The Securities and Exchange Commission has launched a website for a fake initial coin offering to educate investors about what to look for in a scam. HoweyCoins.com looks a lot like other scam ICO websites investors may come across, complete with an “About” page, team member photos, job titles and testimonials. Co-founder and Head Architect “Josh Hinze” is actually Owen Donley, chief counsel of the SEC’s Office of Investor Education and Advocacy. When visitors click on “Buy Coins Now,” they’re directed to investor education tools and tips on how to avoid similar schemes. “Fraudsters can quickly build an attractive website and load it up with convoluted jargon to lure investors into phony deals,” Donley said. “But fraudulent sites also often have red flags that can be dead giveaways if you know what to look for.”

Most Americans Don’t Have a Financial Plan

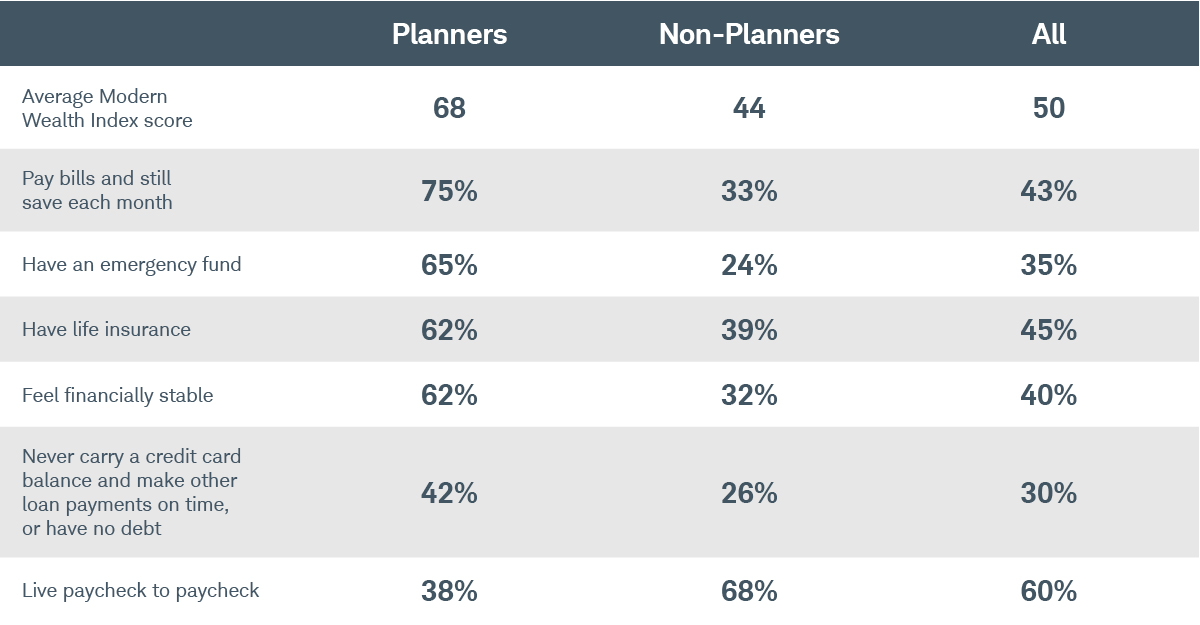

Having a financial plan can lead to better daily money behaviors, but only about one in four Americans have one, according to the latest results of Charles Schwab's 2018 Modern Wealth Index. The survey of 1,000 Americans found that three in five live paycheck to paycheck, two in five feel financially stable and just 35 percent have an emergency fund. The numbers, however, vary widely between those who have financial plans and those who don’t. For instance, just 38 percent of those with plans live paycheck to paycheck (compared to 68 percent of those without), 62 percent of those with plans feel financially stable (compared to 32 percent of those without) and 65 percent of those with plans have an emergency fund (compared to 24 percent of those without). One of the reasons why more don’t have a plan is because they believe their wealth doesn’t merit it. “Whether people think they don’t have enough money, believe it would be too expensive or just find the whole concept too complicated, the longer they wait the harder it is to achieve long-term success,” said Joe Vietri, senior vice president and head of Schwab’s retail branch network. “We must make planning and advice more accessible to more people. Simply put, we believe every American deserves a financial plan, regardless of how much money they have today.”

Kennedy Co-Sponsors Warren’s Bill to Pay Arbitration Awards

U.S. Sen. John Kennedy

U.S. Senator John Kennedy (R-La.) said Wednesday he’s co-sponsoring Senator Elizabeth Warren’s (D-Mass.) legislation intended to compensate investors for unpaid arbitration awards. The Compensation for Cheated Investors Act (S. 2499) would direct the Financial Industry Regulatory Authority to use its existing power to create a pool of money funded by penalties against its members to compensate victims. There are an estimated $100 million in unpaid arbitration awards. The bill would also require FINRA to track whether future arbitration awards are paid.