Sponsored by Lincoln Financial

A third (35%) expects a decrease in use, a third (32%) staying the same and the remaining third (33%) expecting an increase. This represents a shift from last year’s results, where 40% of advisors expected their use to stay the same. (The remaining advisors were divided evenly, at 30% each, between a decrease and an increase in 2016.)

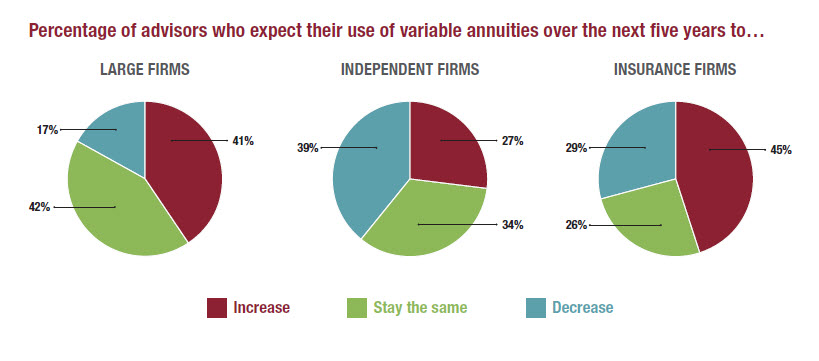

There are differences among advisor channels, however, and those differences tend to align with the trends in usage described in the previous section—namely, the increase in usage from advisors from large firms. For instance, in this year’s survey, advisors from large firms were more likely (41%) than the industry average to expect an increase, even as they were most likely (43%) to expect no change. Meanwhile, advisors from insurance firms were most likely (45%) to expect an increase, with one in every four (26%) specifying they expected a “significant” increase.

Perhaps not surprisingly, advisors who already rely on these products (10% or more of client assets) are most likely (37%) to expect an increase in their use. Low-use advisors (less than 10% of client assets), meanwhile, are most likely to expect a decrease (39%).