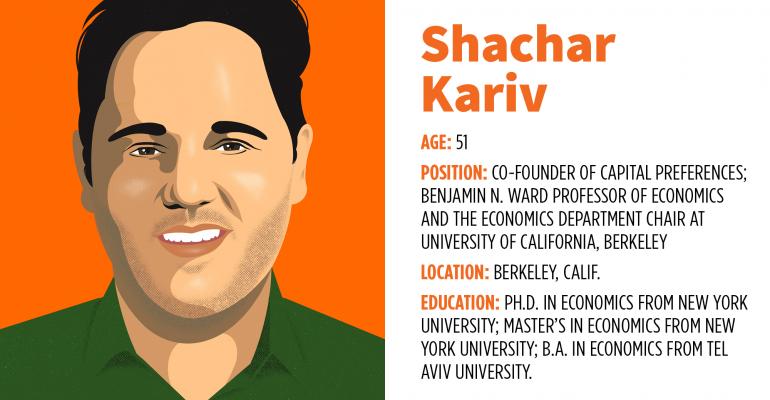

The path that led Shachar Kariv to the economics department at the University of California, Berkeley, and then to a startup creating risk evaluation software, began as an accident. After six years in the Israeli military, the 24-year-old Kariv was looking for a class to audit. He was interested in physics and mathematics, but on a whim, chose a class on game theory.

For someone who has made a career of studying trade-offs and the consequences of decisions, this one changed his life. It was his first encounter with the application of mathematics to human choices.

“Mathematics is the most precise language,” he said. “That’s it. This is why we build things with mathematics. When we are doing risk profiling, we also need to use mathematics.”

Kariv went on to get a master’s and a doctorate in economics from New York University.

In 2014, with a fellow academic, he co-founded the risk evaluation firm Capital Preferences to create software, TrueProfile, that uses gamification and their insights from behavioral finance to get a more accurate read on a client’s risk profile than could be uncovered by traditional questionnaires.

While it may not be the first risk-tolerance tool advisors think of, TrueProfile is increasingly used by some of the larger wealth management firms, including Vanguard’s robo advisor.

Next up is bringing the algorithmic alchemy to ESG investing, powering the decision-making behind personalized portfolios for clients in a time when they are demanding more customized portfolios and services.

It’s his passion for the trade-offs human beings face every day that keeps Kariv at the university and turning down more lucrative offers in the private sector. “I like teaching at a public university. I think I’m doing good,” he said.

The insights offered by his firm’s risk evaluation models are built on investor feedback tracked through a series of slides illustrating “reward upside” measured against “risk downside.” Investors who tend to take higher risks for higher rewards, and lower risks for lower rewards, are often directed toward growth portfolio models, for example.

Precise measurement of risk tolerances and loss aversion is key to achieving financial well-being, he said, not just in investment portfolios and across ESG factors, but by building better matches between investors and products like insurance policies and annuities.

“I’m standing on very high shoulders of the most important people, really, in the social sciences,” he concluded. “There is a bottleneck that we are trying to open between the knowledge that we have—and the financial institutions using it that are profiling people in a variety of domains.”