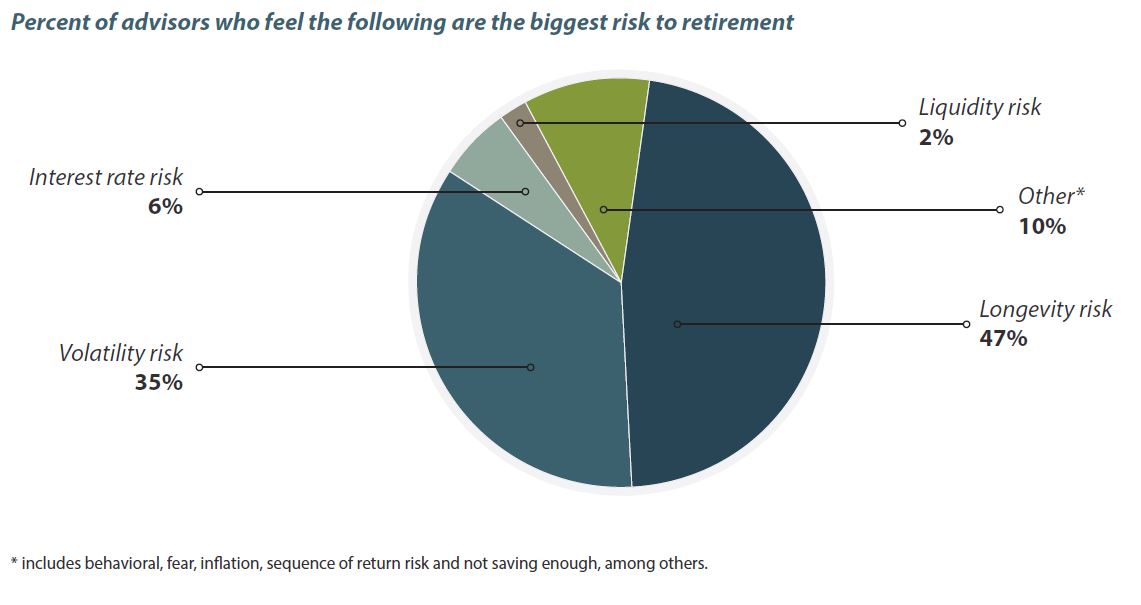

Plan advisors do not agree on any one primary risk to individuals’ retirement savings, but a majority of advisors agree that the top two risks are longevity (47%) and volatility (35%). These two risks line up well with the strengths of the glide path concept. In particular, the gradual reduction in equity exposure over time seeks to minimize volatility in retirement, while the exposure to the growth potential of equities beyond retirement hedges against longevity risk.

TDFs also have a role to play in helping address some of the other risks plan advisors mentioned, including behavioral risk. Specifically, the glide path strategy essentially removes the risk that investors will adjust their allocations based on emotions.

Nearly two-thirds of plan advisors (63%) report favoring a “through” glide path for clients, over a “to” glide path (37%); the latter achieves and maintains a conservative allocation at the target date, while the former reduces its equity allocation gradually throughout retirement. Given that retirement can last for 30 years or more, and that more plan advisors prioritize longevity risk over volatility risk, a “through” glide path is logically the more attractive feature. Even so, most advisors (59%) still tell plan sponsors that the best type of glide path for their plan will depend on the characteristics of both the plan and its participants.