What comes to mind when Americans think about the financial services industry?

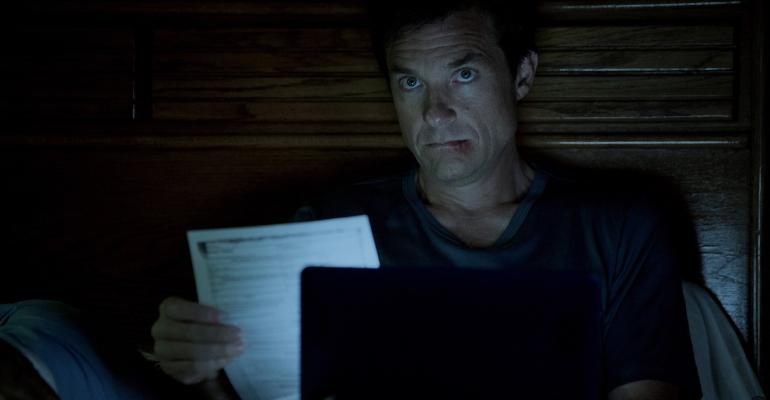

Going by movies like The Wolf of Wall Street and Boiler Room, or the TV drama Ozark, which features an immoral and criminal financial professional at its center, there’s not much that’s favorable. If you look up those (undeniably sensational) titles online, you’ll find keywords like “money,” “power,” “unethical” and “self-serving” attached to them. Add to that news stories, documentaries and podcasts focusing on real-life scoundrels like Bernie Madoff and the headline-grabbing—albeit rare and sometimes tragic—instances in which a financial professional is dishonest or sells an inappropriate investment to a client, and you have a dark cloud that hangs over the industry.

By contrast, it’s rare to find a headline containing a success story about a financial professional who helped a client or family achieve their goals over the long term by way of emotional connection and active listening. Sure, investments, stocks, bonds, mutual funds, etc. are the currency upon which a financial professional is supported, compensated and measured. At the end of the day, though, it is only one small sliver of financial guidance. The negative examples and self-defeating thoughts related to the money aspect of the trade quickly overshadow the good that is done by financial professionals every day.

Financial services is bursting with well-intentioned and highly trained professionals, many of whom have compelling stories about why they became financial advisors. If the industry could take a step back and focus on the “why” instead of the “what” of financial guidance, it would be a step in the right direction. Why do financial professionals do what they do? Did they watch their parents sell a business for less than they should have? Did a friend day-trade themselves into debt? Those types of stories are within most of us and are the reason we chose to enter the industry.

This applies to those behind the scenes as well, the ones who make financial services teams function and who are rarely discussed. Not every financial services professional selects and implements investments for clients. Not even close. Let’s highlight the individuals who enhance technology platforms, devise educational materials, and make sure firms are compliant with regulations and best practices, just to name a few. If we set aside the investment vehicles themselves, we see that every member of a financial services team is part of a people-helping-people industry, not unlike a team of surgeons, nurses and technicians who work in tandem to improve or save the life of a patient.

We’ve all been taught not to judge a book by its cover, but many have been judging the industry from afar. Yes, this is a for-profit industry, but if you ask the array of financial professionals who work for the client why they are here and what their area of expertise is, the stories are compelling, heartfelt and diverse. Let’s take back the media’s myopic narrative by talking about the passionate people with a diverse set of skills and life experiences who help clients achieve their financial and life goals every day.

Julie Genjac, vice president and managing director of Applied Insights for Hartford Funds, engages and educates financial professionals and their clients about emerging opportunities in financial services. She is also the co-host of the Hartford Funds Human-centric Investing Podcast, which features conversations with thought leaders from inside and outside the financial services industry.