The more we understand the behavior and sentiments of consumers, the more we can connect with them. This is particularly true, but often misunderstood, in the financial planning industry.

In the first quarter of 2022, Lone Beacon surveyed 1,500 respondents from coast to coast between the ages of 50 and 70 who averaged just over $500,000 in net investable assets. This is our fifth year conducting such studies and a constant has been the similarity of responses across markets. This suggests that “people are people” no matter where they’re from. Regional differences seem to matter little when it comes to retirement goals, views on aging and cultural beliefs. This finding is true when it comes to general consumerism, as well as the financial world.

This study was focused on two general categories: 1) Lifestyle Self-Perception and 2) Wealth Transfer.

Age Perception and Activities

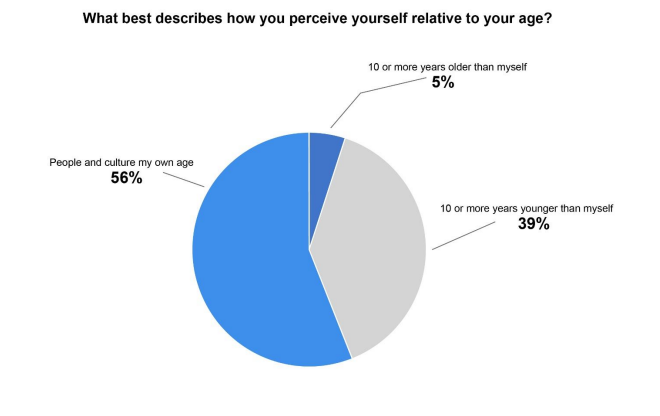

If “perception is reality,” we should consider how this segment of the population views themselves: Only about half of the respondents (56%) best relate to people their own age. When asked which demographic they most identify as, nearly half (39%) said they identify as someone at least 10 years younger than themselves. Conversely, only 5% of the polltakers identify with people older than their actual age. A common saying a decade ago was “40 is the new 50,” but now it seems to be trending closer to “35 is the new 50.” This trend is not to be confused with the decade in time that they most closely identify with, meaning someone can simultaneously believe they feel like a younger demographic but can still relate to older cultural norms.

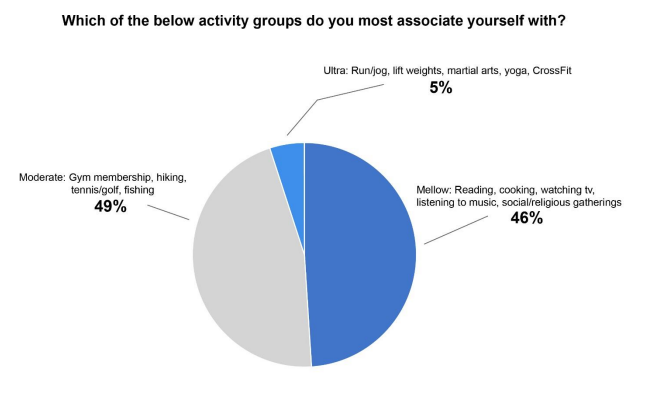

About half of the respondents (54%) say that they participate in moderate to intense physical activities such as running, weightlifting, yoga, tennis, golf, etc. The remaining segment was more inclined toward “mellower” activities such as reading, gardening, theater, etc. The notion that the parents of today’s retirees would have been as physically active in retirement seems hard to imagine. Clearly, today’s retiree is very much on the go and wired to stay young for as long as he or she can.

When it comes to entertainment and pop culture, the study shows that the music polltakers most identify with is from their young adulthood (20–34) at 54%, followed by their high school years at 31% of the respondents. The trend here is that when it comes to music, the identification with people 10 years younger doesn’t hold. Along these same lines, our respondents relate to other cultural norms of decades differently: 48% of them relate to the ’60s and ’70s, and the rest are spread out evenly between the ’80s, ’90s and 2000s.

This sentiment rings true when we consider how legendary artists like The Rolling Stones or Bruce Springsteen seem to be culturally suspended in time. It’s safe to say that their lifestyle resembles that of someone younger than their real age. So, we conclude that while our target consumers might still connect with more traditional cultural norms, they “see themselves” as younger people while doing so.

Wealth Transfer

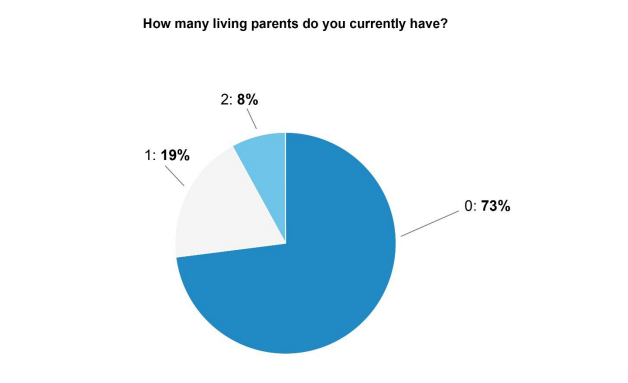

The transfer of wealth is one of the biggest untapped opportunities that exists in the financial world. It’s misunderstood and rarely gets the attention it deserves. Nearly 30% of the respondents still have at least one living parent, and so the possibility of their benefiting from a wealth transfer still exists.

These parents would range in age from late 70s to mid-90s. A fair portion of this population has assets that will, or should, be transferred to their retiring or retired children. Whether this is in cash, equities or property, it represents a significant amount of wealth.

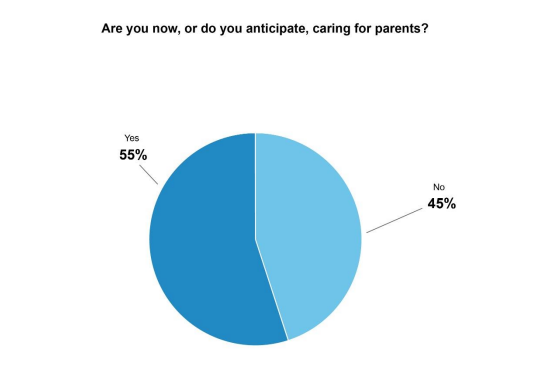

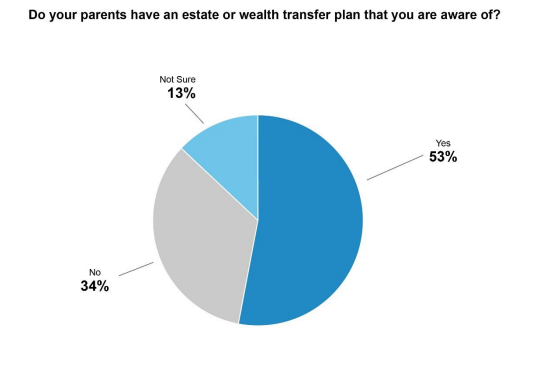

Of the respondents who have living parents, 55% are caring for them in some capacity. For those who are caring for parents, financing the care as well as preserving their estates should be of the utmost importance. Yet, only 53% of the parents have estate plans, according to our survey.

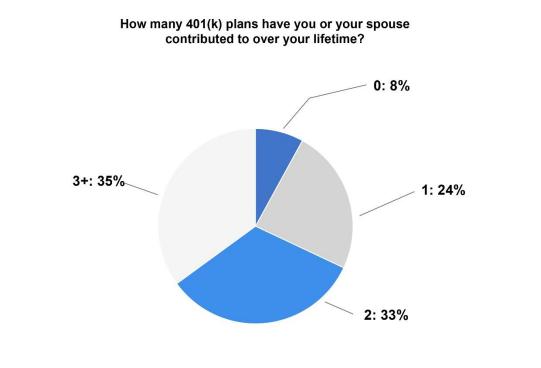

Our survey results also say that 60% of respondents have had at least four separate employers throughout their lifetime, and 20% said they have had seven or more employers. We asked this question because we were interested in learning if many respondents have multiple 401(k) plans. As you would imagine, many polltakers had contributed to 401(k)s: 92% had. Our survey tells us that 35% of the respondents have contributed to three or more separate employers’ 401(k) plans. Our survey results say 13% of all respondents have 401(k) plans that have been left with former employers or are unsure, which presents an enormous opportunity to capture orphan accounts.

What have we learned?

Lifestyle/Perception

- We should recognize that many people view themselves as younger than they actually are and create marketing campaigns accordingly. For example, images of much older people could be a turnoff to many in the target demographic.

- Might active lifestyle events make sense based on the target demographic’s participation in physical activities? Are sports club memberships and tennis shoes more valuable than dinners?

- Let’s consider cultural events that use music themes from their youth that have left an emotional imprint. For example, the current Elton John tour is being sponsored by a major annuity company. This hits the mark better than many current themes used by advisors like “sock hops,” which based on our survey would be outdated.

Wealth Transfer

- There’s a reason why we call the current retirement generation “the sandwich generation”: They care for elderly parents, as well as advise their children.

- Are we taking full advantage of the potential of current clients with living parents? Might this be an opportunity to discuss 1031 exchanges if they own property, or safe ways to transfer equities?

- While conversations are being had with clients and prospects about their parents, this could be an opportunity to talk about their adult children. Especially since it’s likely that they may have unmanaged/available 401(k)s.

- How are we looking at those nonclients who have orphan 401(k)s or are at least 59 1/2 years of age to “transfer” that wealth into a more suitable vehicle?

Billions are spent on marketing in the financial world, and all too often firms will make strategic choices on instinct, or worse, via a herd mentality, versus empirical data. We closely monitor the behavior and media consumption of our database of hundreds of thousands of high-net-worth individuals, and it gives us great awareness. Surveys like this one allow us to ask deeper, personal questions about things that can help us to better engage with them.

John Capuano is co-founder of Lone Beacon.