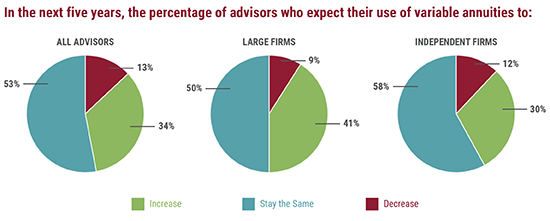

While most advisors surveyed expect to maintain their current level of use of variable annuities over the next five years, more than a third (34%) expect it to increase. Currently, advisors see median sales of five variable annuities per year. This sales level is roughly similar across large and independent firms. But advisors from large firms are more likely (41%) to expect to increase their use of variable annuities than their counterparts at independent firms (30%).

Understandably, advisors who sell more annuities are much more likely to expect an increase over the next five years. In fact, fully half of the financial professionals who sell six or more variable annuities per year expect to increase their use of these products over the next five years.

And though fee-based (advisory) annuities appear generally less popular among the financial professionals surveyed (just 19% of advisors surveyed report using them), they too are likely to benefit from increased use in the near future. Nearly a third (31%) of advisors expect to increase their use of fee-based variable annuities over the next two years. That number rises to 51% among those who sell the most variable annuities (11 or more). What’s more, this appears to be the start of a new trend, as 86% of advisors say their use of this type of annuity hasn’t increased in the past two years.