What if one of the defining behavioral characteristics you attribute to millennials ended up being applicable to your boomer clients? What if those boomer clients started to prefer video calls from their computer or Facetime from their iPhones over coming in to see you? What if they stopped picking up the phone and texted you back instead? Several recent studies of wealthy boomers show this isn’t as outlandish as it sounds. However, our 2018 technology survey shows that most advisors are ill-prepared to manage such a shift in client expectations.

Contradictions

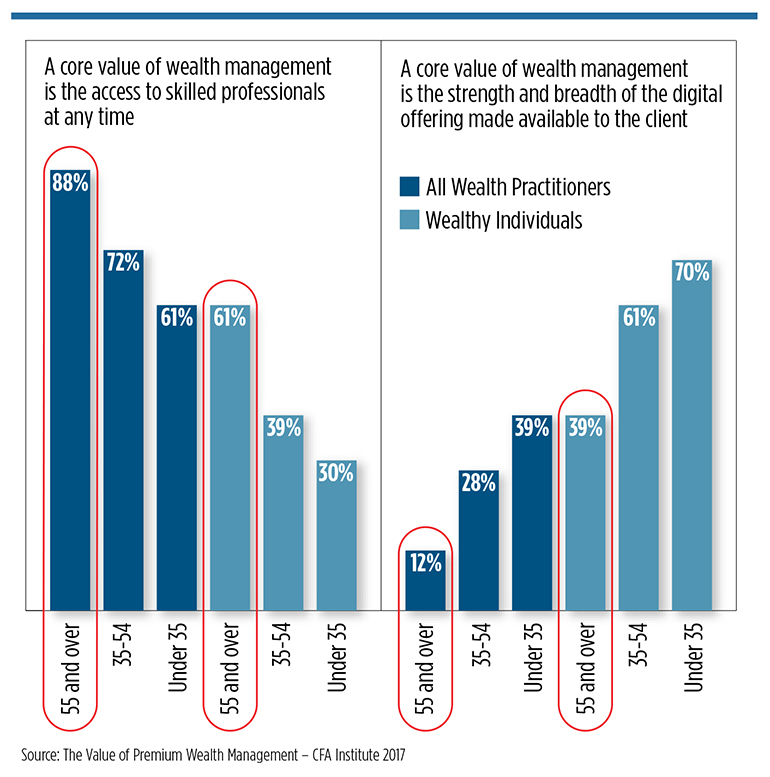

There is significant data out in the marketplace that contradicts the stereotype of what a boomer client demands from their advisors. According to CFA Institute’s 2017 report, The Value of Premium Wealth Management, 39 percent of wealthy individuals 55 or older responded that a core value of wealth management is the strength and breadth of the digital offering made available to them, while only 12 percent of wealth advisors surveyed thought this was important to the boomer generation. This statistic reveals a significant opportunity for firms looking to innovate and serve wealthy families of all generations.

Potentially Big Disconnect

It turns out that wealthy boomers look for a very similar experience to what their millennial children expect: including fast transactions, transparency, mobile-first and elegant experiences according to the CFA report.

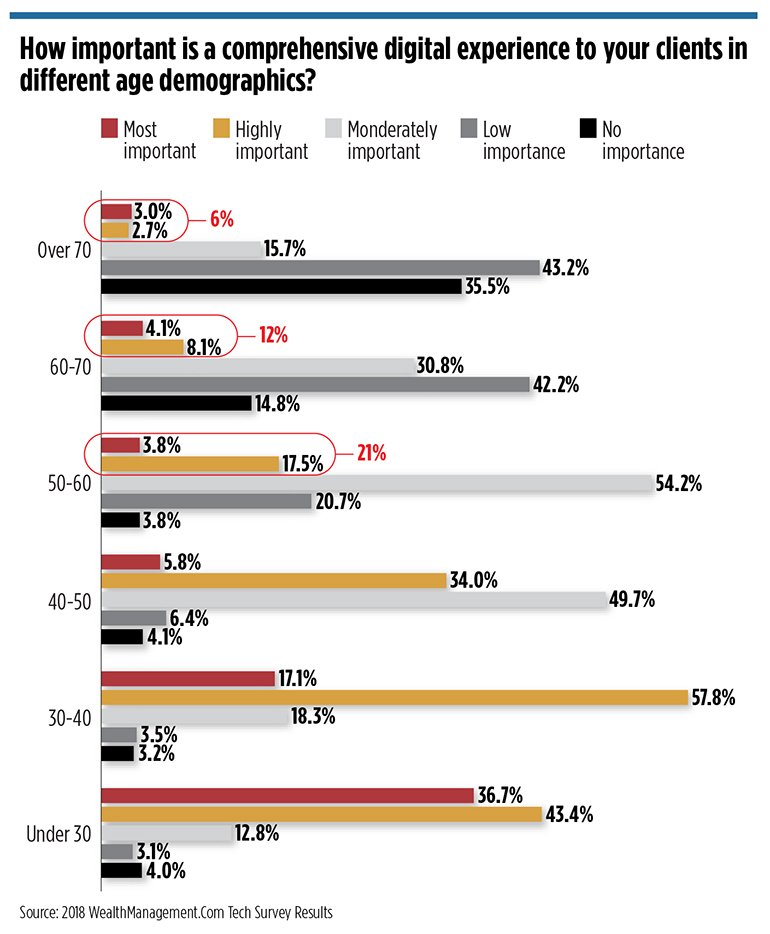

The data gathered from our recent WealthManagement.com technology survey further highlights the disconnect between what advisors think their older clients want and the reality of the situation. We found that advisors significantly underestimated the digital prowess and expectations of their older clients.

Of the 352 advisor respondents, only 21 percent reported that clients in their 50s saw a comprehensive digital experience as anything more than moderately important. Things get worse when it comes to older clients. Advisor perception of the importance of a comprehensive digital experience for clients older than that dropped off to 12 percent when it came to clients over 60 and only 6 percent for clients in their 70s.

It was clear that advisors continue to perceive their clients’ digital abilities as an issue only for a younger generation—potentially, to their own peril. Several studies completed over the past few years have focused on client sentiment for digital ability, as well as how frustration with poor digital capabilities might impact their decision to find a new advisor.

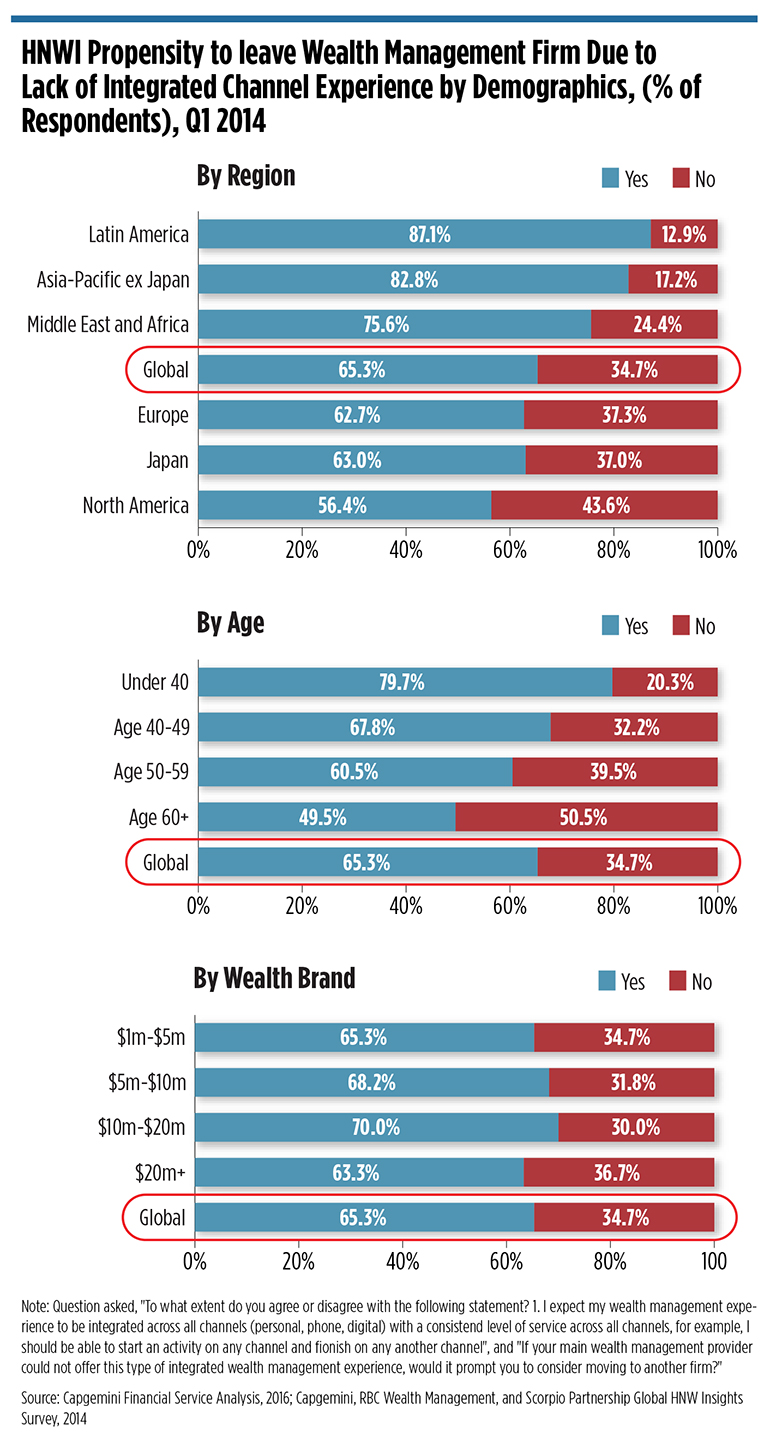

With a wide gap between advisor and client views over the importance of digital, are we headed toward a world where wealth firms begin attracting more clients because of their digital capabilities? While not U.S.-specific, we know from the Scorpio Partnership’s 2014 HNW Insights Survey that globally, slightly more than 65 percent of respondents answered in the affirmative that a lack of integrated channel experience would likely be grounds for leaving their wealth management firm.

Older clients, when their responses were studied, were not that far behind. The same survey found that nearly half the respondents over 60 would leave their wealth management firm due to lack of an integrated digital client experience. Unfortunately, the survey has not repeated the same question since but logic certainly suggests that this percentage is unlikely to have fallen rather than it’s likely to have grown.

Now that we have you thinking, what actions can your firm take to ensure you aren’t missing a huge opportunity to evolve your business to capture both the millennial and boomer markets? We’ve got two easy steps you can take action on today.

1. Ask Your Clients

It’s clear that there’s a disconnect, statistically speaking, between what investors are thinking and what most firms are prioritizing within their client segmentation analyses. Take this opportunity to reach out to clients proactively and have a conversation about their needs and any gaps they see in your firm’s offering. This can be done through internal surveys, client events or as simple as a phone conversation with your clients.

2. Build the Plan

Once you have the data in your back pocket, it’s time to build the plan. Becoming more digital-friendly as a firm doesn’t have to be a different version of your company. It’s going through the process of identifying who you are (or want to be) as a firm and augmenting that with an automated version of that same value proposition:

- Are you mostly a planning-focused advisor? Make sure that your digital client experience prominently covers planning.

- Does your team manage complex family structures across multiple accounts and legal entities? Make sure that your experience can replicate that online.

Once you identify what makes your firm unique and different—the next step is to make that digital.

Execute: Build, Buy or Suffer

Time to decide how you go about delivering the experience your clients expect:

- Building is always an option, with more flexibility and often lower long-term costs. It’s also often overlooked as being too complex and requiring more technical skill and focus than most advisors can muster.

- Buying is the most common option currently. Opportunities abound. Start by asking some of your existing vendors whether they offer customizable client portals. You’ll be surprised by how many now do this.

- While suffering can build character, too many firms are taking the path of least resistance and maintaining their custodial client websites as a primary (or sometimes secondary) client digital experience. Your clients expect more.

Wrapping Up

Don’t wait for your clients to complain. The research clearly points to older, wealthy investors wanting more digital capabilities than most firms currently support. Make sure you’ve got a compelling experience for them which amplifies your brand and value proposition.

Doug Fritz, CEO of F2 Strategy, will share his extensive tech expertise over the coming months, interpreting these survey results in a series of guest columns on wealthmanagement.com. In these pieces he will debunk common myths in the RIA, wealth management and family office space and share the data-backed reality of what clients actually want—and tangible ways to get your firm’s digital strategy on track.