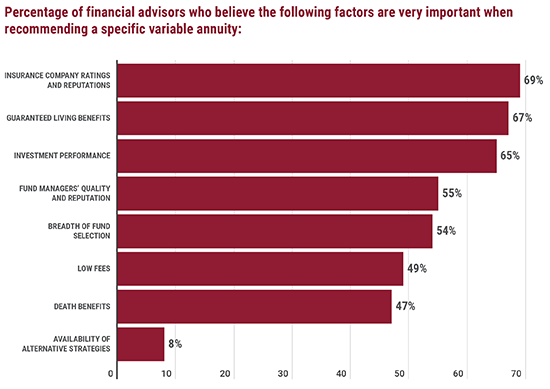

Chief among the factors financial professionals weigh when considering whether to recommend a specific variable annuity is the ratings and reputation of the issuing insurance company—more than two-thirds (69%) of advisors flagged this factor as very important. Despite the relative importance of the carrier, however, only a small fraction (11%) of advisors who sell different types of annuities use the same carrier for the various types.

Hinting at the reasons different advisors have for selling annuities, those who sell the most variable annuities were most likely (90%) to indicate guaranteed living benefits as very important. By comparison, those advisors who sell the fewest variable annuities, were most likely to point to investment performance (63%).

Variable annuities are popular but there are a few potential reasons advisors limit their use. Most agree on one reason: two-thirds of advisors surveyed find the high fees of variable annuities a limiting factor. Turning capital gains into ordinary income is the second-most commonly cited reason for limited use, at 52%, while 46% of financial professionals believe variable annuities can be too confusing for clients.