A typical client’s portfolio has a median value of 10% to 15% held in variable annuities—this value is slightly higher for clients at independent firms, at 16% to 20% of portfolio value. And allocation decisions within variable annuities can add to the challenge of establishing an appropriate allocation for the broader portfolio.

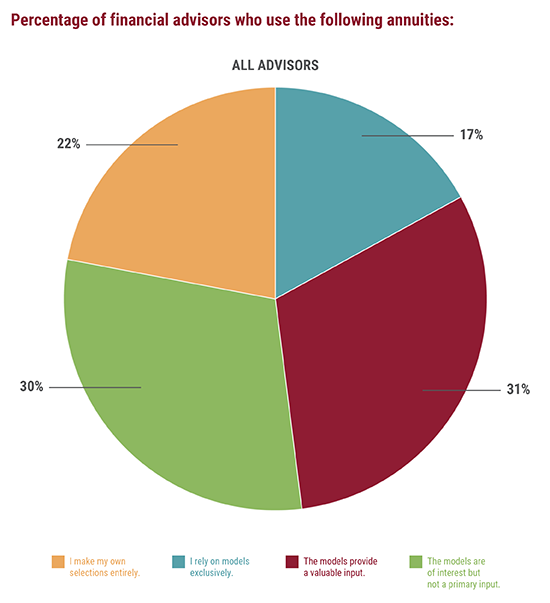

Nearly two-thirds of financial professionals find a balance between using the asset allocation models within variable annuities and making their own individual strategy selections for annuity holdings. Less common is an all-or-nothing approach, where advisors rely exclusively on either the models or their own selections. Remarkably, this pattern is consistent across the industry, regardless of firm type or the volume of variable annuities sold. It is also a long-term pattern, with three-quarters of advisors expecting their process to remain unchanged over the next two years.

Advisors also face choices about how they allocate and invest the remaining 85% to 90% of a typical client’s portfolio that is not held in a variable annuity. Mutual funds are the most common (77%) product used often or always in client portfolios, followed closely by cash (65%), exchange-traded funds (58%) and individual stocks (49%).

Volume of sales of variable annuities appears to influence these product choices, however. Financial professionals who sell11 or more annuities per year are much less likely than their colleagues who sell just a handful of annuities to report often or always using cash (49% versus 67%), with a similar pattern for often or always using individual stocks (39% versus 54%). Advisors who sell more variable annuities may be less inclined to more tactical and strategic allocation choices that require closer monitoring.