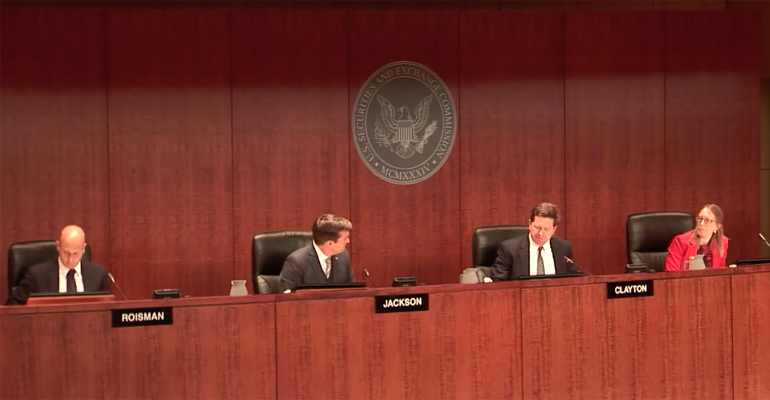

The Securities and Exchange Commission voted 3-to-1 to finalize a rule package that includes a best interest standard of conduct for broker/dealers. Commissioner Robert Jackson Jr. was the only one to dissent, voting against all four SEC staff recommendations. Chairman Jay Clayton and Commissioners Hester Peirce and Elad Roisman voted to push the regulation through.

“My hope was that the rules we announced today would significantly raise the standard for investment advice in this country,” Jackson said during the open meeting Wednesday. “I hoped to join my colleagues in announcing that the nation's investor protection agency has left no doubt that, in America, investors come first. Sadly, I cannot say that. Rather than requiring Wall Street to put investors first, today's rules retain a muddled standard that exposes millions of Americans to the costs of conflicted advice. Even worse, contrary to what Americans have heard for a generation, the Commission today concludes that investment advisers are not true fiduciaries.”

The commission voted on four items: Regulation Best Interest (Reg BI), which will set a standard of conduct for broker/dealers; a relationship summary, Form CRS; an interpretation reaffirming the fiduciary duty for investment advisors; and an interpretation of “solely incidental,” a prong of the Investment Advisers Act of 1940.

The rule package the SEC wound up passing did not change dramatically from those originally proposed about a year ago, with the exception of the "solely incidental" interpretation.

Reg BI and Form CRS will go into effect 60 days after those rules are published in the Federal Register. But firms will have a transition period until June 30, 2020, to comply. The Advisers Act interpretations will take effect as soon as they’re published.

“This action is long overdue,” Clayton said. “The fact that it is overdue does not make it easier. I believe the delay has made it more difficult as many interested parties have developed strident and divergent views on the state of the market, as well as current law and regulation, and what should be done to better serve the interests of our Main Street investors. Another complicating factor is that we regulate two types of financial professionals that play important roles in this vast market—broker-dealers and investment advisers—but do so in significantly different ways and under different regulatory regimes.”

The final version of Reg BI is similar to the original proposal, with a few modifications. In his opening statement, Clayton argued that it goes beyond FINRA’s existing suitability standard, addressing criticisms from investor advocates. The rule draws from key fiduciary principles, cannot be satisfied through disclosure alone, and was tailored to fit the broker/dealer model, the SEC says. The rule includes four obligations: a disclosure obligation, care obligation, conflict of interest obligation and compliance obligation.

One change under the care obligation is that it now explicitly requires the broker/dealer to consider the costs associated with the recommendation. It doesn’t, however, require that the least expensive recommendation be made by a broker, said Brett Redfearn, director of the division of trading and markets at the SEC. Cost is an important factor, but not the only one that should be taken into consideration.

“In fact a recommendation of the lowest cost security or investment strategy without consideration of all of the other factors that we’ve talked to in the care obligation, such as the customer’s investment objectives, could even violate Regulation Best Interest,” Redfearn said. “Sometimes the more expensive product might be the better match for the customer.”

The conflict of interest obligation, requiring firms to adopt written policies and procedures “reasonably designed to identify and at a minimum disclose or eliminate conflicts of interest,” was also enhanced. Those written policies and procedures must be designed to eliminate sales contests, sales quotas, bonuses and noncash compensation based on the sale of specific securities within a limited period of time.

Another change from the original is that Reg BI will now apply to account recommendations, including recommendations to roll over or transfer assets in a workplace retirement plan account to an IRA and recommendations to open a particular type of securities account. It also applies to hold recommendations.

The compliance obligation is new and would require b/ds “establish, maintain and enforce policies and procedures reasonably designed to achieve compliance with Regulation Best Interest as a whole.”

The commission has also passed a rule mandating a Customer Relationship Summary, or Form CRS, a disclosure document that was tested with investors. Here, firms will present specific information about their services, accounts or investments as well as their fees, costs, conflicts of interest and standard of conduct related to those offerings.

The form will include a “conversation starters” section, which will include questions retail investors can ask b/ds and advisors.

One key change that the agency made in response to comments is that the form will now include a standardized set of topics, using a question-and-answer format. The headings will be structured and machine-readable to facilitate data aggregation and comparison. Instead of requiring certain wording, firms will have more flexibility to describe their offerings in their own words.

Also different is that the instructions integrate the proposed fees and costs section with the sections on conflicts of interest and standards of conduct, “to help clarify the interconnectedness of these topics and better explain them to retail investors,” said Elizabeth Miller, senior counsel in the chief counsel’s office of the SEC’s division of investment management at the SEC.

Some commenters were concerned that the wording in the comparison section for b/ds and investment advisors was confusing or misleading for firms that are not dually registered, so the SEC did not include that section for those firms.

Also new is that the relationship summary will have a separate section about whether a firm or financial professionals have reportable legal and regulatory history and where investors can find out more information about those events.

The staff is not recommending adoption of a separate rule restricting b/ds and their reps from using the terms “advisor” or “adviser” as part of their title when communicating with retail investors. The use of those titles, instead, would be a violation of the capacity disclosure requirement in Reg BI, unless b/ds or reps are registered as investment advisors.

They’re also not recommending a requirement for b/ds and IAs to disclose firms’ registration status in investment communications.

The SEC also addressed the interpretation of the fiduciary duty under the Investment Advisers Act, saying that it’s a duty of care and duty of loyalty. The interpretation clarified that they’re not required to make an affirmative determination that each particular client understood the disclosure and their consent was informed.

“Rather disclosure should be designed to put a reasonable client in a position to be able to understand and provide informed consent to the conflict,” said Ben Kalish, an attorney at the SEC.

But, as commissioner Jackson pointed out, the final guidance removes language from the original proposal requiring investment advisors to “put its client’s interests first.” This is a change the SEC staff failed to mention during the meeting.

“Thousands of advisers who have taken pride in putting clients first for decades will be surprised to learn that, all along, the SEC has had lower expectations for their work,” Jackson said.

The agency also put out an interpretation of the “solely incidental” prong of the Investment Advisers Act, saying that broker/dealers with unlimited discretion over securities transactions was not solely incidental to brokerage and would not be exempt from registering as investment advisors. But most broker/dealers take limited discretion, and this would still be considered “solely incidental.”

“Where the discretion is limited in time, scope or other manner and lacks the comprehensive and continuous character of investment discretion, I would suggest that the relationship is primarily advisory. It is consistent with the solely incidental prong,” Kalish said.

Full monitoring of client accounts is also not considered solely incidental to a brokerage, while limited monitoring can be, and the agency will provide examples of this in the final release.

One question left unanswered today is whether state fiduciary standards, such as those developed by Nevada and New Jersey, would be preempted by the SEC’s rule. Clayton did say such a patchwork approach would increase costs, limit choice for retail investors, and make enforcement and control more difficult.

“I am deeply discouraged that our release is unclear about whether, and how, today's rule will displace carefully constructed and hard-won state laws,” Jackson said, in his comments. “We can and should say unequivocally that today's release sets a federal floor, not a ceiling, for investor protection. Our failure to do so invites extensive and expensive litigation over the scope of the rule—and its effects on nascent state regulation.”