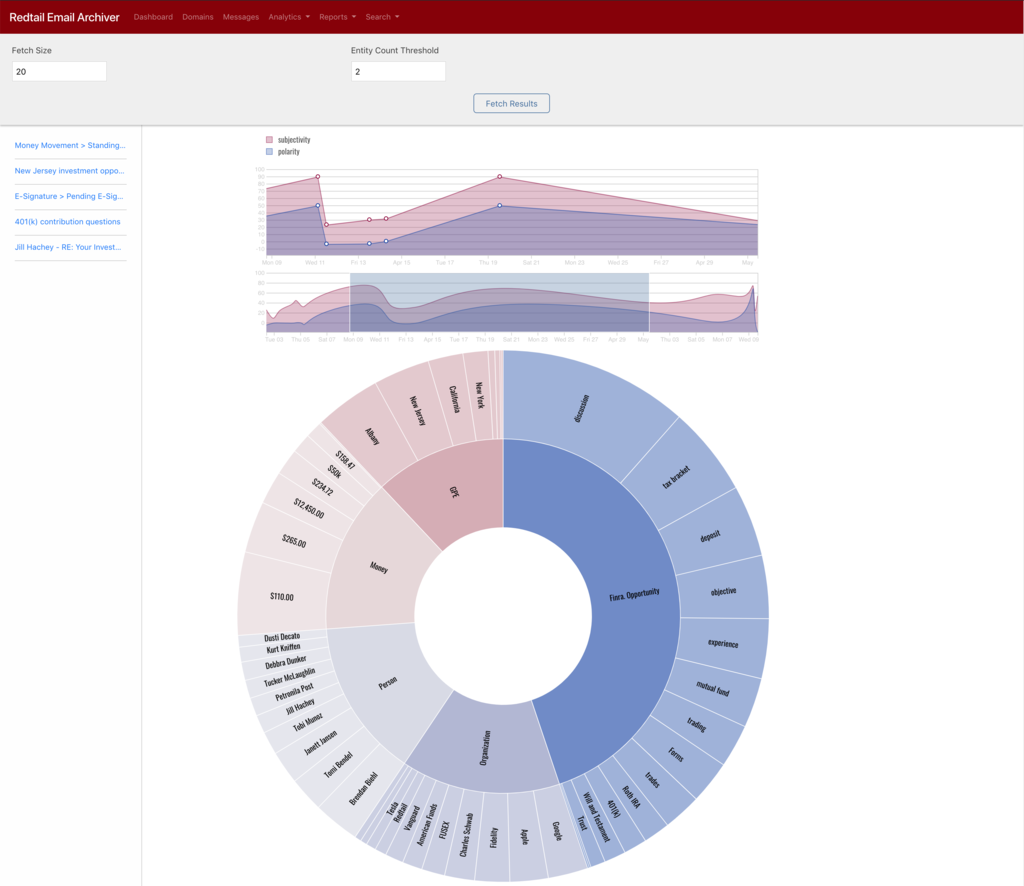

A machine-learning feature will be coming to Redtail Technology’s popular CRM program sometime this winter, according to company’s CEO Brian McLaughlin. He made the announcement at Riskalyze’s Fearless Investing Summit in San Antonio, Texas. Billed as artificial intelligence, the new feature will provide advisors with three specific, actionable feedback buckets: sentiment, keyphrases and entities, or tags, such as specific types of investment accounts.

The project, developed primarily from open source technology, has been in the works for nearly 18 months. When work began, the company looked to Amazon’s and Google’s natural language processing libraries, but found they were too general or not specific enough for the financial services industry. So Redtail developers decided it would be better to put its own spin on open source technology instead of paying big tech companies to provide customized toolkits.

The tool works like a personal assistant, said McLaughlin. For example, say an advisor’s existing client sends an email to the advisor expressing a negative experience. Redtail’s artificial intelligence engine reviews the email in the context of the entire email conversation, looking for specific phrases, keywords and patterns. Behind the scenes, the AI engine compares this unique email to information gleaned from specific training sets incorporating the 70 million individuals, 1.3 billion filtered emails, 50 million notes and 450 million activities that have touched Redtail’s system. Identifying a negative sentiment in the email, the engine alerts a business owner that they may need to reach out to the client to provide extra support or clarification, addressing the client’s needs to avoid losing the client.

The new feature will not auto-draft emails or automatically execute actions. Instead, it’s looking for patterns in discussions or client needs, as well as getting advisors more comfortable with machine learning in their practices. “Overall, a lot of this is about confidence building,” said McLaughlin.

Although he hasn’t ruled out developing predictive analytics in the future, McLaughlin envisions advisors using the tool less as a way to predict what clients will need and more as a way for advisors to validate the direction they’re moving with clients. Because the tool is referencing a training set, it will still work with new clients for which an advisor doesn’t have a history of communications, he said.

It’s also about covering advisors’ blindspots. “You know a lot of things, but you miss that one little detail, that one critical component,” McLaughlin explained. “That’s what AI should be helping with.” In some ways it’s Redtail’s version of Gmail’s Nudge and Remind features: a way for advisors to make sure nothing is slipping through the cracks.

In the same way that business owners could be alerted to negative sentiment from a client, compliance officers could also benefit from Redtail’s new feature, said McLaughlin. The engine would be able to pull up possible compliance issues, providing context and clarity for officers reviewing advisors’ communications.

The decision to roll out the new technology as a feature, instead of an add-on, was intentional, said McLaughlin. Fine tuning the tool depends on advisors verifying if the CRM is correctly clustering and addressing communication routed through the system. Advisors will be able to opt out of the feature, as well.

Redtail will have to wait and see if the “build it and they will come” approach works with advisors. “Automatically screening and tagging could be helpful in driving daily focus,” said Ben Rickey, CEO of Leonard Rickey Investment Advisors. The Yakima, Wash.-based advisor was one of the more than 600 conference attendees who saw the announcement.

“If I’m investing in this kind of tech I want it to be doing real work for me, not just creating tasks on emails I am reading and responding to now,” said Rickey. He noted that Salesforce, his current CRM provider, has “a similar set of AI tools available on their platform. We don’t currently use them, but are looking at ways to implement them into our business.”

Another advisor already using Redtail can’t wait to start using the new features, seeing the tool as a competitive differentiator. “We plan to implement Redtail AI in our practice to review data and address the needs of our clients,” said Nina O’Neal, an advisor and partner at Archer Investment Management in Raleigh, N.C. She expects the tool to allow her to “better understand what [clients] want to talk about and inform our business.”