Market returns are coming down this year, and investors should expect a lower return environment for the next decade, according to J.P. Morgan Asset Management. That means investors will have to save a lot more to meet their retirement goals.

“Fear is not a good motivator, but we do want a wakeup call,” said Katherine Roy, chief retirement strategist at J.P. Morgan Asset Management, during a presentation on the firm’s 2017 Guide to Retirement.

In its Guide to Retirement, the asset manager estimates a compound nominal return of 5.5 percent for a 60/40 portfolio this year, down from an assumption of 6.25 percent last year.

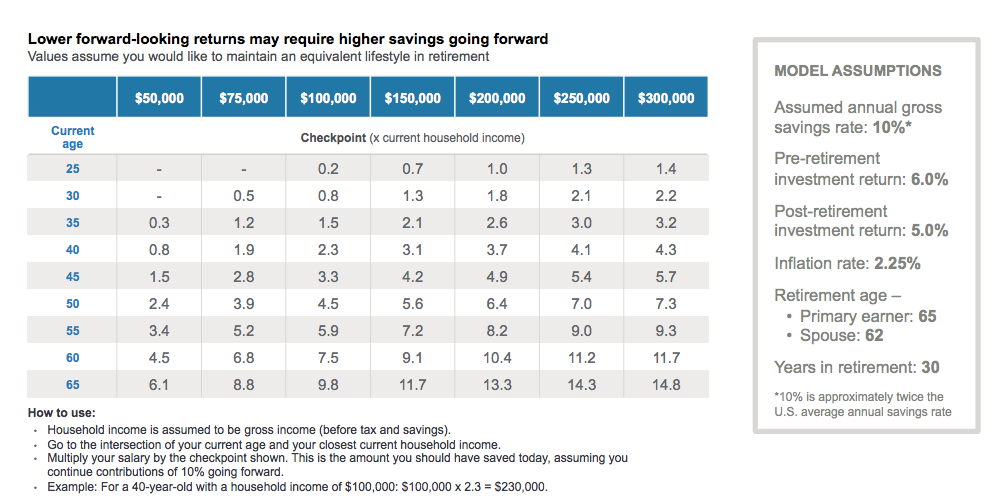

In one of the most popular charts in the Guide, J.P. Morgan estimates that a 40-year-old with a household income of $100,000 should have at least $230,000 saved for retirement. That’s assuming an annual gross savings rate of 10 percent going forward (twice the U.S. average annual savings rate), a pre-retirement investment return of 6 percent, a post-retirement investment return of 5 percent, and a retirement age of 65 for the primary earner (62 for the spouse).

This year, J.P. Morgan increased its savings rate assumption from 5 to 10 percent. But if the savings rate stays the same (5 percent) and the rate of return drops by 0.5 percent, then the investor would need a lot more today to produce the same result because the market will not work as hard for them, said Roy. If they only save 5 percent, that 40-year-old would need savings of $310,000 today to maintain an equivalent lifestyle in retirement.

That compares to last year, when J.P. Morgan said that a 40-year-old would’ve needed $260,000, based on a 6.5 percent return and 5 percent savings rate.

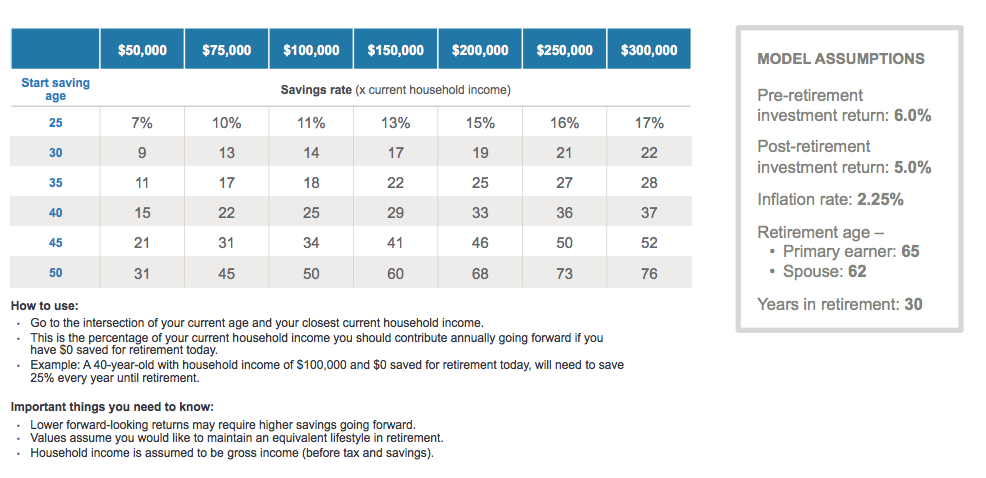

The firm also estimates (below) how much in annual savings is needed if an investor is starting to save for retirement today. For example, a 40-year-old with a household income of $100,000 and nothing saved, will need to save 25 percent every year until retirement. That assumes a pre-retirement return of 6 percent, a post-retirement investment return of 5 percent, and a retirement age of 65 for the primary earner (62 for the spouse).