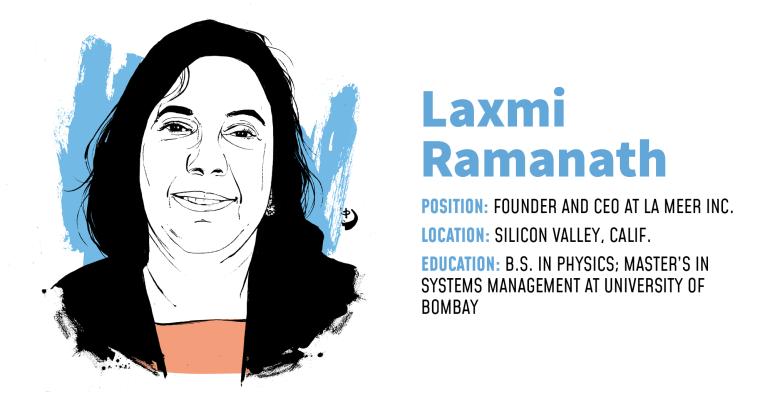

Laxmi Ramanath has been deeply embedded in two of the bigger technology changes in finance.

From 1988 to 1995, as a senior systems manager for CMC Limited in Bombay, she helped implement the automation of the Bombay Stock Exchange online trading systems. For five years after that, as a senior consultant with Citicorp based in London, she helped manage the technology adoption for the introduction of the euro.

“You can see the effect of the euro, the clashes, the challenges,” said Ramanath. “The whole thing played out before me.”

So Ramanath is no stranger to solving big, complicated problems inside financial institutions, particularly where those businesses bump up against ever-changing regulatory and compliance requirements. After four years as a business analyst at Silicon Valley Bank, she launched her current venture, La Meer, a web-based tool to help financial firms analyze risks around things like cybersecurity and money laundering, identify the weak links, and meet regulatory and compliance requirements across the businesses. The tool is meant to encompass modular applications so firms can essentially tailor the monitoring functions to their own businesses, and ensures the data is coming together and getting to the right stakeholders rapidly.

Started as a service for larger enterprises like banks, institutional investors and asset management firms, Ramanath sees an opportunity in the growing retail wealth management channel. She says the financial crisis of 2008 really hit home for her the need to bring the kind of automated risk mitigation processes closer to the advisor and the end client.

“The market crisis, people lost their homes, people lost their money, people lost their shirts,” said Ramanath. “That was something I wanted to help solve as a team. … If you enable these organizations to manage their risk through a visibly transparent system, then that is a way to prevent or at least have early warnings about risk.”

Add to that the COVID-19 pandemic, cybersecurity risks from at-home work, increased scrutiny from FINRA and the SEC—the regulatory and compliance landmines are proliferating. Many fast-growing RIAs and wealth management enterprises are out- pacing their ability to keep up with the risks, and here La Meer hopes to make a difference.

Outside of the business, Ramanath said as a woman in finance and technology, she recognized the limiting reality of glass ceilings. She said she had been able to overcome these structural challenges by proving her worth consistently.

“I realized how to navigate the system is to first listen. You need to understand what their challenges are,” said Ramanath. “It never came to me as, ‘I’m not white so I’m not going to get the respect.’ I always approach it as problem solving. I never look at it as ‘I’m female’ or ‘I’m brown’ or whatever it is. It never enters my mind. If somebody tries to toss me off, I leave it. I let it go. At some point, when they see the value in what you’re bringing to the party, you get included.”

Ramanath added that she was guided by a Sanskrit prayer, “Lokah Samastah Sukhino Bhavantu,” which means “May All Beings Everywhere Be Happy and Free.”

“Only when everyone is happy, can I be happy too,” Ramanath wrote. “If there is suffering that I see, I cannot be happy. So being caring of each other and the world is fundamental to all our success.”