Kelley Rating (one asterisk = lowest, to five asterisks = highest):

- Ease of navigation, design of interface and learning curve *****

- Instructional documentation and help system - N/A

- Carries out the goal of the product as represented *****

- Overall usefulness *****

ACTEC Wealth Advisor, v. 1.4 is an iPad app that provides wealth management professionals with resources and tools for practice enhancement.

The app includes applicable federal rates (AFR) and 7520 tax rates, a grantor retained annuity trust (GRAT) calculator, convenient access to important estate planning statutes presented in state-by-state summaries, a directory of American College of Trust and Estate Counsel (ACTEC) fellows and comments on current trust and estate issues. It provides handy mobile access to these items and is available to the public from the ACTEC public home page free of charge. The data presented by each component of this app is periodically updated as appropriate.

ACTEC Wealth Advisor was created by ACTEC, which, as described on the opening screen of this app, is a national organization of approximately 2,600 lawyers and legal professors elected to membership by demonstrating the highest level of integrity, commitment to the profession, competence and experience as trust and estate counselors.

What’s It All About and How Does It Work?

To procure this app, click on the ACTEC Wealth Advisor App for iPad and proceed to the iTunes app store.

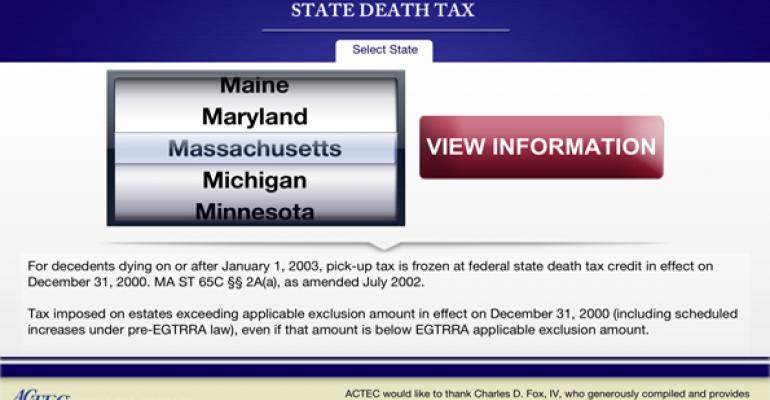

From the opening page of the app you press [Main Menu] to go to the list of resources and tools. Press on the name of a state statutory summary to proceed to it. Then, select a state and press [View Information] to see the data presented for that state. Press on the names of other items to proceed to them. The date of last update is shown at the bottom of the screen for each textual resource. The resources and tools include:

· ACTEC Roster 2012-2013 : Offers the entire roster of ACTEC fellows searchable by state, last name and location

· AFR/7520 Rates : Select a year and month and press [View Rates] to see the 7520 rate, the short-term Rate, the mid-term rate and the long-term rate for that month. The opening page explains the nature and derivation of each of these rates.

· GRAT Calculator

: Opens with an input screen for entry of the contribution amount, term of the trust, growth, 7520 rate and percent increase. Select by year and month and click [Get Rate] to insert the 7520 rate for that month into the input screen. [Term] is the number of years of the trust (the calculator is for term trusts not exceeding 10 years only). [Growth] asks you for a rate comprising the total return on the contributed asset, including appreciation, interest, dividends, etc. produced by the contributed property. Press [Calculate GRAT] to determine the remainder amount and the percentage of distribution for each year of the GRAT. This calculator assumes annual payouts at the end of each year and a payout rate of the optimum, or zero out, percentage of the contributed amount. The percent Increase prompt asks for the yearly increase in annual payments, if any, made each year and is capped at 20 percent. The [Calculate GRAT] output displays the economic remainder at the end of the trust and the annual payment percentage for each year of the trust. The calculations are made without rounding, for increased accuracy.

· State Death Tax Tables: Based on information compiled by Charles D. Fox, IV. Select the state you desire and press [View Information] to display the type of tax imposed, information regarding the state death tax and legislation affecting state death tax.

· Domestic Asset Protection Trust Statutes: Reflects the citation of each state’s statute, its effective date, website, the allowable duration of trusts, trust requirements and other elements of the statute. Compiled by David G. Shaftel from state information furnished by other Fellows.

· No Contest Clauses: Displays the state law treatment of no-contest (in terrorem) clauses to the extent such clauses in a will or trust are, or are not, enforceable; whether a suit to construe the governing instrument is considered a challenge and whether such clauses are strictly construed. Includes the article STATE LAWS: NO-CONTEST CLAUSES, by T. Jack Challis and Howard M. Zaritsky, discussing state law treatment of no-contest clauses.

· The Rule Against Perpetuities: Provides information for each state as to the period of the rule (with citations), whether there is an election out, exceptions and judicial reformation.

· Uniform Prudent Investor Act (UPIA) and Modern Portfolio Trust Investment Statutes: Examines the modifications made to the UPIA by the states adopting it and lists the statutes for the states that have not adopted the UPIA, but have modern trust investment statutes. Includes citations and analysis of statutory requirements.

· States with Decanting Statutes Passed or Proposed : Gives the statutory citation, effective date and status for each state.

· Bases of State Income Taxation of Nongrantor Trusts: Displays state statutory citations, top rate, application to trust created by will of resident, application to inter vivos trust and other trust information.

· “Capital Letters” by Ronald D. Aucutt: Letters from 10/30/2006 to 2012, discussing the federal legislative process related to estate and transfer tax and administrative developments at the Treasury and IRS.

· “Musings on Current Events” by Stephen R. Akers: Provides extensive summaries and analysis of significant recent developments in trust, estate and tax law, including discussions of the portability regulations, recent cases of interest and comprehensive summaries of planning and practice information of interest presented at ACTEC meetings (including internal links to specific discussions). Press on a listed item to proceed to it and scroll down. Each discussion includes links to the statutes and cases that are cited.

Other ACTEC Public Resources

The ACTEC public website also includes other resources available to the public (free unless otherwise indicated), such as:

· Ronald D. Aucutt’s Capital Letters

· Steve R. Akers’ Musings on Current Events,

· Steve R. Akers’ Heckerling Musings 2013–The Estate Planner’s “Playbook” for 2013 and Going Forward Under the Post-ATRA “New Normal” of Permanent Large Exemptions and Portability

· Summary of States that Adopted the Uniform Trust Code and Those States’ Treatment of Exception Creditors (Sections 503-504) (PDF) by Barry A. Nelson–2/20/2013

· List of States with Decanting Statutes Passed or Proposed (PDF)—prepared by M. Patricia Culler—2/1/13

· ACTEC Commentaries on the Model Rules of Professional Conduct

· ACTEC Engagement Letters: A Guide for Practitioners

· ACTEC Quicken Fiduciary Accounting Templates (for sale)

· ACTEC Toolbox/Topical Index (a list of links to Web based trusts & estates resources and practice tools)

What About Help and Support?

The ACTEC Wealth Advisor app is easy to navigate. It includes some descriptive material for certain items, but has no help text, as such. The app does not state any support contact.

How Do You Contact the Publisher?

ACTEC Wealth Advisor is published, free of charge, by The American College of Trust and Estate Counsel.

Address:

901 15th Street, NW

Suite 525

Washington, DC 20005Phone: (202) 684-8460, Fax: (202) 684-8459

Website: http://www.actec.org/

Bottom Line

ACTEC Wealth Advisor is a remarkable compilation of trusts and estates resources developed and generously made available to the public by fellows of The American College of Trust and Estate Counsel.

Trusts & Estates magazine is pleased to present the monthly Technology Reviewby Donald H. Kelley—a respected connoisseur of the software and Internet resources wealth management advisors use to further their practices.

Kelley is a lawyer living in Highlands Ranch, Colo. and is of counsel to the law firm of Kelley, Scritsmier & Byrne, P.C. of North Platte, Neb. He is the co-author of the Intuitive Estate Planner Software, (Thomson – West 2004). He has served on the governing boards of the American Bar Association Real Property Probate and Trust Section and the American College of Tax Counsel. He is a past regent and past chair of the Committee on Technology in the Practice of the American College of Trust and Estate Counsel.

Trusts & Estates has asked Kelley to provide his unvarnished opinions on the tech resources available in the practice today. His columns are edited for readability only. Send feedback and suggestions for articles directly to him at [email protected].