When attempting to achieve advisor headcount growth, recruitment can often be a costly investment for broker/dealers (B/Ds). This is particularly in the case of best-in-class advisors receiving signing bonuses equal to 300% of their previous year’s production. Many executives across the industry recognize that this practice, at current cost levels, is not sustainable over the long term. Advisors defect to other firms for myriad reasons. That being said, it would seem that keeping your firm’s current employees satisfied, at a reasonable price, is a cost-efficient means of managing retention as it also plays a large role in a firm’s desired headcount projections.

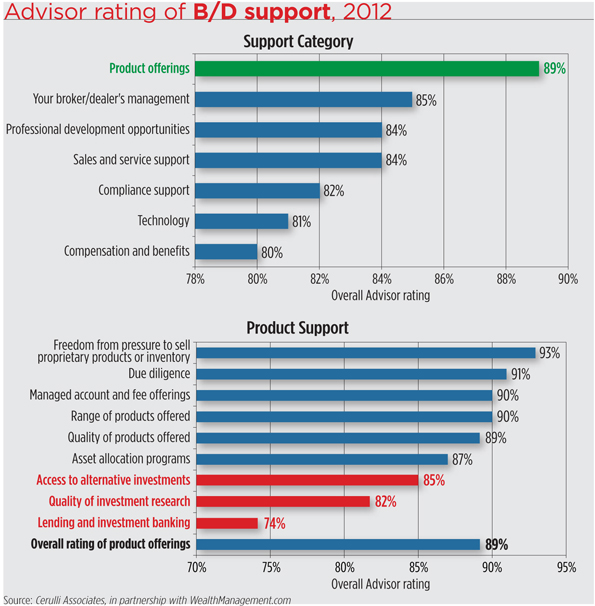

Cerulli finds that advisors are satisfied with product offerings more so than any other support provided by their B/D (see Exhibit 1). However, examining the B/D’s product support reveals dispersion in advisor satisfaction. According to advisors, they are least satisfied with their firm’s banking products, investment research, and access to alternative investments. Fortunately, remedying these issues can be relatively inexpensive and, thus possible regardless of resource availability or fall outside of typical demands of many firms’ advisors. B/Ds should prioritize product support developments based on the projected adoption and relevance to their underlying population.

Although rated lowest by advisors, lending and investment banking service ratings should cause the least concern for B/Ds. Only advisors at firms with affiliated investment banks have in-house capital market access. The average retail investor does not demand business funding services in the form of debt or equity offerings. While firms with in-house investment banks may have greater access to IPOs, even those in the top wirehouses reported dissatisfaction in their allocations to hot IPOs such a Facebook. Unless an advisor is dealing with the rare case of a high-net-worth (HNW) client looking to underwrite a bond deal (e.g.,wealthy business owners, then investment banking shouldn’t be a top support priority, and one-off requests can be navigated through a trusted referral relationship.

Investment research falls low on advisor satisfaction ranks comparatively against other services, but is still rated highly (82%) by advisors in absolute terms. Even still, 58% of B/Ds in 2012 indicated that they planned to increase their research group headcount in the next two years. This is a strong indication that management recognizes the demand for more timely research and additional coverage of certain investments. With advisors adopting more managed investments as well as flexible allocations, macroeconomic research and fund screening are priorities. Cerulli analysts expect that advisor satisfaction with regard to investment research will soon increase due to additional resources already being allocated to this budget.

Amplified demand for alternatives largely stems from those seeking investments that will dampen volatility during turbulent markets. In some cases, this can come in the form of REITs or commodities, but a number of alternative mutual fund managers have had success gaining flows because of their product’s appeal to a wider investor base. Access to alternative investments has a strong relationship with the quality and quantity of investment research at the B/D. In order to provide access to these products, a B/D must have a proper team in place to vet them. Regardless of the vehicle’s packaging, home-office executives have expressed to Cerulli a need to beef up their alternatives research staff. Other broker/dealers have chosen to terminate existing research generalists and hire analysts experienced in alternative research in order to provide better expertise, a final appeasement to advisors who are unsatisfied with the B/D’s slow adoption to alternative product. However, B/Ds should consider conducting a cost/benefit analysis of alternative products that require significant due diligence and are not in demand by a large swath of their advisorforce.