Advisors using Betterment will no longer be flying solo. The robo advisor is launching Co-Pilot, a new feature for advisors that will serve as part dashboard and part intelligent to-do list. The tool surfaces specific household information in one place, promoting better client engagement, according to a company announcement.

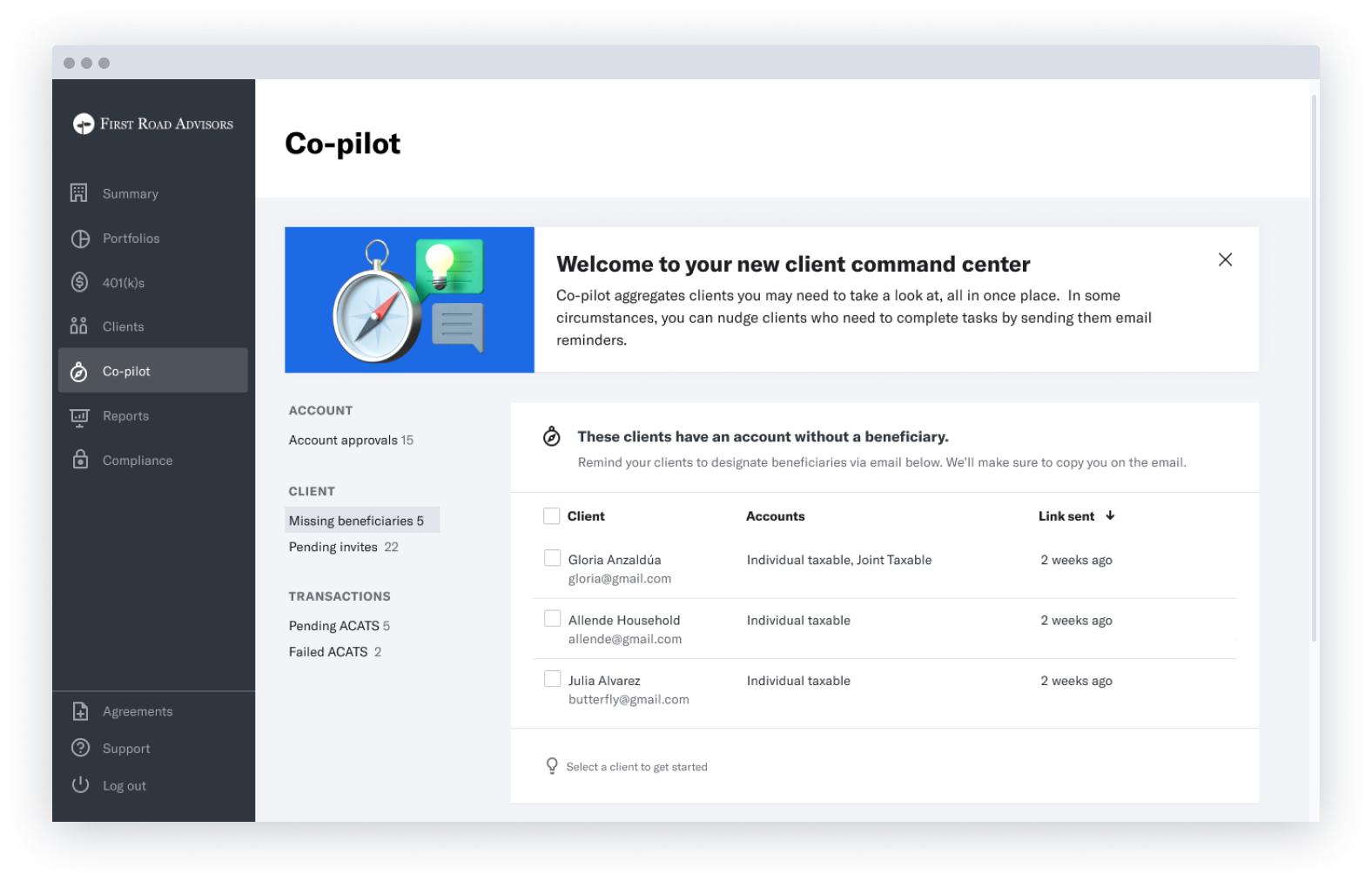

The initial version of Co-Pilot, which will be available as part of the standard feature set of Betterment for Advisors, includes an option for reminding clients about accepting invites to access Betterment, resurfacing expired invites, sending client reminders about approving account openings, adding missing beneficiary information, and monitoring pending and failed ACATs transfers. Co-Pilot is also a feature name at FixFlyer, but the functionality is unrelated.

Co-Pilot is part of the same focus on advisors that produced custom portfolios in the Betterment for Advisors business line, said Jon Mauney, general manager of the division. “It is totally fair to say that in years past, a lot of what we put into our Betterment for Advisors application was downstream of things that we were building in our retail application,” he said. “This … should be a good signal to the market that we're building specifically for advisors.”

Part of what differentiates the advisor business and the retail business is a focus on households in the former, he added. Betterment for Advisors is built for household management, while the retail line revolves around the individual.

With the launch of custom portfolios, and now Co-Pilot, Mauney expects the advisor business to continue to build on a period of intense growth. “Firms that joined in 2020 brought on over 90% more clients on average in their first 12 months than prior cohorts,” he said, attributing it to advisors no longer feeling like they needed to kick the tires of the platform before moving their businesses onto it.

“We've spent a lot of time over the past few years really rounding out the product to make sure that it's a complete experience,” he added. “Advisors can minimize the things that they have to do off platform.”