Goal-based planning significantly helps people save money, according to the 8th annual America Saves study released Monday by the Consumer Federation of America.

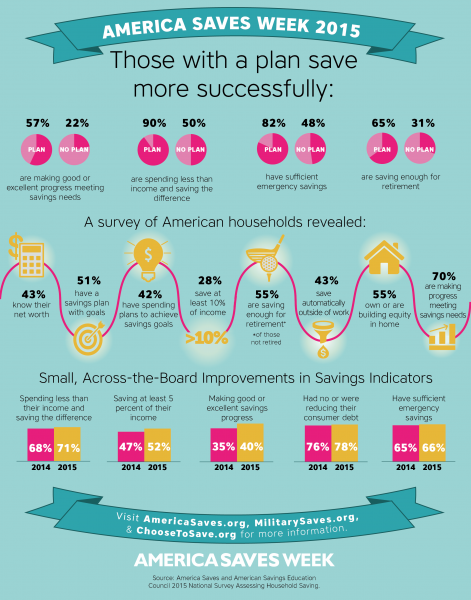

The survey of 1,009 adults found that those with a specific plan to reach their personal goals were far more likely to make good or excellent progress towards their needs, spend less income and save the difference, have emergency savings, and save enough for retirement. They are also more likely to name higher goals.

“Making a savings plan focuses one’s attention on how one spends and saves their income,” said Dallas Salisbury, president and CEO of the Employee Benefit Research Institute and founding director of the American Savings Education Council. “Those with a savings plan tend to be more careful spending money, less willing to borrow unwisely, and more likely to save conscientiously.”

In general, Americans did better saving money over this last year. Stephen Brobeck, the executive director of the CFA and a founder of America Saves, said the survey showed small improvements across all measured indicators compared with its 2013 study, as well as significant improvements in two of the most important categories. The amount of people saving at least 5 percent of their income increased from 47 percent to 52 percent, and people who feel they are making either good or excellent savings progress grew from 35 percent to 40 percent.

“Across the board improvement reflects the continued economic recovery and consumer confidence,” Brobeck said during a conference call. “Higher incomes make it easier to save.”

Less than half of Americans feel they’re making good progress with saving, and although this was one of the most improved areas, Brobeck believes the lack of progress shows persistent inequality in the economy.

“Americans are saving a little more effectively today than a year ago, but only a minority are doing so very successfully,” Brobeck said in a statement.

Only one-third of young adults reported success with saving. But despite recent articles on the millennial generation’s supposed financial incompetence, Brobeck said that the CFA study was especially encouraging for 18- to 34-year-olds. Young adults that save 5 percent of their income rose from 50 percent to 56 percent, more than the general population, and those with an emergency fund grew from 53 percent to 64 percent. There were also notable increases in the amount of millennials who have a savings plan and a spending plan.