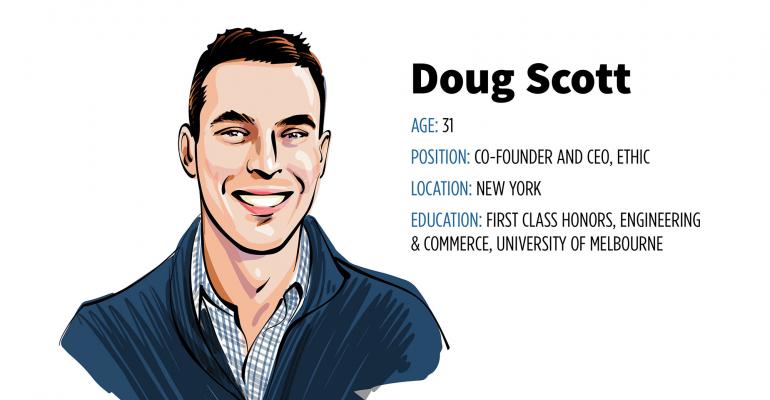

Growing up in Melbourne, Doug Scott’s time was filled with social and political activism encouraged by two politically conscious parents. So when he entered the world of investment banking, dealing intimately with the oil and gas industry, he struggled internally.

“I was working with incredibly talented and driven people, who cared about the work involved with our clients. It just didn’t sit well with my value set,” he said.

Scott left his job (and Australia) for the Bay Area with a tenuous understanding of the tenets of sustainable investing but sensed a better career fit. In 2015, he partnered with Johny Mair and Jay Lipman to form Ethic, an asset management company using technology to create separately managed accounts based on an individual client’s stated values.

Ethic clients can select from existing environmental, social and governance (ESG) models built around themes, or they can create custom portfolios via direct indexing.

Ethic basically “unwraps” exchange traded funds to offer clients the benefits of the index approach while letting advisors tweak the portfolio to align it with a client’s individual needs or ideals. The values-based platform can be viewed as a prudent weighing of risks and opportunities, Scott says, asserting that companies who treat workers, shareholders and the environment well are both in line with many investors’ moral compasses and often provide better long-term returns.

“Think about it with the concept of food; if you consume unhealthy food, that’s a risk. But there’s also the expression: what if I want cage-free eggs?” he said. “You can have a risk and values expression, and sustainability is about both of those.”

Since Ethic’s founding, the 25-employee firm has moved to an office in Manhattan’s Tribeca neighborhood. Ethic has $180 million in assets under management, according to its Form ADV, mostly sourced from other investment advisors.

The company boasts support from funders like Kapor Capital, ThirdStream Partners and Sound Ventures. In late September Ethic announced it would partner with Fidelity Investments to offer advisors the means to create personalized portfolios. And earlier this year, Dynasty Financial Partners announced a partnership with Ethic.

Scott thinks Ethic’s approach will only grow in prominence, as the technology brings direct indexing to advisors and clients. Why invest through an asset management company when an advisor can tweak an index based on individual client needs without sacrificing returns or taking on undue risk?

“Our general view is what we’re seeing is a disruption of the traditional model for financial product creation,” he said. “What we see as the next frontier for equities investing is around unwrapping ETFs and creating them in a personalized way for a given client. And one way to personalize is with a value set.”