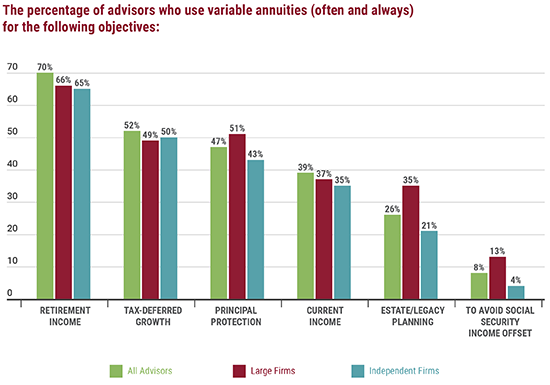

Variable annuities are an important tool for many advisors and financial professionals. They account for a median value of between 10% to 24% of an advisor’s total client assets, according to the survey results. The main reason financial professionals turn to variable annuities: retirement income. Seven in 10 advisors surveyed report often or always using variable annuities to achieve a client’s retirement income goal. That compares to 52% who use variable annuities to achieve tax-deferred growth and 74% who use them for the purpose of principal protection.

The ranking of these objectives is consistent across the industry. However, advisors in larger firms (wirehouses and regional firms) tend to be more likely to report often or always using variable annuities across multiple objectives than their colleagues at independent firms (independent RIAs and independent broker/dealers). This pattern lines up with survey findings that advisors from large firms had a slightly higher median percentage of client assets in variable annuities (10% to 24%) than do advisors from independent firms (1% to 9%).

Not surprisingly, advisors and financial professionals who sold 11 or more variable annuities in the past year are generally more enthusiastic across all of the objectives listed. They are also far more likely (74%) to report using variable annuities often and always to address current income objectives than are their counterparts who sold fewer annuities in the year, indicating a different focus or emphasis among higher volume sellers.

Part 1: The Role of Annuities in a Portfolio

Advisors turn to variable annuities to achieve a range of objectives, from retirement income to principal protection.