By Sabrina Willmer

(Bloomberg) --Fidelity Investments has stepped up promotions of women in its stock-picking group, which was hit last year with sexual harassment allegations.

About 30 percent of fund manager appointments in the equity unit have gone to women in 2018, the most in five years, according to an analysis by Bloomberg. Even with these moves, men still overwhelmingly dominate the money-manager ranks.

Janet Glazer, who has an MBA from Massachusetts Institute of Technology, was tapped in June for the senior leadership team that oversees the business. And Nidhi Gupta, a Harvard MBA, will exclusively preside over more than $7.8 billion in technology assets.

The stock group has been a high-profile engine of the investing giant for decades, managing north of $1 trillion across more than 350 mutual funds. Abby Johnson, who became Fidelity’s chief executive in 2014, has set out to improve the gender mix at her 72-year-old firm, if only gradually, by recruiting more women on campus and tapping talent from within. It’s a challenge faced by the entire industry, where women accounted for about 10 percent of fund managers in 2016.

A year ago Fidelity came under media scrutiny after it dismissed a prominent stock picker who had been accused of sexual harassment by a junior female employee. While the firm had named women to leadership positions and fund management roles before the misconduct allegations, the incident spurred Johnson to look even more closely at female talent for promotions. And women who moved up to bigger roles this year earned it, Fidelity spokesman Vin Loporchio said.

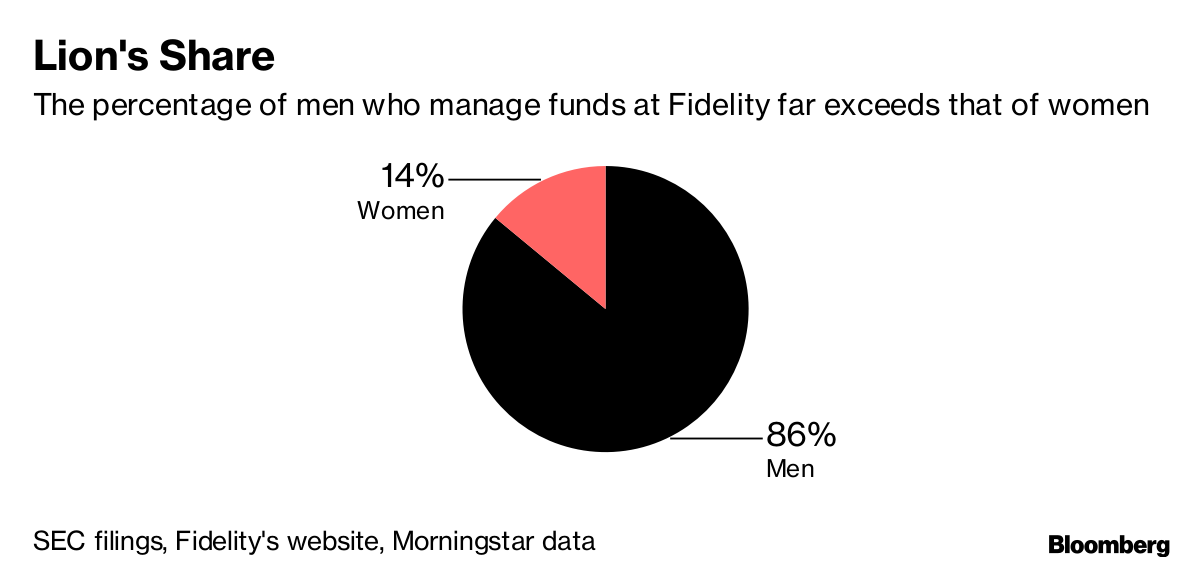

After the promotions, men still comprise about 86 percent of fund managers in the stock group, according to the analysis of government filings, Fidelity’s website and Morningstar Inc. data this year through October. A quarter of the unit’s 16-member leadership team are women.

“Under-representation of women in financial services roles is not isolated to Fidelity; this is an industrywide challenge,” Loporchio said. “Increasing diversity is a top priority for Fidelity, and we are making tangible progress.”

Fidelity’s stock division had a reputation in recent years for a cliquey culture. Some past appointments, primarily to males, were earned more through personal connections to powerful men than performance, according to several current and former employees of the group. Loporchio said promotions in the group were based on merit.

The harassment allegations brought the issue of the treatment of women in the unit to a head. Johnson made several moves, including relocating her office near money managers on the 11th floor of the Boston headquarters and requiring them to undergo unconscious-bias training.

Read a Q&A with Johnson as she plans for a $22 trillion shift to women

Toward the end of last year, Fidelity also surveyed investment professionals about its culture. It revealed concerns about a power imbalance between the mostly male fund managers and analysts, and showed that women and minorities generally felt out of place without a clear path forward in their careers, according to people with knowledge of the questionnaire.

Several months later, Fidelity shook up the leadership of the stock unit. Brian Hogan, the former head of the group under whose watch the alleged misconduct occurred, moved to another position in the firm in January. Hogan declined to comment.

Loporchio said at Fidelity when Hogan learned of allegations of harassment and other inappropriate behaviors, he responded properly. Hogan was moved to bring a fresh view to a strategically important business, the spokesman said.

New Leaders

In March, Johnson named Pam Holding, 54, as co-head of the equity group, making her the first woman to hold that post. She rose to the position after serving as chief investment officer of Fidelity Institutional Asset Management.

Three months later, Fidelity appointed Glazer, 34, a managing director of research, becoming the fourth woman on the leadership team. Glazer will also run solo more than $1 billion in industrial assets, replacing Tobias Welo, who will leave the firm at year-end. Welo didn’t respond to a request for comment.

The promotions have been a big enough break from the past to stir resentment among some men in the unit who now see less opportunity for themselves, said people with knowledge of the group. These veteran analysts and managers are concerned about what seems to be a concerted effort by Fidelity to elevate women in response to misconduct issues.

“The women who have been promoted to fund management roles have been with Fidelity for many years,” Loporchio said. These appointments are “given to the best candidate and done in the best interest of fund shareholders.”

As it is, more than 45 men in the stock unit solely run funds with more than $1 billion in assets, compared with three women. Four more women are set to join them over the next year, replacing men who are leaving or will manage separate funds. A handful of other women co-manage portfolios in excess of $1 billion.

Running Big Funds

Gupta, 37, will start exclusively managing the $7.8 billion in tech assets in December when her co-manager on the funds, Charlie Chai, retires. She was given her first fund to run more than five years ago and was appointed co-manager of the tech funds in July.

Shilpa Mehra, a portfolio manager at Fidelity since 2012, will oversee on her own a $1.8 billion trend fund, replacing Daniel Kelley, who became lead manager of a $27 billion pool. Mehra, who got an MBA from Columbia University, joined Fidelity in 2009.

The firm also elevated women from more junior roles to fund manager, including the employee who brought the sexual harassment claim last year, people familiar with the promotions said.

And Jennifer Fo Cardillo, who was moved up from analyst, is set to become solo manager of more than $2.5 billion in small cap assets. Cardillo, who joined Fidelity nine years ago after receiving a bachelors in finance from Boston College, is currently co-manager and will replace James Harmon, who is retiring next June.

Robby Greengold, an analyst at Morningstar who has examined the stock unit, calls the changes there incremental.

“Fidelity has a long history as a star manager-led investment firm,” he said. “They are not looking to undo what has worked well.”

Across the industry, the number of women in money management remains strikingly low. By one measure, they are even losing ground.

Industry Slide

The number of females working as mutual fund managers declined from a peak of 14 percent in 1999 to about 10 percent in 2016, according to a study by a Federal Reserve economist and two professors who examined more than 12,500 managers over 24 years. They found that women are less likely to be promoted compared to men with comparable performance.

“We still see a preference for males because of the assumption that they are more competent," said Mabel Abraham, an assistant professor at Columbia Business School, who co-authored a study with Tristan Botelho of Yale showing that investors trusted the stock picks of male fund managers over those of females with similar performance. “When women are being evaluated, whether by peers or hiring managers, there is more scrutiny.”

Fidelity says it has made strides in promoting women over the years but there’s more to do. Its top female executives include the presidents of fixed income, institutional asset management and personal investing -- all of whom held the posts prior to this year. Fidelity, like Dodge & Cox and Russell Investments, are among the few asset management firms led by female CEOs.

To build its bench of female talent, Fidelity is expanding recruitment efforts as fewer young women consider careers in finance.

Three years ago, Fidelity started bringing high school girls into the firm to introduce them to investing. Last summer it began searching for top graduates from all four-year colleges and universities rather than a select list of schools.

“It may take several years before Fidelity’s recent recruitment efforts pay dividends,” Morningstar’s Greengold said.

To contact the reporter on this story: Sabrina Willmer in Boston at [email protected] To contact the editors responsible for this story: Margaret Collins at [email protected] Vincent Bielski, Josh Friedman