Knowledgeable financial advisors usually recommend that clients postpone taking Social Security payments for as long as possible, pointing out that the eventual monthly checks will be higher, and the chance of those delayed checks being taxed or penalized will be lower.

In the process, the advisor usually faces objections from retirees who are concerned about either their personal longevity, or that of the Social Security program — or both.

In these desperate times, such objections make a lot of sense. You may want to start encouraging retirees who are in dire need of income to start taking Social Security today, instead of tomorrow. Here are five reasons why.

- They need the money

Unemployment rates for those who are over 65 and looking for jobs reached 6.8 percent in February of 2009, the highest figure recorded since the government began tracking the statistic over sixty years ago. The numbers are equally ugly for those in the 55-to-64 age bracket.

Although better days may be ahead for the younger unemployed, it's highly unlikely that those in their late fifties or early sixties are ever going to see brighter job prospects — especially at the wages they earned in their prime working years.

So your under- or unemployed clients who have reached age 62 but are coming up short every month will welcome the additional income from Social Security, even if the amount is less than what they would have received if they were to wait to full retirement age (66 for those born between 1943 and 1956).

Keep in mind, though, that if your clients under normal retirement age are receiving Social Security while they work, they will lose $1 in benefits for every $2 earned in excess of $14,160.

- Yields are low

It's rarely possible to get both safety and high income from an investment, and that's especially true now. As of the beginning of April, yields on ten-year Treasuries and five-year CDs were under 3 percent.

According to the Social Security Administration, the average retiree's monthly benefit check in 2009 will be about $1,150. Your clients would need to invest $460,000 at 3 percent interest to get the same amount of income.

Even comparing Social Security payments to a more-analogous investment like an immediate annuity reveals the value of the check from Uncle Sam.

According to www.immediateannuities.com, a 65 year-old male would have to deposit $164,000 in a life-only annuity to get $1,150 per month — and that still wouldn't provide the potential future cost-of-living increases or survivor benefits available to those collecting Social Security.

- Emphasis on “Security”

Taking Social Security sooner rather than later will certainly save clients from having to commit several hundred thousand dollars of their precious liquid assets to income-producing investments.

But in times of bank failures, bond defaults, and precariously-positioned insurance companies, the Social Security payments may be the safest and most predictable source of income available to retired clients.

Yes, there is the widely-known concern over the long-term viability of the program. But Social Security is currently collecting more money than it pays out, and the Congressional Budget Office estimates that the accumulated surplus won't be exhausted for another thirty years.

- Leave equities alone

It's understandable that nervous retirees would want to sell their equity positions to either move the money into the aforementioned bonds, or just spend the proceeds on living expenses.

But although future performance of equities is unknown, it seems that liquidating a stock fund or stock portfolio after one of the worst years in the last couple of centuries only ensures that the clients won't participate in any future gains.

Commencing Social Security payments now could give your clients the income they would have otherwise taken from selling equity positions, and give them the courage they need to ride out future stock market storms.

- Doing a do-over

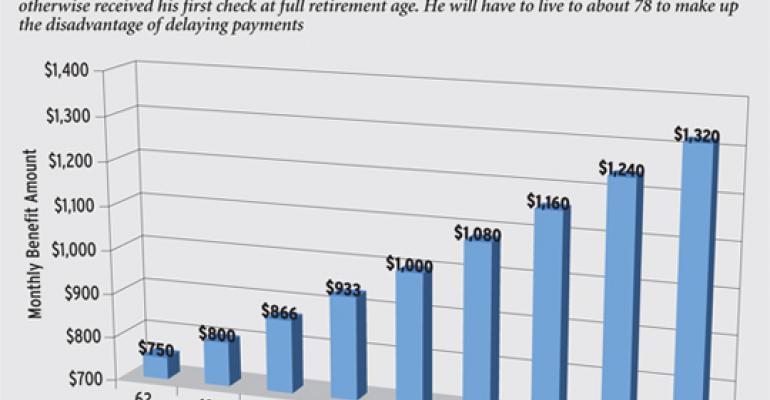

Of course, one big reason your clients should delay initiating Social Security payments is that checks started later will be larger, by 8 percent for each year that the eventual recipient waits.

The actual cost of taking the payments now instead of later will be determined by many future variables, including interest rates, tax rates, investment returns, and how long the recipient lives.

But if your client takes Social Security this year, and later discovers that it would have been more advantageous to wait, he has a little-known way to correct his mistake.

By filing Form 521 (Request for Withdrawal Application) with the Social Security office, and repaying the benefits already received, your client can re-start a new, higher monthly payment stream (because it's based on the client's new, advanced age).

Preliminary steps

You can help your clients estimate their current benefits (as well as the break-even point for delaying benefits) by using the calculators available at www.ssa.gov.

Assuming they prefer today's smaller check in hand to a larger one in the future, there are a couple of actions you should take to maximize their net payout.

First, make sure that you minimize the likelihood of their benefits being subject to income tax by realizing any taxable events (like selling an asset with capital gains or converting an IRA to a Roth IRA) in the year before initiating payments.

Then, if the clients are under full retirement age and still working, make sure they pay close attention to the limits on income that can be earned before benefits are reduced.

Finally, if your clients are married, you may want to consider whether both spouses should begin taking benefits, or if just one's checks will be sufficient.

And if all of this seems like too much work, remember that every dollar of Social Security that you help your clients obtain is a dollar that they won't remove from your assets under management.

Writer's BIO:

Kevin McKinley

CFP© is Principal/Owner of McKinley Money LLC, an independent registered investment advisor. He is also the author of the book Make Your Kid a Millionaire (Simon & Schuster), and provides speaking and consulting services on family financial planning topics. Find out more at www.advisortipsheet.com.