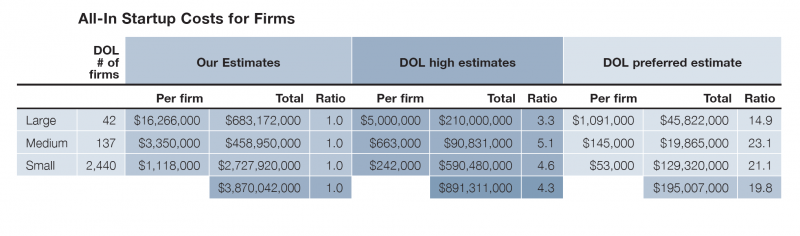

The Department of Labor’s proposed fiduciary rule will cost independent broker/dealers nearly $3.9 billion in start-up costs, according to a new study commissioned by the Financial Services Institute.

The industry lobby group released the report, conducted by Oxford Economics, on Tuesday. The report found that startup costs per firm range from $1.1 million to $16.3 million, depending on the size. FSI’s report found that total costs are roughly 4.3 times higher than the Labor Department estimates in its most expensive scenario.

Tuesday’s findings were based off of interviews with almost 36 executives from 12 firms that employ independent contract brokers as well as registered investment advisors. The specific cost estimates in particular were generated from follow-up interviews with six of the firms.

Oxford also interviewed executives from clearing firms regularly used by independent broker dealers to gain information about pass-along costs related to technology and disclosure processes required by the proposed rule.

In the cost-estimate released alongside the proposed rule in April, the DOL estimated the implementation could total between $2.4 billion and $5.7 billion over the next 10 years. Startup costs for large b/ds (those with more than $1 billion of capital) would be $5,000 per firm, and on-going costs at $2,000 per firm, according to the agency.

The Securities Industry and Financial Markets Association undertook a similar cost study, reporting in July that it found the DOL’s proposed rule could cost firms almost $5 billion to implement and an additional $1.1 billion in annual expenses.

SIFMA provided estimates based on a survey of 40 of its large and mid-sized broker/dealers member firms. The industry group surveyed 18 of its members (12 large broker/dealers and six regional broker/dealers), who estimated it would cost between $5 and $6 million to implement and between $1 and $2 million in annual maintenance.

The Labor Department drew its analysis from a report submitted by SIFMA in response to the SEC’s request for information. But industry groups have argued in comment letters and during last week’s public hearings that the agency’s estimate is flawed.

In FSI’s report, the organization notes the DOL estimates that the rule would cost RIAs and plan sponsors $1,000-$10,000 per year, even for large firms.

“Since the focus of our work was entirely on b/d firms, we do not have data to directly dispute these numbers," FSI's report notes, adding its interviewees generally believed the investment adviser parts of their businesses would require significant attention and resources to ensure compliance as well.