Wealth management firms expect the mergers and acquisitions market to cool in 2023, according to a recent survey, although more than 60% intend to engage in some form of M&A next year.

The data, collected in October by WealthManagement.com and Informa Connect in partnership with Bluespring Wealth Partners, Cambridge Investment Research and Skyview Investment Advisors, found most advisors remain optimistic about the future of their own firms but believe new economic realities will likely slow the fervent pace of M&A, particularly in the RIA space, and result in a buyers’ market in 2023.

RIAs, which have seen the greatest market growth and loftiest valuations over the last decade, have adopted a dimmer view than the larger industry, but individual firms remain confident in their own prospects.

“Despite the declines in the markets, rising interest rates and all sorts of other external factors that might suggest that M&A activity would come to a halt, we’re actually seeing that there’s some consistent, and even aggressive, activity that is taking place,” said Mark Bruno, managing director of Informa Wealth Management, during a recent webinar around the survey results.

Of the 493 respondents to the October survey, nearly half (48%) are from RIAs or hybrid firms, while 22% are affiliated with independent broker/dealers. Advisors at insurance firms, regional firms and bank brokerages make up the remainder, with 16%, 9% and 6%, respectively.

Around 330 responses came from firms with less than $1 billion in client assets. Sixty-nine are at firms with between $1 and $5 billion, 34 are with firms managing between $5 and $20 billion, and 60 are with firms with more than $20 billion.

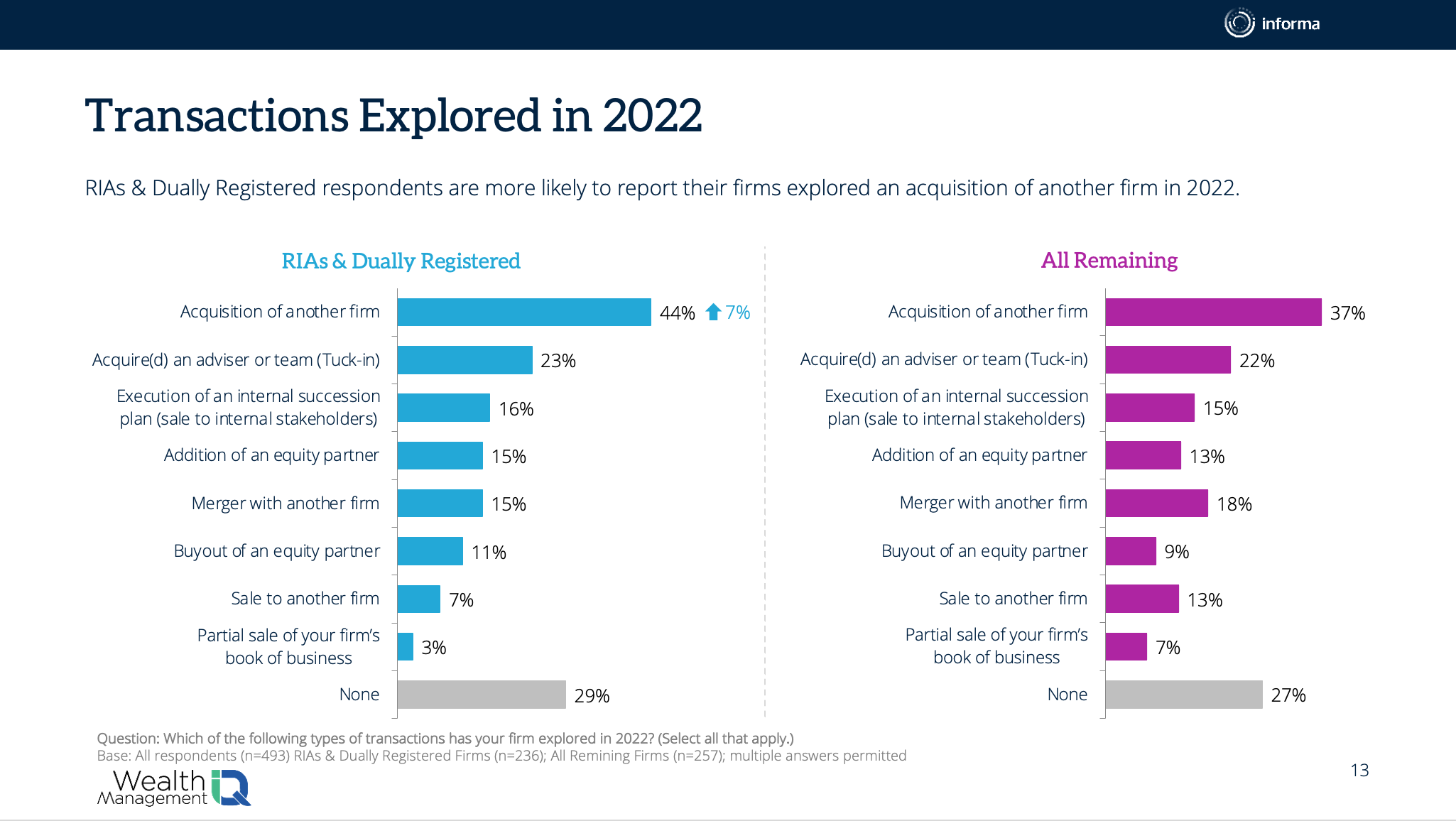

Seven in 10 respondents said they explored an acquisition, merger or sale in 2022, even as the rest of the U.S. economy fled the negotiation table. A little more than 40% said they pursued an acquisition, while half that number explored tuck-in opportunities, and 16% said they looked into a merger or executing an internal succession plan. Only a tenth said they considered selling, but nearly a third were approached by potential buyers.

Ultimately, 44% ended up making a deal. Acquisitions and tuck-ins comprised the bulk of those, at 28%, while only 4% said they sold their practice and 5% completed a merger. Private equity transactions made up 13%, and execution of an internal succession plan made up 7%.

“As strong as it’s been, on a relative basis there haven’t been as many transactions as one would think, given the huge denominator,” said Bluespring President David Canter, who participated in the webinar along with Jeff Vivacqua, president of growth and development at Cambridge Investment Research, and SkyView Managing Partner Aaron Hasler. Noting that there are 15,000 SEC-registered and 20,000 state-registered firms, Canter said the 200-plus transactions expected this year "seems like a small amount.”

Sixty-three percent of respondents said they expect to engage in some form of M&A activity next year, with just over half identifying an acquisition or tuck-in opportunity as the target. Twelve percent would like to add an equity partner, and 5% would like to be bought out by one; 9% want to execute on an internal succession plan, and 4% want to sell to another firm. Just 2% are looking to sell part of their book of business.

At the same time, 45% of RIA and hybrid firms expect to see industrywide M&A activity decrease next year, while 34% of other respondents agree. Twenty-one percent expect no change in M&A.

Similarly, about half of RIAs and hybrid firms expect valuations to drop in the coming year, compared with just 41% of other respondents. Interestingly, a larger percentage of both groups—54% and 46%—believe the rising cost of capital will cause activity to decrease, while 31% and 33%, respectively, believe it will have no material impact. The remainder (14% and 21%, respectively) think higher interest rates will result in more activity.

“When you're looking out across the industry more broadly, that's when reality starts to set in,” said Bruno. “Still not terribly bearish but not quite as bullish.”

The primary reason for engaging in M&A, cited by nearly three-quarters of respondents, is acceleration of a firm’s growth. This is followed by the acquisition of new talent (40%), succession planning (27%), adding new capabilities (24%), expanding career opportunities for employees (20%), monetizing an equity stake (13%) and acquiring new technology (10%).

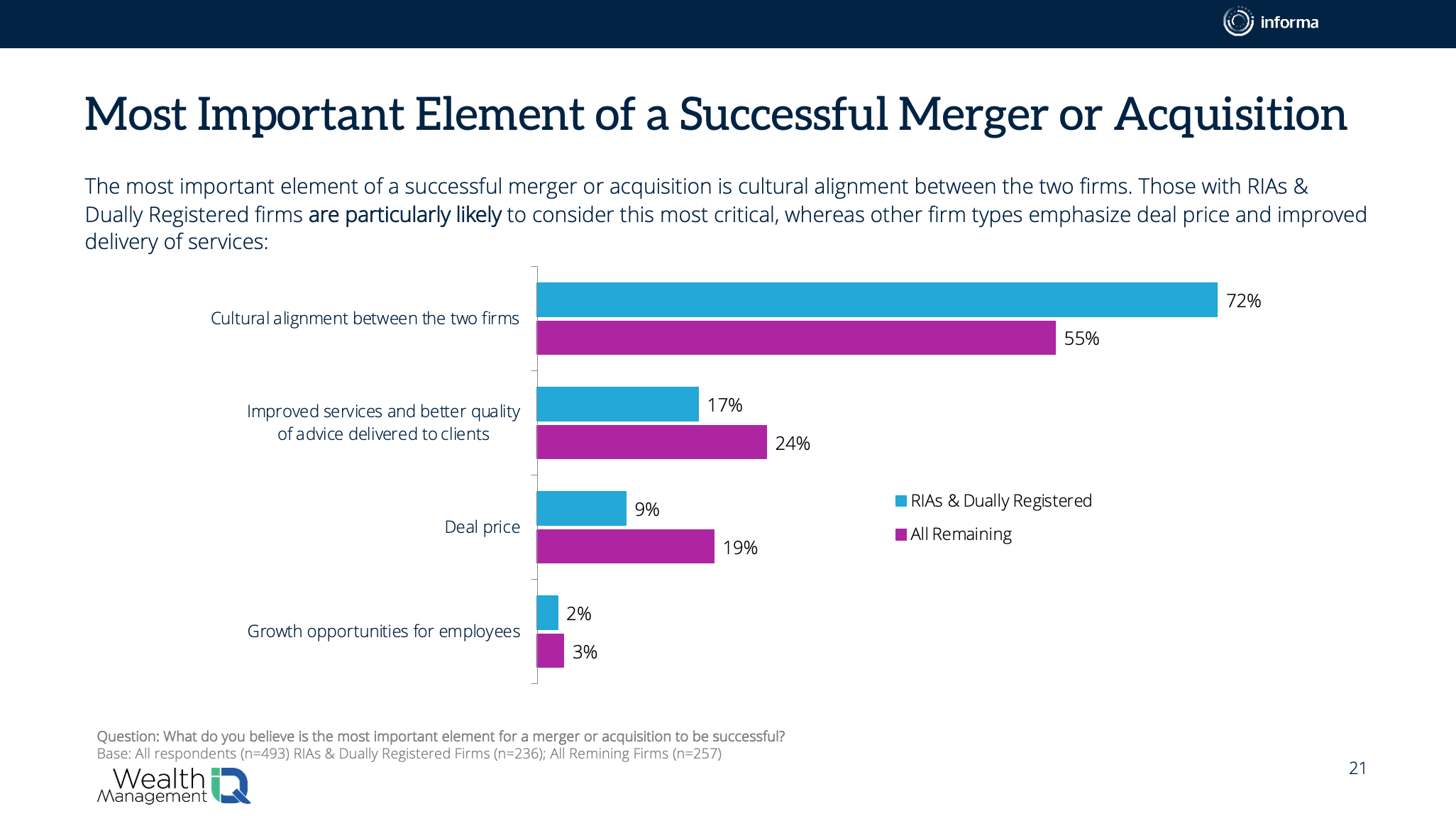

Culture was cited by 63% as the most important factor in a successful transaction, followed by improved services and advice (21%) and the price tag (14%). The panelists said the emphasis on culture was a good sign for the future of the industry.

“Firms that are focused on acquisitions just for revenue really tend to flame out,” said Skyview’s Hasler. A focus on cultural alignment and a strategic approach to the placement of acquisitions within the larger market, he said, leads to better post-merger results. He also recommended identifying opportunities that reward and incentivize existing employees, who drive growth and do much of the work needed for a major transition.

“I think a very effective acquisition is one that rewards the employees,” said Hasler. “And you’re building your own foundation and firm for an eventual internal succession plan if you desire. So, I like focusing on all those aspects as you're evaluating what your targets are for acquisition.”

Vivacqua said he sees too many firms rushing headlong into the M&A process without proper preparation or expert assistance.

“The workup to the deal and the closing is not the hard part,” he said. “It's what comes after the close of the deal. ... Where I see bumps in the road is when people try to shorten the timeframe up to closing and move too fast or don't take enough time asking the right questions.”

For firms without a dedicated, in-house professional qualified to help navigate transition management, Vivacqua recommended outsourcing the function to ease inevitable pain points and ensure no details are overlooked.

More than half of all respondents believe the coming year will favor buyers in the M&A market, with RIA firms favoring the seller slightly more, and 21% of both groups saying neither party will have the upper hand.

“It's neither a buyers’ nor a sellers’ market,” opined Canter. “I believe that there's going to be plenty of sellers, and that just goes back to a lot of the demographics, but at the same time there there's plenty of buyer demand. So, there will be deals that get made in the middle.”

Canter acknowledged the challenging market environment and rising capital costs but said quality firms demonstrating sustainable growth “will always command a solid and fair multiple and be fairly priced.”

Canter, Vivacqua and Hasler all agreed that there are currently seven avenues available to firms considering inorganic growth opportunities: a minority transaction in which only some chips are taken off the table; a purely financial majority transaction in which no capabilities or larger resources are acquired; a full or majority sale in which the seller retains branding and some level of control while having access to a larger platform and expanded capabilities; a “cross-town” merger to achieve scale by combining with a peer firm; internal succession strategies; and doing nothing.

“Perhaps that’s the most perilous choice,” Canter said of the last option. “Just the demographics alone have shortened the lifespan of folks having the ability to take choice seven.”

Both Canter and Vivacqua remain bullish on M&A in the wealth management space, particularly among RIAs. Canter cited industry demographics and the widespread need for succession solutions, which are unlikely to be affected by market conditions. Vivacqua said interest rates may not have the outsized effect many are predicting.

“Price in the absence of value,” said Vivacqua. “We all coach that, we all teach that. So, you got to push the wrong fallacy off to the side and say, ‘Is it the right firm for me? Is it the right culture?’” He recommended not assuming the capital costs of a potential buyer.

“They could have a lot of cash on hand, they could have a line of credit that has a fixed interest rate regardless of what's going on in the marketplace,” he said. “So, push some of those self-contained notions aside, clear the noise and just go into the conversation.”

The 2023 Wealth Management M&A Outlook study and other research topics can be found at the WMIQ page on the WealthManagement.com website.