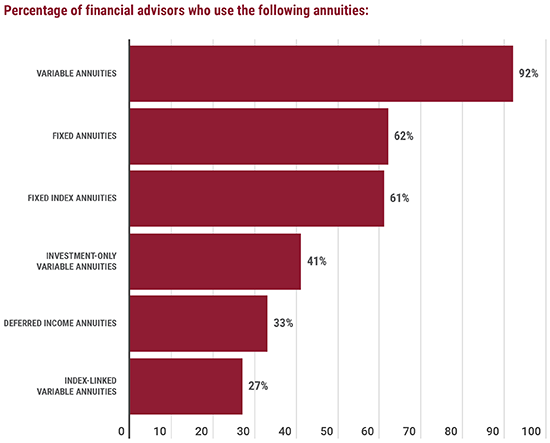

Variable annuities offer financial professionals the opportunity to address a host of objectives (see Part 1). Their versatility is likely why most advisors (92%) sell variable annuities. By comparison, only 61% of advisors surveyed sell fixed index annuities and just 60% sell fixed annuities. Advisors from large firms are more in favor of variable annuities (95%) than fixed and fixed index annuities (50% and 51%, respectively). But while advisors at independent firms also strongly favor variable annuities (89%), they also favor fixed and fixed index annuities (58% and 59%, respectively) more than their large-firm counterparts.

Other types of annuities, such as deferred income annuities and investment-only variable annuities, find less support among advisors and financial professionals. Their reticence toward investment-only variable annuities is understandable given that two-thirds (67%) of advisors believe that guaranteed living benefits are very important features when deciding to recommend a specific variable annuity. As a result, a variable annuity without those benefits would hold much less appeal. Finally, just 27% of advisors report that they use index-linked variable annuities, although another 34% expect to use them in the next two years.