While outright acquisitions and deals get all the media attention, mergers are quietly transforming the industry. At the time you read this, thousands of advisors are negotiating the combination of their practices with others in order to create scale, leverage each other’s skills, gain resources, and tackle succession. Perhaps the fastest and best way to grow into a bigger firm is by merging with another business.

Consider that more than half the industry consists of solo practices—advisors who work one-on-one with their clients without the help, input or distraction of another advisor. In fact, 47 percent of the respondents in the WealthManagement.com 2014 Compensation Survey say they work alone, and another 20 percent say that they are part of a branch or other structure but have little in common with the other advisors besides the office and overhead. Only 33 percent of the industry works in teams where advisors are building a business together. Teams are more common in registered investment advisory firms, (RIAs) where they comprise 50 percent of the structures.

Many solo advisors are feeling pressure to consider if they will continue to practice that way or if they are going to seek out partners. The pressure comes from several sources:

• Capacity – Growth has led some of the most successful solo practices to literally run out of capacity. They cannot grow unless they add advisors.

• Resources – The need to provide ever-growing lists of sophisticated services leaves advisors looking for alliances where they can tap into better portfolio management, better technology, better planning, better research, etc.

• Succession – Succession is a hard question for solo advisors to answer. Many struggle to tell clients how they will implement a 15-year plan when they themselves are likely to retire in the next 10 years.

• Competition – The industry seems to be rapidly consolidating, and advisors are feeling anxiety that competing in the future may require being larger.

The question, “Should I stay solo?” is on the mind of many advisors, and finding the right answer is critical for future professional and personal success. We want to examine some of the possible answers.

Stay Solo

There are three primary reasons why an ensemble practice may not be the right fit for an advisor: 1) You simply have not found the right partner. 2) You desire to have full control of your practice. 3) You prefer a more flexible lifestyle.

Partnerships are a lot like marriages—you can’t just decide to get married and drive the first person you meet to Las Vegas or to the municipal court. It has to be the right person and it has to be the right time in your relationship. Rushing to form a partnership before ensuring that the other party is ready for such a relationship can be one of the biggest mistakes you can make in building a practice.

“Control” is a big factor for the sense of satisfaction and accomplishment that advisors get out of their practice. It is the reason you are likely to meet many advisors with a small practice of their own who are much happier than the advisor with the largest practice in, say, the Chicago office of a national firm. The ability to influence your own environment, the ability to change what you don’t like and leave your mark on anything from the software you use to the way you present financial plans to clients, is critical for the sense of success an advisor gets from their practice.

Unfortunately, when you are part of a team you surrender that control in exchange for resources and support. If you are insistent on not having to argue for your decisions and to explain your reasons every step of the way; if you want to be able to do what you feel is right 100 percent of the time; if you want to buy whatever you like without a committee meeting … well, an ensemble practice may not be for you, since you will have to do all of those things—argue, explain, do things you disagree with, and sit through meetings.

Many practitioners also assign a high value to their work-life balance—the ability to spend a lot of time with their family, to pursue their personal hobbies and interests, even to only work part-time. This also applies to the cost structure of the practice, as such advisors prefer to keep overhead low so as not to experience the pressure of having to cover a larger bill. Clearly, having multiple employees and having other colleagues puts more pressure to maintain a similar workload and contribution, as it’s difficult to be lifestyle-oriented in an ambitious team of people.

Merge With Another Practice or Firm

Mergers have a tremendous potential—they can combine the resources of two firms, create economies of scale, and even pave the way for succession for one or both of the merging partners. In fact, many of the top firms in the industry today found their jump-start in a merger. Aspiriant was born out of the merger of Kochis Fitz and Quintile; Balasa Dinverno Foltz was the product of a merger between two independent RIAs; Private Ocean was a firm likewise formed by the combination of two RIAs. These are just three of many such examples.

Mergers have a tremendous potential—they can combine the resources of two firms, create economies of scale, and even pave the way for succession for one or both of the merging partners. In fact, many of the top firms in the industry today found their jump-start in a merger. Aspiriant was born out of the merger of Kochis Fitz and Quintile; Balasa Dinverno Foltz was the product of a merger between two independent RIAs; Private Ocean was a firm likewise formed by the combination of two RIAs. These are just three of many such examples.

Finding the right partnership can make your life so much better; enter the wrong one and you will spend the rest of your career bickering and snickering. Sometimes the first one doesn’t work, but the second one might—you just have to find the right partner.

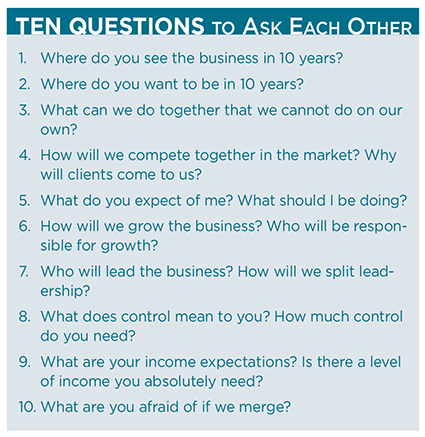

When a client brings up the possibility of merging practices, my first question is always, “What can you do together that you cannot do on your own?” The best mergers involve a strong sense of synergy between parties. Perhaps one partner brings business development ability, while the other has the skill to manage the business; or one party is strong in client service and relationships and the other is very good at forging new connections; or one partner is younger and the other older, and succession is a priority. A good sense of what the synergy is will help move the negotiations along and should be the first area explored.

If the first issue to consider is synergy, the second is the person you’re working with—the person, not the personality. The personality (which may or may not exist) is a set of communication patterns and thinking tendencies that we exhibit and perhaps modify. People with different personalities frequently work together very well. The key issue is the person—the set of values, beliefs, ambitions and visions that motivate and drive an individual. People with different values and vision never work together well.

Being business partners with another person is a level of working together that is well beyond knowing each other socially. My partner at Fusion Stuart Silverman and I frequently joke that we were first friends, then friends and partners, then just partners; and now that we are no longer partners, we are friends again. Most of all, partnerships are based on trust and respect. If you get to know someone well enough to respect their business judgment and trust that they will always do what is best for the business, you can overcome a lot of the difficult decisions and difficult episodes in the life of a partnership. On the other hand, without trust, partnerships are just not possible.

A shared vision is necessary as well. You need to understand where the other person sees the business in the future. Are they looking to grow as much as you want to grow? Are they trying to build an empire or a small, cozy place? Not having the same vision is a fatal flaw for a partnership; it makes it impossible to function. Imagine a two-horse buggy where the horses disagree on direction!

In a good partnership, the question should be, “What is the best way to achieve our vision?” or “What is the most effective method for OUR business?” It should never be “How do I do this?” Force of habit and reluctance to change will doom any collaborative business venture. It’s important to remember that the act of merging is an act of change. If not changing is the priority, you can simply keep your own practice the way it is. One of the biggest problems I see in merger discussions is a relentless holding on to habits and preferences, instead of looking at what’s best for the combined business.

The devil in mergers is usually in the details, and that’s where sharing and compromising becomes most evident. If you believe you have the right vision and the right synergy, then it’s time to make lots of decisions. Will you leave your broker/dealer, or will she? Will you change office, or will he? Is she keeping all her staff, and are you keeping all of yours? How will they work together? Are there discrepancies in pricing? What about services? Will your CRM survive, or hers? To make a merger practical, you need to go through all of these and many other questions together. Be patient, but be very specific. Vague compromises are the worst possible outcome, because they turn into inefficient and potentially disruptive business decisions.

There is a great temptation to structure a merger as a “dating” arrangement rather than enter into a full agreement about sharing equity and profits. It feels safer to merely try and share expenses or a few clients before the two businesses choose to combine and start fully relying on each other. There is certainly merit to this idea, and it can be a very natural and practical step towards a merger. That said, the intentions and timeline will have to be clear. How long will this dating period last? What will drive the two parties to go forward?

The big potential of mergers comes from synergies of size or capabilities, and those are rarely part of an expense-sharing agreement. In fact, expense-sharing agreements frequently have high overhead and poor management, as everyone is focused on their own practice and ignores the “shared” infrastructure. A period of a year or two to get to know each other is logical and may be a safe step. But after a year, there has to be a clear idea of, “Are we moving forward with the partnership, or are we staying where we are?”

Mergers are complex and risky, but the right merger can transform a business and drastically improve its resources and competitiveness. Most of all, it can drastically improve the quality of life and practice of the partners. If I could summarize my advice for a successful merger in one sentence, it would be, “Find the right partner, get to know them well, take a risk, and trust and respect each other.”

Philip Palaveev is the CEO of The Ensemble Practice LLC. Philip is an industry consultant, author of the book The Ensemble Practice. Ensemble is the premier management-consulting firm in the advisory industry and works with many of the top firms to help them create profitability and value. More information about Philip and his colleagues can be found by emailing [email protected].