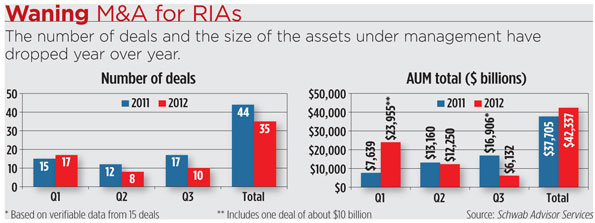

Blame it on fiscal cliff nervousness, volatile stock markets, or the uncertainties that accompany a tepid economic recovery, but the world of mergers and acquisitions in the registered investment advisor channel is having a lackluster 2012. Data from Schwab Advisor Services show that for the first three quarters of the year, deals were down 20 percent compared with the same period in 2011. Total assets under management in the deals appear bigger this year, but the tally is skewed by AMG Wealth Partners’ equity stake in Veritable LP that was reported in the first quarter; outsized Veritable had more than $10 billion in AUM. It’s possible, however, that the fourth quarter will put up more activity, says David DeVoe of DeVoe & Co., an M&A consultant. The fourth quarter is typically the busiest for deals, and this year RIAs may feel the need to close before the capital gains tax increase scheduled for the start of 2013. Total deals have averaged 56 a year over the past five years. National acquiring firms continue to make up the lion’s share of buyers, accounting for 54 percent of the YTD transactions. “While national acquiring firms remain dominant players, RIAs as acquirers have been sitting on the sidelines waiting for the right opportunity,” says Schwab’s Jon Beatty, senior vice president, sales and relationship management.