Bank of America's wealth management unit posted record profit of more than $1 billion in the first quarter, despite revenue falling slightly compared with a year ago.

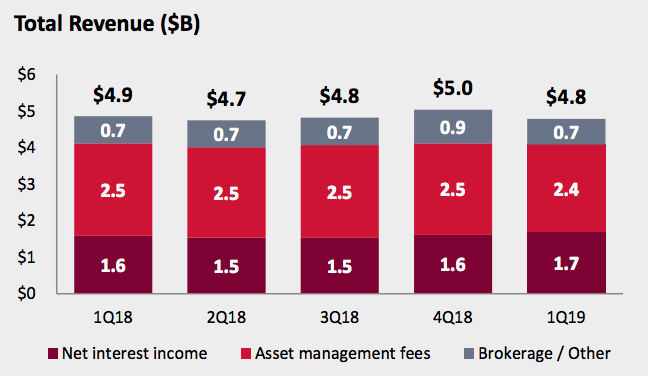

Revenue for the Global Wealth and Investment Management division, which includes Merrill Lynch Wealth Management, was down 1% to $4.82 billion compared with the first quarter of last year. But net income was up 14% to $1.05 billion, and noninterest expenses fell 4% to $3.43 billion during that same period. Lower expenses were driven by the amortization of debt from the purchase of Merrill Lynch, a lower Federal Deposit Insurance Corporation expense and revenue-related incentives, the company said.

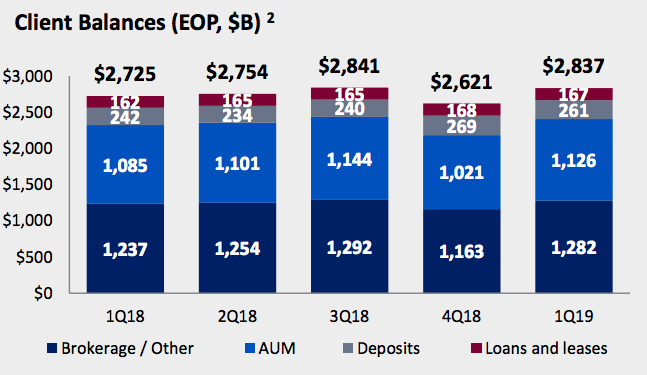

Client balances at the end of the quarter were up $111 billion, or 4%, to $2.8 trillion, a result of positive net flows and the market valuation.

The majority of client assets are divided between the wealth manager's brokerage business ($1.28 trillion) and advisory accounts ($1.13 trillion), but most of the unit's revenue stems from the asset management fees and interest income, all of which remained relatively steady over the past year.

Incentives for financial advisors to grow their practices, as well as referrals to and from Bank of America's other businesses, are delivering results, according to the company. Net new households served by Merill Lynch Wealth Management were up a record 85% over the past year—10 times the historical run rate—and the gross number of new households was up 41% to 17,625. Experienced Merrill Lynch advisors are on track to each add at least five new relationships this year. More than half (62%) of advisors have also referred a client to Bank of America's banking unit in the past year.

Wealth managers, including Merrill Lynch, are expanding and improving their ability to loan money to clients, a relatively small but lucrative line of business. A 12th-consecutive quarter of growth in custom lending and mortgages helped credit balances at Merrill Lynch reach $4.5 billion, up 4% year over year.

Referrals from banking helped the Retirement and Personal Wealth Solutions group hit a record level of 850 funded institutional retirement plans so far this year, 179 more when compared twith last year. Bank of America expects to grow its retirement business and for it to be a source and destination for new relationships, according to a Merrill Lynch executive familiar with the business. Morgan Stanley has recently taken a similar attitude about its retirement business and said it is looking for acquisitions, but Wells Fargo recently sold its retirement business.

GWIM had 19,523 advisors at the end of the first quarter, up 1.3%. Merrill Lynch accounted for 14,761 of the workforce, which the bank said was down less than 1% compared with last quarter and a year ago. Most of the remaining 4,762 advisors are part of Merrill Edge, and about 450 are affiliated with the recently renamed Bank of America Private Bank, formerly U.S. Trust.

Bank of America reported record net income of $7.3 billion, up 6% from last quarter, and diluted earnings per share of $0.70, up 13%. Shares were trading just over $29 in the hours following the bank's earnings call Tuesday morning.