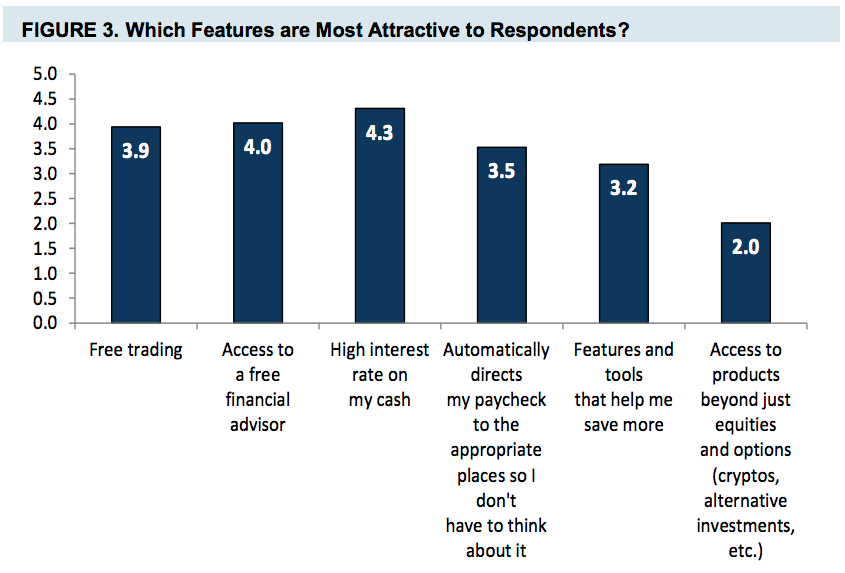

Brokerage customers are more interested in getting a better return on their cash than other account features, including free trading or financial advice, according to a recent survey by JMP Securities.

Nearly 75 percent of more than 500 respondents said a higher yield on cash was one of the most attractive things their brokerage or investment firm could add or improve. Free access to a financial advisor and free trading ranked a close second and third, according to the survey.

Devin Ryan, a managing director and equity research analyst at JMP Securities who co-authored a report on the survey, told WealthManagement.com the responses about cash yield were surprising. Most customers know they are earning little or almost nothing on cash in brokerage, checking and savings accounts, and that some companies pay more than others. But their keenness to earn more shows why a wave of new companies have begun offering better returns, Ryan said.

Legacy brokerage firms have built the interest they earn on client cash into their business models and have a hard time offering higher cash yields at the expense of their own revenue. Newer entrants, more focused on growth and new accounts, don't face that predicament, Ryan said.

Goldman Sachs' Marcus, SoFi Money and Ally have all started offerings high-yield savings accounts in the last three years, with rates as high as 2.25 percent. In February, Wealthfront launched an FDIC-insured cash account, separate from its investment account, with a 2.24 percent annual percentage yield.

Betterment announced it August of 2018 it was launching “Two-Way Sweep,” a feature that uses an algorithm to automatically analyze and move excess cash to and from an investor’s checking account and Betterment’s Smart Saver account. The investment account is a portfolio of exchange traded funds that invest in 80 percent short-term U.S. Treasury Bonds and 20 percent short-term investment grade bonds; the company expects it to earn an annual yield of 2.09 percent.

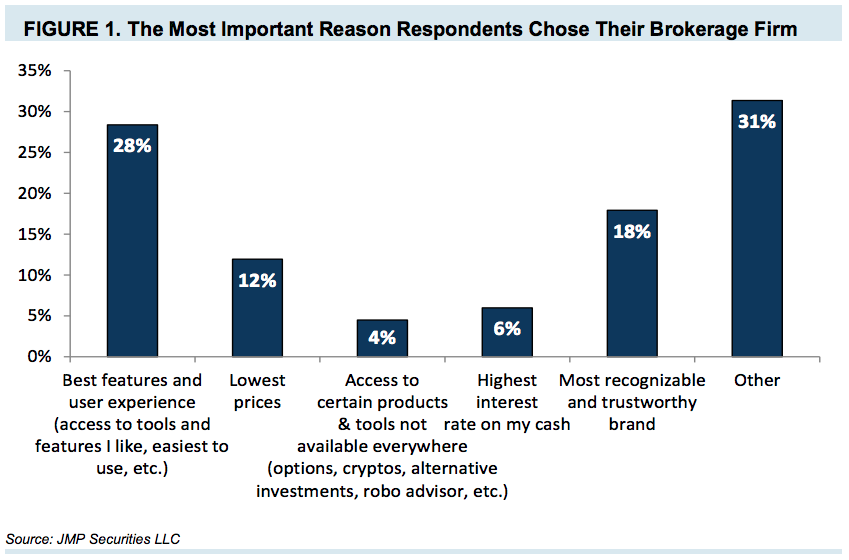

To be sure, the return on cash is not driving investors to choose one brokerage over another. Investors said they chose a brokerage account based on a longstanding family relationship or an employer recommendation, according to the survey.

The report also noted that to Millennials, a recognizable and trustworthy brand was the single most important factor in their decision. The survey showed that 26 percent of Millennials cited brand as the biggest factor and 21 percent said the best features and user experience. Family and work relationships were also important to Millennials, which the report said suggested that introductions to corporate relationships could be important for firms that currently don’t focus on the group.