Many privately held family businesses unwittingly destroy shareholder wealth every year by falling into the “wealth-evaporation trap.”

With public-company investments, shareholders can realize value any day simply by selling their stock. Private-company shareholders don’t have this option. Rather, their investments lie trapped inside the sealed vault of a private business, often family owned, with no meaningful options for sale.

Shareholder Wealth Evaporation

Shareholder wealth evaporates in privately held businesses in many ways:

- Time value of money. A delay in distributing cash returns to shareholders generates a significant reduction in overall returns due to the time value of money and inflation. Waiting for a future liquidity event, such as a sale of the business, is costly from an investment-return perspective. Unfortunately, family businesses often treat shareholders as family members rather than investors. However, when a family business recognizes this dynamic and shifts its focus to treating shareholders as investors, the leadership makes different and more salutary decisions. These, in turn, bring improved realized returns and, as a complementary benefit, improved family dynamics.

- Working capital management. Many conservatively managed businesses shy away from corporate debt. They thus fail to manage working capital properly (that is, accounts receivables, inventories and payables) due to an abundance of retained capital. This misuse of the family business’ equity capital results in poor stewardship of a family’s wealth. For example, a business can establish a working-capital line of credit today for an interest cost of about 3 percent. By self-funding with retained capital, the family is making the unconscious decision to “invest” shareholder equity capital in an investment returning a mere 3 percent. This is a common example of why shareholder wealth evaporates over time. The misappropriation of equity capital also impacts the amount of funds available for business reinvestment, thus hurting future growth.

- Capital structure. Even conservatively managed businesses should have an appropriate level of debt to support the enterprise. A no-debt or low-debt policy for all but high-risk businesses produces substandard shareholder returns due to the lack of financial leverage on the balance sheet. Unfortunately, I’ve worked with several companies that proudly report they have no debt and excess cash balances. The result: earn negligible returns and expose family wealth to lawsuits and other unforeseen risks. Tax-efficient transfer of excess cash into special purpose entities (SPEs) provides additional asset protection, greater liquidity to the operating business, or individual shareholders and better diversification of the family wealth portfolio.

- Business management. Too many privately held businesses focus solely on the income statement (that is, revenues, costs and profits). When management isn’t disciplined about generating cash and realizing shareholder returns, it makes decisions that destroy shareholder value. Examples include unjustifiable capital investments, poor working-capital management, substandard cost controls, inadequate product or customer margins, and a financially sloppy management culture. When both profits and cash are central, management makes better decisions. Cash is said to be king, but shareholder-realized cash is the true king!

- Unrecognized tail risks. Shareholder value retained in the business is exposed to many tail risks that aren’t recognized or sufficiently acknowledged by family leadership. Examples include: declining future economic prospects; new competition/products; loss of key customers, suppliers or executives; new governmental regulation; product-liability claims; and detrimental press. In addition, uncontrollable economic factors such as interest rates, valuation multiples and tax rates can diminish or decimate shareholder value. The business economic cycle is still a reality; to wit, the Great Recession of 2008 destroyed shareholder value for many privately owned (and publicly owned) businesses—some irretrievably—through no fault of management in many cases.

Realizing Shareholder Returns

Since realizing shareholder value requires cash or other asset distributions, private-company CEOs and their boards need to implement strategies that generate current and future cash flow for their shareholders. There are three primary strategies to consider:

- Recurring cash distributions—from ongoing operating profits plus depreciation, less current or planned capital expenditures.

- One-time or periodic cash distributions—from improvements in working-capital management, restructuring of the business’ capital structure and tax-efficient distributions of assets (for example, sale and leaseback of real estate used by the business).

- Cash distribution from sale of the business—made possible or enhanced by steps to increase the company’s valuation and maximize its net proceeds after taxes.

Family Wealth Roadmap

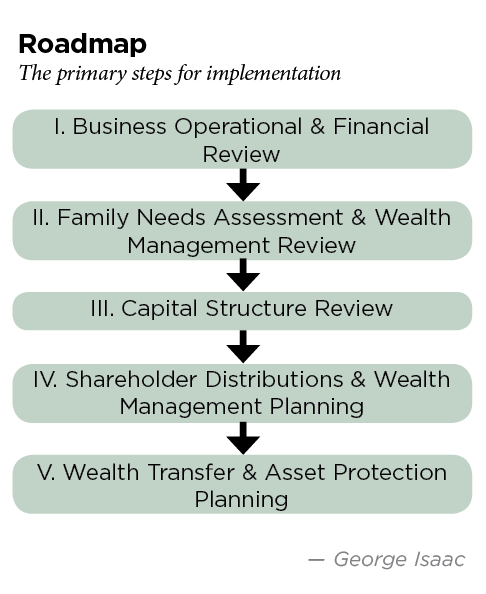

I recommend creating a multidisciplinary team of senior company executives and external professionals experienced in finance, business operational assessment, wealth management and taxes/estate planning to implement the roadmap. The primary steps are:

- Business operational and financial review—evaluating the business’ future cash-flow-generation capability, sustainability, volatility and capital needs. The goal is to determine the amount of free cash flow available for tax-effective distributions over the following three to five years.

- Family-needs assessment and wealth management review—understanding the individual and overall family’s financial objectives and evaluating the family’s wealth portfolio inclusive of the family-business asset. I often uncover family-dynamics problems during this phase that need to be addressed so that individual family issues don’t undermine the future survival of the multigenerational business.

- Capital-structure review—rationalizing current working capital, overall business capital structures and existing shareholder-distribution strategies. Business needs, always of utmost importance, are evaluated along with shareholder objectives and needs. The goal is to meet the current and future capital requirements of the business while developing strategies to realize increased shareholder value through one-time or recurring shareholder distributions. The team needs to evaluate a variety of options, such as recapitalizing the business through debt or equity transactions; sale-leaseback transactions (real estate, major equipment); spinning off non-core assets into separate asset-protected companies; selling underused assets and replacing them by outsourcing; and improving working capital management.

- Shareholder distributions and wealth management planning—preparing a five-year financial plan for the business and for the family’s wealth portfolio. The project team needs to develop financial models to test various scenarios to determine which plan best supports the business while meeting overall family wealth management investment objectives. I recommend a large cushion of conservatism, with implementation strategies modified annually based on actual business results and an assessment of the economic outlook. In certain instances, I’ve suggested transferring distributions into an SPE with the same ownership group as the business. This standby SPE can lend funds to the main operating business, guarantee loans, and provide asset-protection strategies by holding assets outside of the operating company. An extra benefit is that shareholders control the assets of the SPE that are now protected from exposure to creditors of the main family business operating entity.

- Wealth-transfer and asset-protection planning—projects of this nature can lead to gift and estate planning. Estate-planning attorneys’ narrow focuses on taxes, wealth-transfer strategies and asset protection often misses the important issues that impact family-business longevity and overall wealth management. A more holistic and goals-driven approach addressing succession plans, governance and family dynamics is required. Plans need to be tailored to meet the needs and objectives of the individual stakeholders, the overall family’s wealth (evaluated from an investment-portfolio perspective) and the “golden goose”—the family business. (See “Roadmap,” this page.)

Best of Both Worlds

Private companies have the benefit of longer time horizons for performance measurement than public companies. They don’t have the pressures of public companies to produce ever-increasing quarterly earnings, a blessing and a curse. Because public companies focus on delivering shareholder value, they tend to do a better job on this essential measure. Private companies need to up their game on this objective. Once they do so, private companies will have the best of both worlds!

This is an adapted version of the author’s original article in the September 2017 issue of Trusts & Estates.